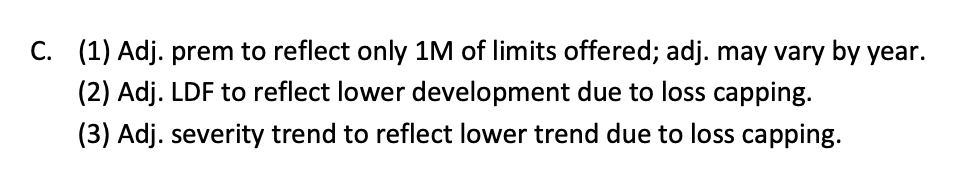

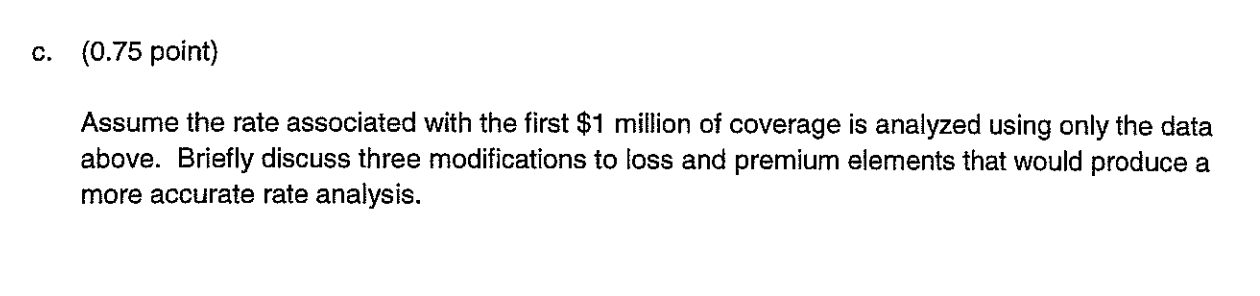

Fall 2013 Q5 c)

Could you explain what the first point means? "Adjust premium ...". Is the stated OLEP not reflecting the premium for policies with a 1 million limit?

Also, could this also be a viable answer: adjust frequency trend to reflect lower frequency due to capping.

Thank you.

Comments

Suppose you have these 2 policies that are the same in every way except for the coverage limit and the premium:

Policy A:

Policy B:

If you use both policies in a rate analysis for policies with only 1 million coverage, you would have to cap the premium for policy B at $1,000 and also cap B's the loss data at 1 million.

For your second question: You cannot say to "adjust frequency trend to reflect lower frequency due to capping" because frequency is not affected by caps on losses. (The frequency is the same with or without a cap on losses.)

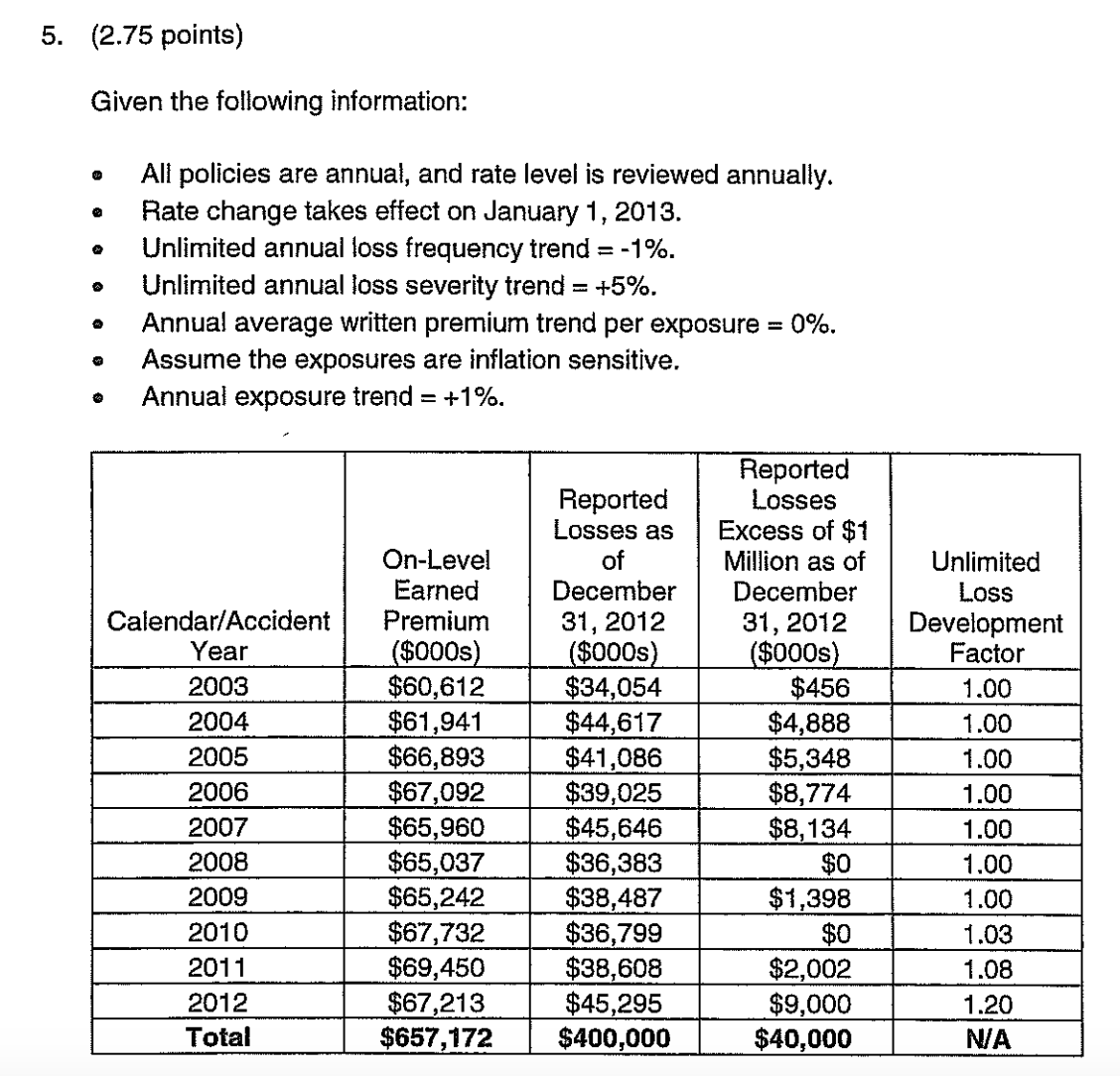

Why have they applied exposure trend to on-level earned premium for part a)?

Thanks

The given information states that exposures are inflation-sensitive. Whenever you're told that, you need to apply the exposure trend appropriately. If there were no exposure trend (or if the exposures were not inflation-sensitive) then you could use the premiums in the denominator without adjustment. But if exposures are increasing and they impact the dollars received by the insurer, then they must be accounted for.

See this section of the wiki:

Again, if the problem tells you that exposures are inflation-sensitive, they are likely testing whether you realize that an exposure should probably be applied somewhere in the solution.