Spring 2016 #13

Hi! I hope everyone's studying is going well. I'm having such a headache learning premium liability and duration and I was wondering if someone has the solution to Spring 2016 #13, using the new method, without discounting the maintenance expenses? I couldn't find it anywhere. I got 3695.88 for premium liability amount, 1.746 for premium duration and 178.43 for interest rate margin but I'm almost certain it's wrong. Thanks!

Comments

I got 3420 for the premium liabilities. My pV factors using the new method were 0.949 for 2.92% and 0.9575 for 2.42%. What did you get for your pv factors? I'm not too confident with my numbers either!

I made a mistake in my calculation...

Now I got 0.9491 for 2.92% and 0.9575 for 2.42% as well. Then,

PV@2.92% = (5000 x 0.65) x 0.9491 = 3084.7

PV@2.42% = (5000 x 0.65) x 0.9575 = 3111.86

APV = 3111.86 + 3084.7 x 10% = 3420.33

Macaulay = (0.5 x 0.2464 + 1.5 x 0.2394 + 2.5 x 0.2327 + 3.5 x 0.2261) / 0.9446 - (0.5-0.3333) = 1.7974

Modified = 1.7464

Interest Rate Margin = (20090 x 1.4307 - (3420.33+300) x 1.7464 - 5569.17 x 1.4389) x 1.25% = 177.90

Please advise if you got the same number lol!

Agree! I originally made a mistake in Macauley because I forgot the (0.5 - 0.3333) so thanks! My answer for the interest rate margin is 177.9 same as yours.

The whole problem seemed the same except for pv factor calcualtion and the discounting of the maintenance expenses but the maintenance expense discount was small. The official answer for the old method was 191.1 so the new method is a bit lower.

I also found a page in the wiki that shows the new method but for a different problem...

https://battleactsmain.ca/wiki6c/2016.Fall_Q15_Redone

The question does not provide the discount rate. The solution calculates the portfolio yield to discount the liabilities. Is the calculation of the portfolio yield something we would be required to know for this upcoming sitting?

You shouldn't be asked to calculate the discount rate, at least not like in this problem. The reading on bond valuation was removed.

The will probably just give you the discount rate, but if for some reason they did ask you to calculate it, note that it's just a weighted average and you could probably just figure it out. Here's a simple example (from an outdated reading) just to demonstrate the calculation in it's simplest form:

Exam-taking tip: If they want you to calculate the discount rate and you don't know how to do it on the exam, just make up something reasonable, like 3.0% or something like that. This is just so you can continue doing the problem. Otherwise you can't complete the problem even if you know how to do the rest of it. You might lose 0.5 pts for not doing the discount rate calculation but at least you could complete the rest of the problem.

@graham

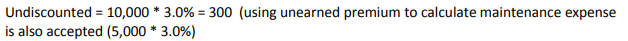

the answer above used 10000*3%=300 as maintenance expense;

are we supposed to use UPR 5000 to do the question?

thanks!!

Yes, because the written premium is given as 10,000 and policies are written uniformly through out the year starting on Jan 1, so by the end of the year, half the written premium will have been earned and half will remain unearned.

chg(premium liab) = APV* interest rate shock* modified duration. Why do we include maintenance cost as part of APV? I thought APV is only PV+ Pfad. Or APV here actually means Premium liab(UPR) and thus we need to include maintenance cost?

APV is the Actuarial Present Value of the premium liabilities. Also, I think you should use 10000*3% as the maintenance expense and not 5000 as alluded to above. Maintenance expenses are a % of GWP not UEP

From examiner's report:

I also saw the unearned premium used to get the maintenance expenses on other problems as well, see Spring #14, 2018.

Is there a reason this was used? Or is this another case of CAS inconsistency

Good thing they accepted both methods though.

In this question, they specifically mention that maintenance expenses are a % of GWP. In this case, the CAS were being lenient by accepting 5000 which imo is incorrect.

However, in spring 2018, they mentioned it is just a % of premium and didn't provide any GWP.