Fall 2019 Q20

Part c

1) Why is the 60% not considered in sample 1 solution?

2) Why do we have to add 12750 [capital required (unpaid claim) for the base scenario]? We are not adding other amounts from the base scenario.

It looks like you're new here. If you want to get involved, click one of these buttons!

Part c

1) Why is the 60% not considered in sample 1 solution?

2) Why do we have to add 12750 [capital required (unpaid claim) for the base scenario]? We are not adding other amounts from the base scenario.

Comments

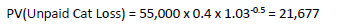

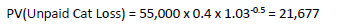

Question 1: The question has an error. They meant to ask you to calculate the MCT at Dec 31, 2019, not 2018. If you're at the end of 2019, then the amount of 60% x 55,000 has already been paid (so it is no longer part of the unpaid amount.) If you scroll all the way down to the bottom in the examiners' report, they mention this. For that reason, they accepted the answers given in both sample answers 1 and 2:

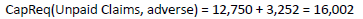

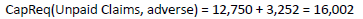

Question 2: They add the 12,750 because the catastrophe is an "add-on" to the claims that happen under the base scenario. The reason the other categories don't add the base scenario amounts is that the catastrophe doesn't affect those other categories, but also that they directly give you the values for the other categories under the adverse scenario. (The only other category that changed was interest rate risk, and that went down because it's based on investing capital available and there was less capital available in the adverse scenario.)