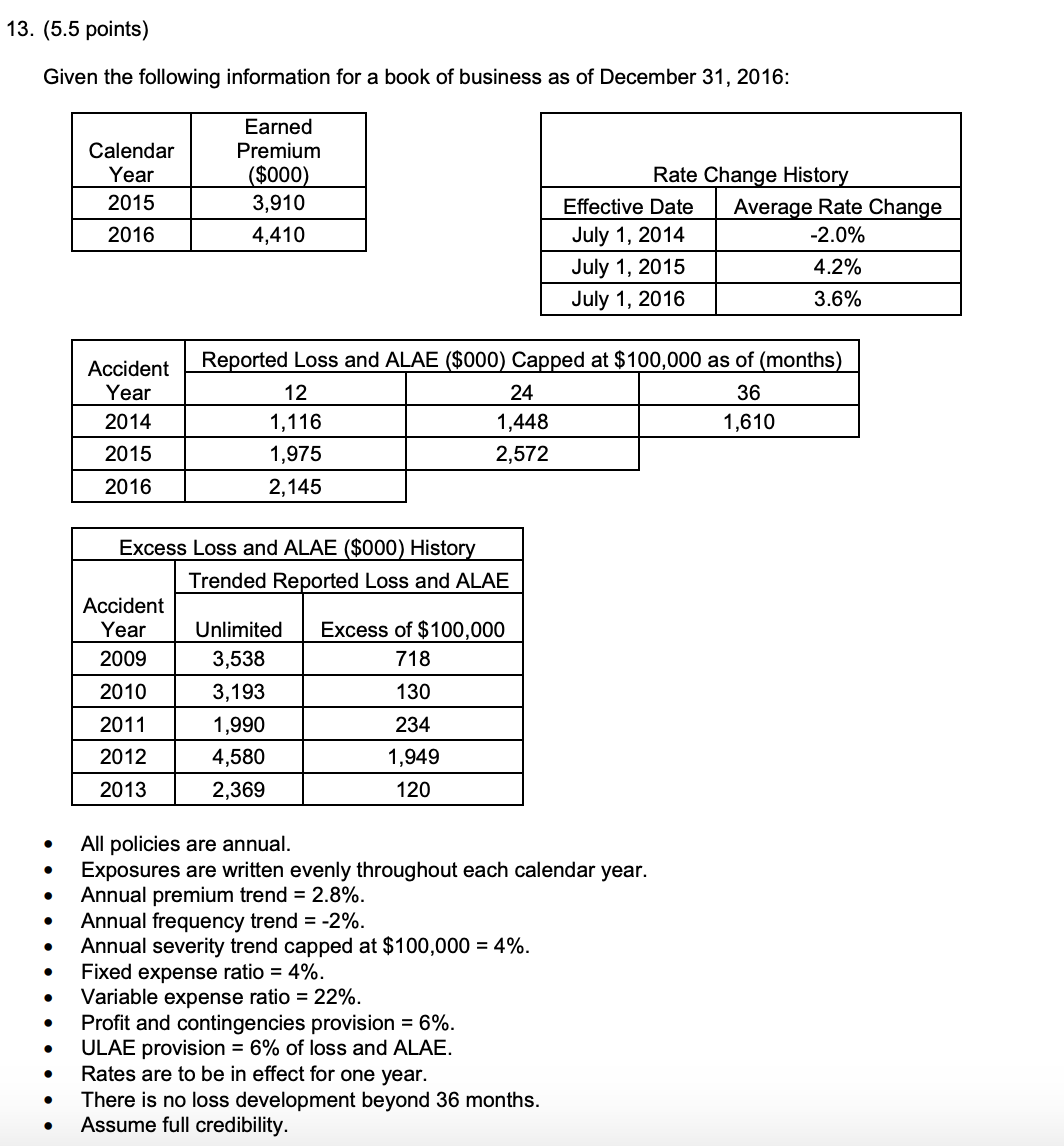

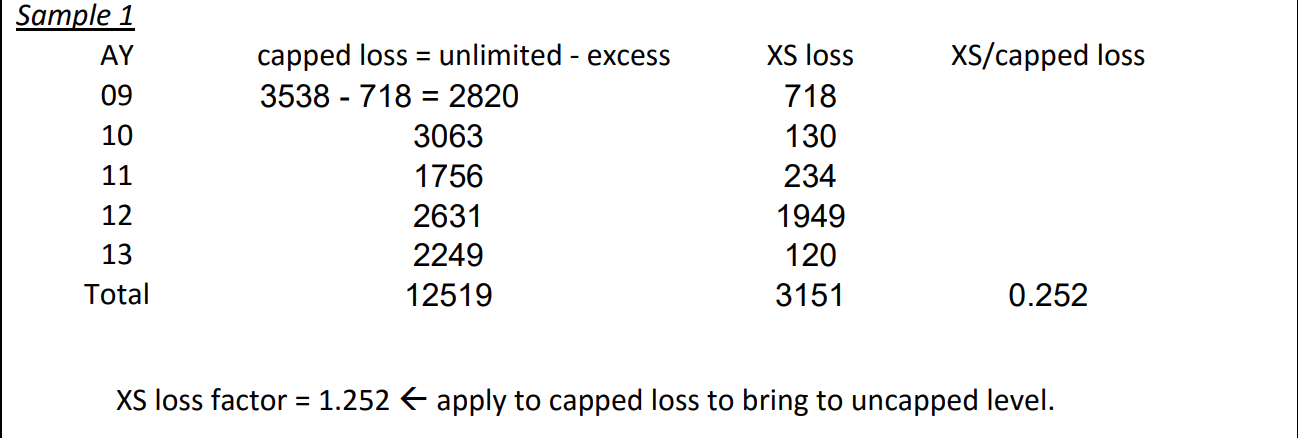

Spring 2017 Q13 b)

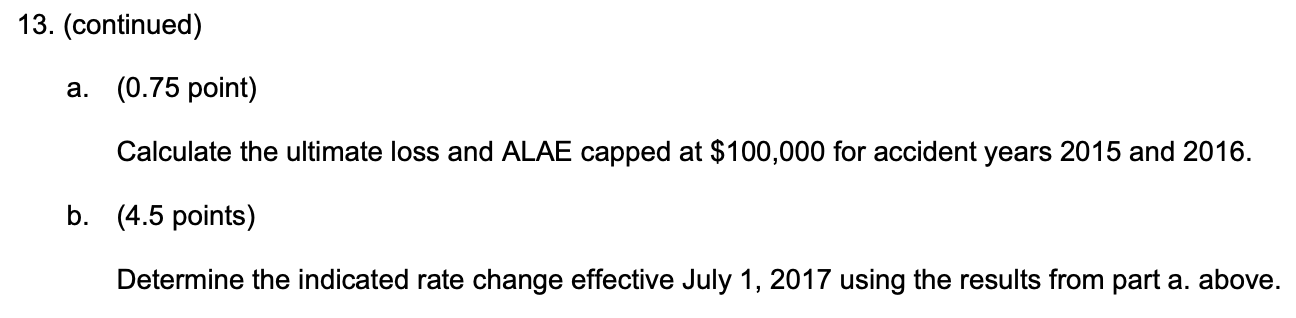

Why do we want to bring losses to the uncapped level when calculating our indicated rate change? Are the premiums received for losses with a policy limit of 100K or is it for the total losses and that is why we are not capping the losses?

Also, if the historical excess losses and LAE are TRENDED reported loss, how does this impact the way we calculate and apply the xs/non-excess ratio? In other words, if they were not trended, we would have to trend them first and then calculate the multi-year average ratio?

Comments

"Why do we want to bring losses to the uncapped level..."

"Also, if the historical excess losses and LAE are TRENDED reported loss..."