Spring 2015 Q13 b)

Am I understanding this correctly:

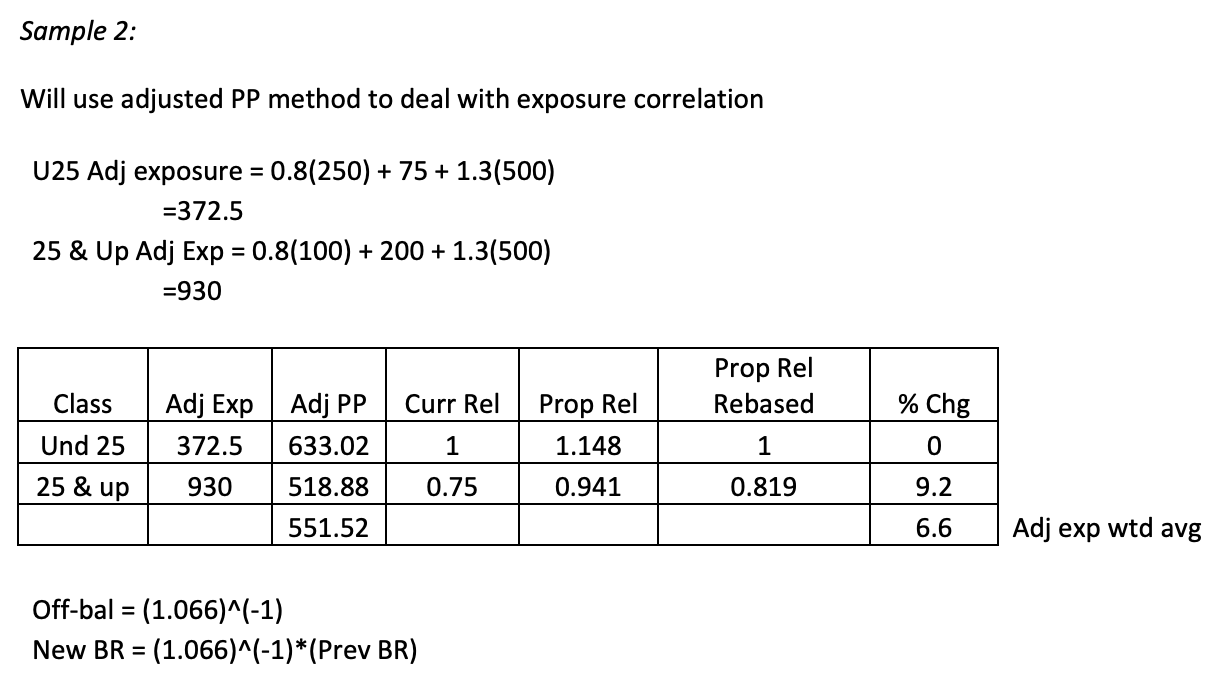

- we calculate adjusted exposure to deal with exposure correlation and use this to calculate adjusted pure premium

- we use the pure premium to calculate proposed relativity (ex: 633.02/551.52)

- we rebase the proposed relativity to have the same base as the current relativity, i.e. class under 25.

- we calculate the % change between the current relativity and proposed relativity (e.g. 0.819/0.75 - 1)

- the % change tells us how much the relativity changed from current to proposed. because we want a revenue neutral base rate, we "undo" the % change by dividing by the % change (e.g. current base rate / 1.066). this is a valid way of calculating proposed base rate because the current base rate (numerator) is calculated under the current relativity (???) (i think i am having trouble understanding what the % change is applied to and what those numbers mean)

Thank you!

Comments

Your explanation is correct.

If the overall rate change is 6.6% but you want to the change to be revenue-neutral then you have to "back out" the 6.6%. You do that here by multiplying the base rate (which isn't given) by the inverse of the change or: