2018 Fall Q23

Hi,

BattleCard solution to this question says

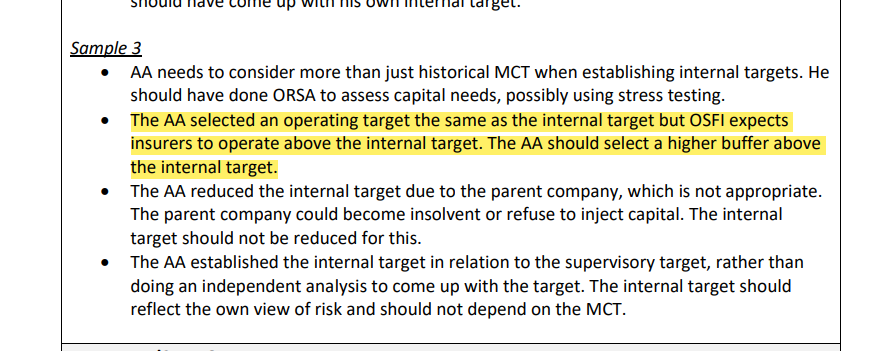

"error 1:

- internal target too low

- internal target should be higher than MCT target for advance warning of trouble"

After reading the sample answers in the exam report, it feels like the error is about that the operating target should be set higher than internal target to leave buffer. Is my understanding correct?

A second question is, what is operating target? Thanks!

Comments

Yes to your first question. Basically the operating target is the level that an insurer should consider taking into account the impact of future planned, foreseen and likely potential changes to its risk profile due to changes in its operations, its business strategy or its operating environment. In these future scenarios, the operating target should not fall below the internal target level.

Thanks for the explanation!

Battle card 8 says:

What does this mean "capital injection should not be used unless planned and certain"

Why is this an error

When doing an ORSA/FCT you need to be absolutely certain that you are able to promptly access capital from your parent company before you are able to use a capital injection as a corrective action. If a capital injection is uncertain, the parent could refuse to provide liquidity during times of distress

This solution here talks about independence when setting internal vs supervisory targets. I read through the source and didn't see anything regarding this. Instead it says the internal target should be based on ORSA and should consider risks included in capital guidelines and insurer specific risks.

I understand that simply adding 40% to the supervisory minimum is a lazy approach, but could a company set an internal target as the level of capital required to cover a 1 in 100 event and still be above the supervisory target?

For example a company sets their internal target at 150% + Loss from a 1 in 100 event / MinCapReq.

Or does the internal target require complete independence from the supervisory minimum?

Basing an internal target on ORSA basically means setting an ICT that is independent of the supervisory target. The supervisory target capital is just 150% and is pretty arbitrary.

You can't just say well I would like to be 30% of the supervisory target and call it a day. There needs to be a rationale, analysis, the risk appetite of the company needs to be determined.

"I understand that simply adding 40% to the supervisory minimum is a lazy approach, but could a company set an internal target as the level of capital required to cover a 1 in 100 event and still be above the supervisory target?" This would depend on the process - How is the 1 in 100 level chosen? what considerations were taken, etc.

"For example a company sets their internal target at 150% + Loss from a 1 in 100 event / MinCapReq." This wouldn't work - There are more things to consider than just the loss from a 1 in 100 event, which is why you'd need to go through the whole ORSA process.