EP vs OLEP

versus

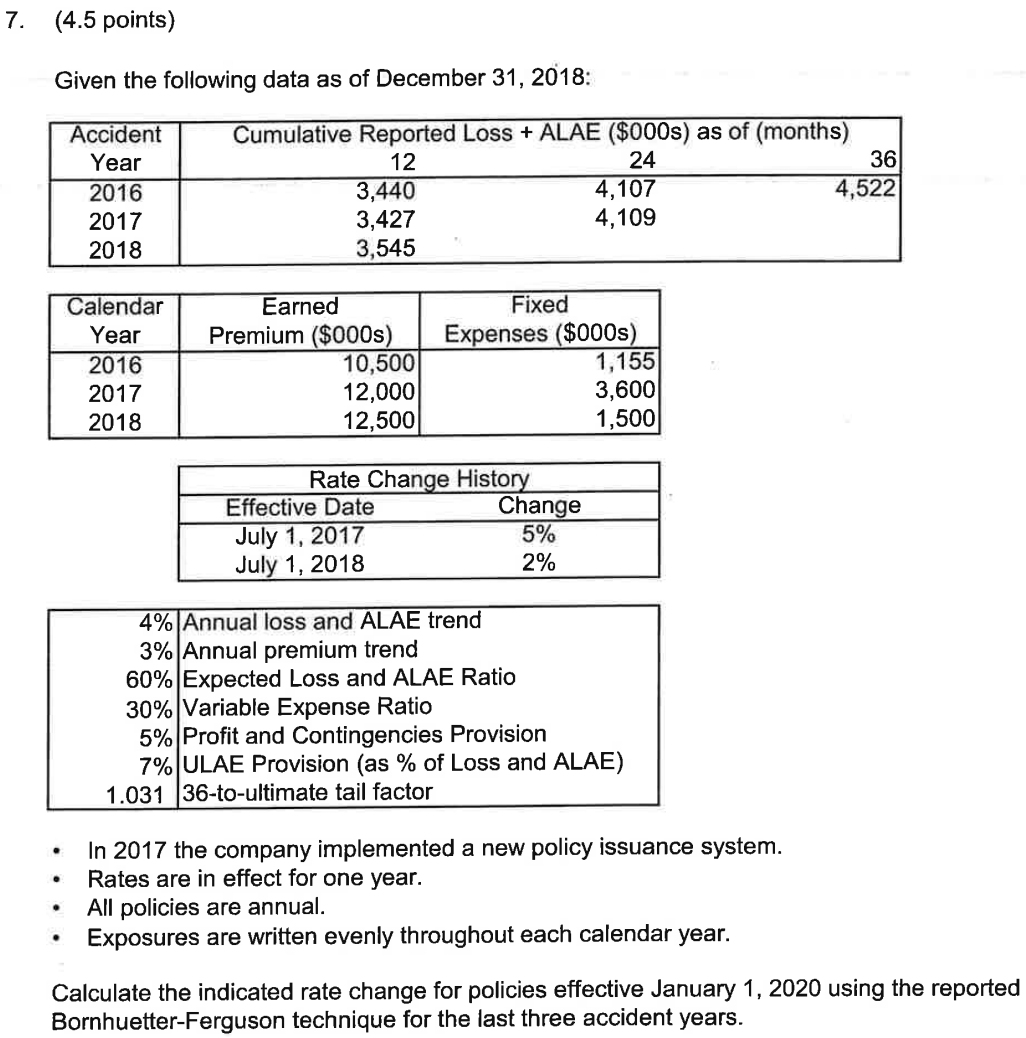

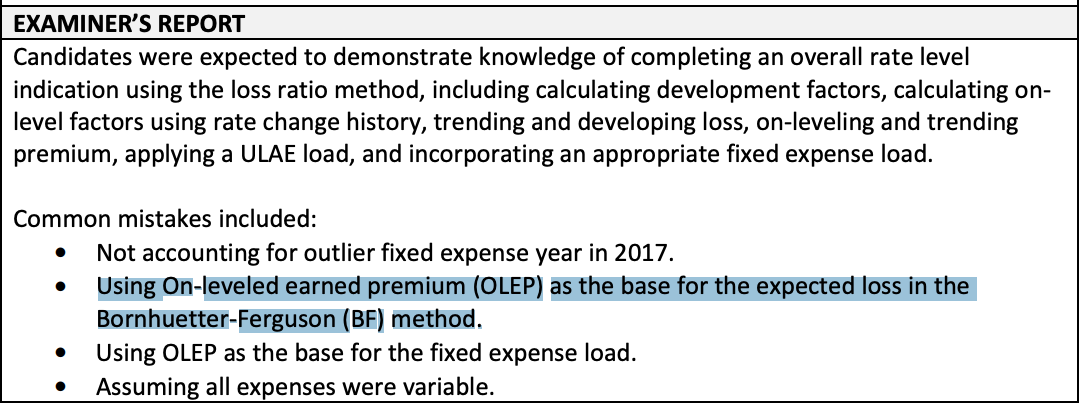

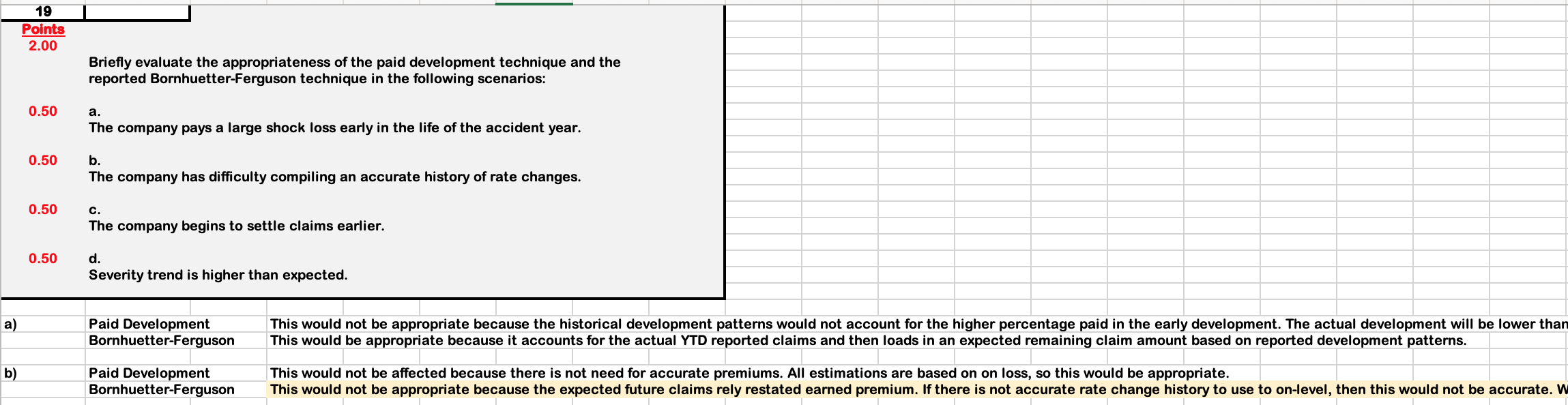

Comparing Fall 2019 Q7 and Spring 2018 (original) Q19, I am confused about OLEP as the base for the BF method. I saw another post about the question from Fall 2019, and I understand why EP should not be trended (to be on the same basis as losses if those are not trended) but I am still uncertain about whether or not BF requires OLEP and how to know when to use OLEP vs EP.

Comments

In 2019-Fall-Q7, you were given the ELR (expected loss ratio): 60%. You then use this ELR in the BF formula but in the BF formula, you need regular EP, not OLEP (because the EP needs to "match" the losses which are not developed or trended.

If they had not given you the ELR and required you to calculate it, then you would have needed OLEP in that step.

For example in this problem, where you have calculate the ELR yourself, you need to use OLEP when calculating the ELR:

Here you use trended and developed losses divided by OLEP to get loss ratio estimates for each year which could then be averaged (or something else appropriate) to get the ELR. But then when you use the actual BF formula, you need "regular" EP and reported losses (not trended & developed losses.)