Fall 2016 Q18 c) vs Spring 2016 Q24 b)

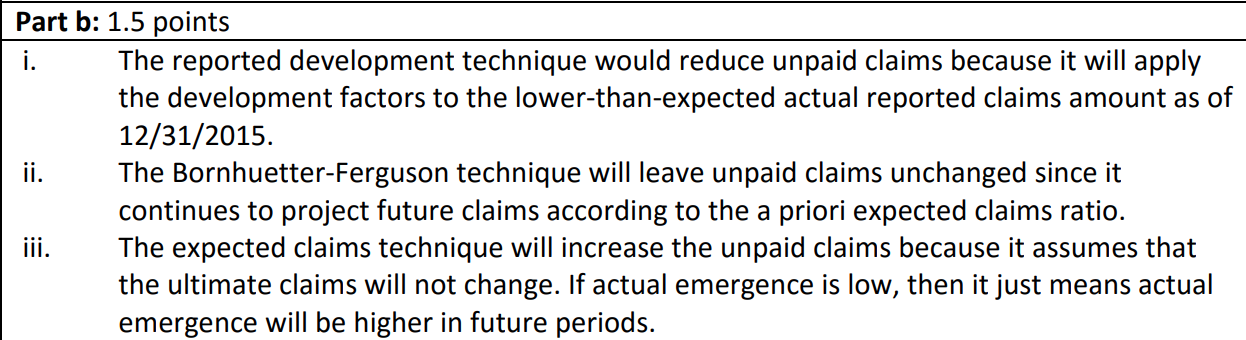

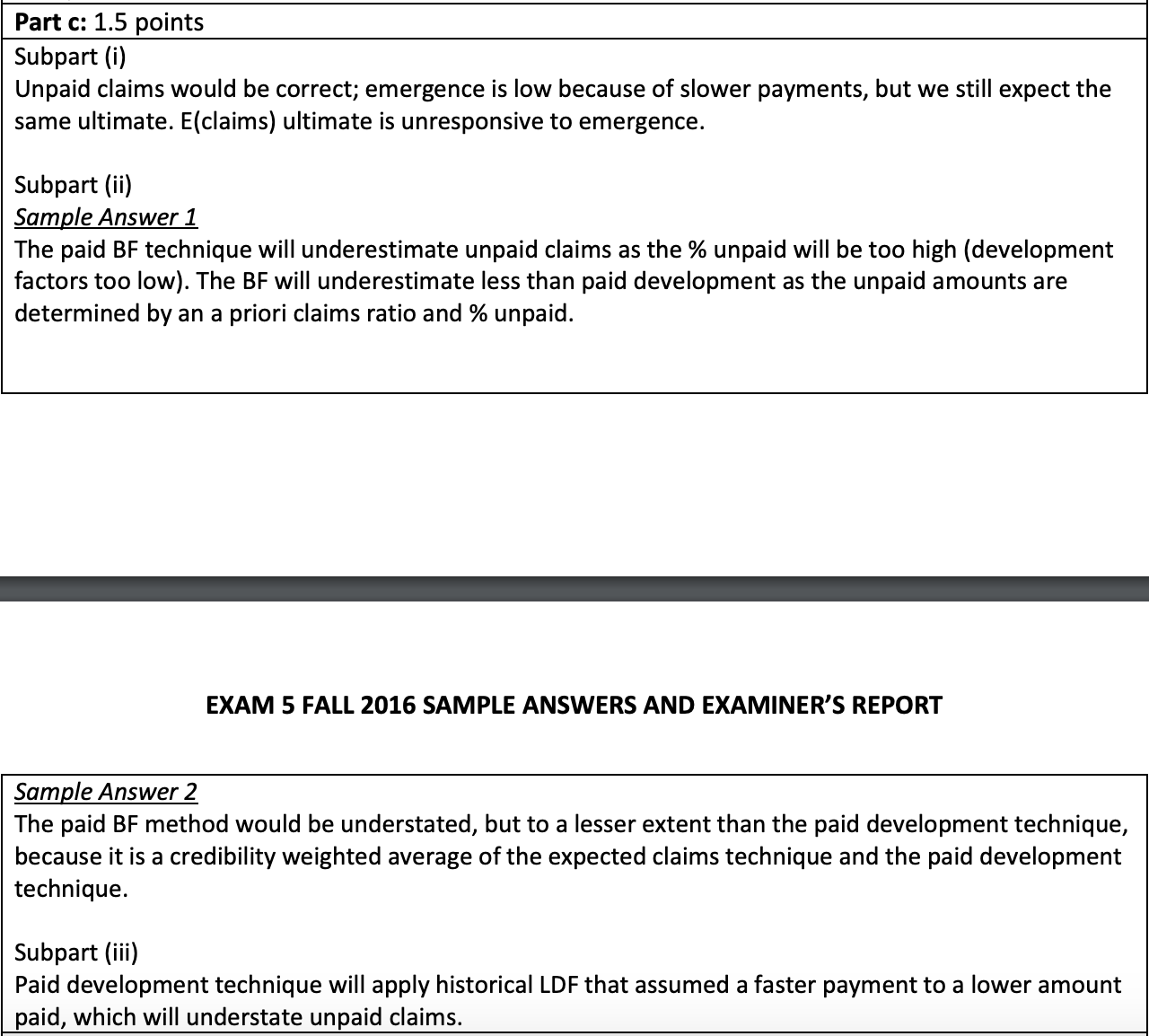

For context, actual reported emergence was less than expected reported emergence in part a of the first question shown in screenshots.

In comparing these two questions, I want to confirm my understanding. Both questions and their solutions are the same. If actual emergence is lower than expected emergence, assuming that we still expect the same ultimate, ECR method produces the correct unpaid claims amount. In other words, if we use the ECR method to produce unpaid claims amount when the actual emergence is lower than expected emergence, we are essentially increasing our recommended unpaid claim amount because despite the reported claims being lower than expected, we maintain the same position on ultimate estimates.

As an aside, why would leaving the recommended unpaid claims at the same expected level be achieved through a reported BF method? Is it because, although actual reported emergence was less than expected reported emergence, we disregard that information and continue to develop unreported claims using ECR method so that we still expect the same unreported claims as if we did not have the new information of actual reported claims from the prior period?

Is it valid to use actual/expected REPORTED emergence to make insights on unPAID amounts/estimates as is done in b)?

Comments

(1) Your understanding regarding the accuracy of the ECR method (even with a slowdown of payments) is correct.

(2) Regarding the BF method, your comments relate to this section of chapter 9 in the wiki:

That subsection discusses the fact that unreported claims do indeed emerge in accordance with expected claims.

(3) When you ask:

If I understand your question correctly, then the answer is "yes" but it depends on exactly what you mean by "make insights".