Spring 2016 Q24 b)

In part a, we see that actual emergence is less than expected emergence.

What is meant by the "recommended unpaid claims"? By recommending a reserving technique, are we suggesting that the actuary's ultimate selection should change?

Could you let me know if I am understanding the solution correctly:

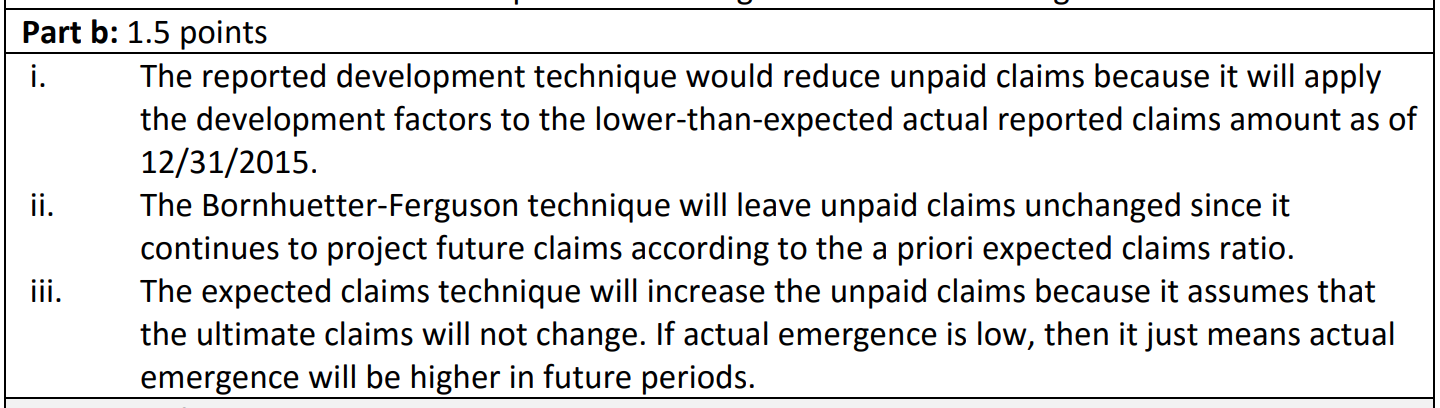

i) We know that actual emergence is less than expected emergence so if we use a development method, then because reported claims are lower than we assumed given our current LDF selections (we know this because expected is higher than actual), we will get a lower ultimate compared to previously so we have reduced our unpaid amount

ii) We acknowledge the lower than usual reported claims using the reported development method weighting for the BF, but we develop unreported claims as usual using ECR method so that our recommend unpaid is the same as expected.

iii) We use ECR method and thus disregard the lower than expected reported claims we are observing. In this way, the unpaid is higher than previous.

Thank you.

Comments

I'm not sure if you saw this old post about this exam question, but here's the link:

Anyway, to address your questions:

I don't think this was a very well constructed exam question and given the length of the explanation in the examiners' report, it appears that candidates were confused about this question as well.

For (i)

For (ii) and (iii), your explanation (and the examiners' report) is correct.