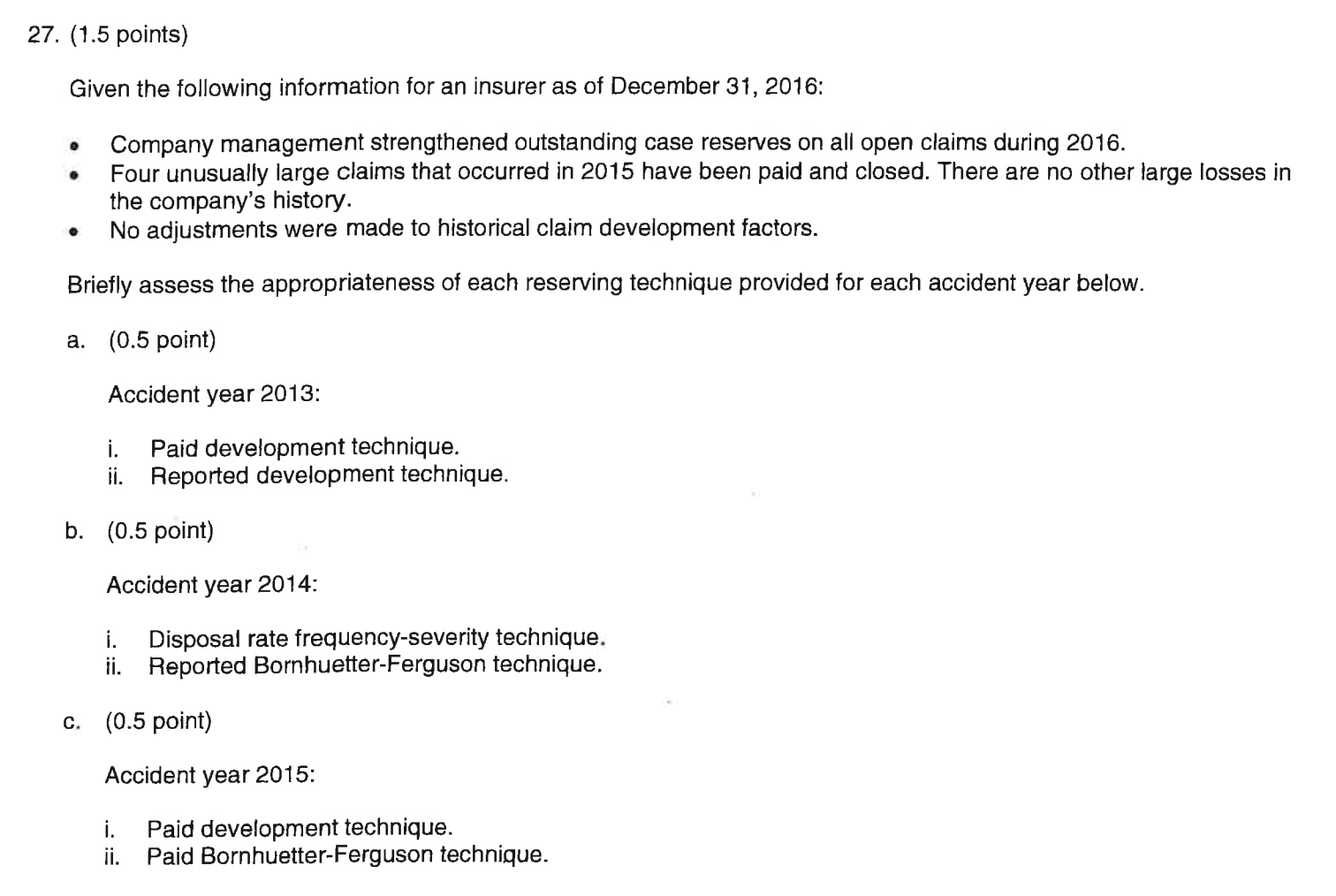

Fall 2017 Q27 c) ii)

Is my understanding correct?

Because of large losses in 2015, the 12-24 LDF is higher than the TRUE 12-24 LDF. This means the % paid is expected to be lower than the TRUE % paid. So more weight is being given to the ECR method.

Why does this mean that AY 2015 is overestimated?

Also, how can we be sure that the LDF is too high/low? For example, if the 4 large claims are all reported in age 12 of 2015, the 12-24 LDF would be the same. However, if they are reported in age 24 of 2015, the 12-24 LDF is too high.

Comments

There is some ambiguity because the statement of the question doesn't tell you whether the 4 large claims were paid in 2015 or 2016 and that makes a difference to how the LDFs are affected. But it seems they wanted you to assume they were paid in 2016. (Also, for paid triangles, it doesn't matter when those claims were reported, only when they're finally paid.)

Give that the 4 large claims occurred in 2015 and were presumably paid sometime in 2016, then your reasoning is correct that the 12-24 paid LDFs would likely be too high. That means the development method will likely overestimate the AY 2015 ultimate. The paid BF method will also overestimate but not by as much because it's weighted with the ECR method (and assuming the ECR in the ECR method provides is a more reasonable (lower) estimate than the paid development method.)