App C Sh1 - LRC(onerous)

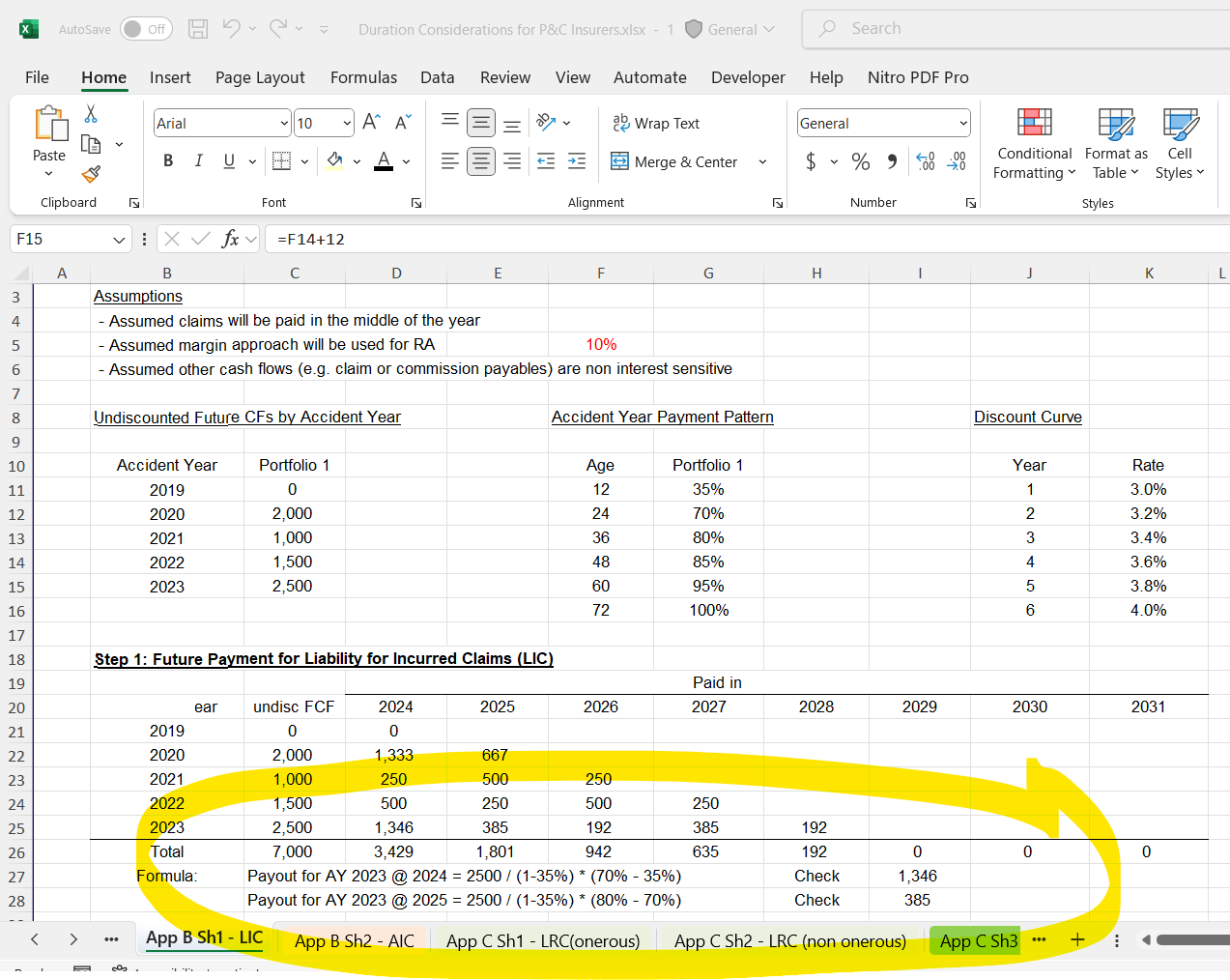

for the calculation of Future Claims & Claims Expense, why are we not calculating using the formula of "Payout for AY 2023 @ 2024Q1 = 2100 / (1-35%) * (70% - 35%) * 0.25"?

It looks like you're new here. If you want to get involved, click one of these buttons!

for the calculation of Future Claims & Claims Expense, why are we not calculating using the formula of "Payout for AY 2023 @ 2024Q1 = 2100 / (1-35%) * (70% - 35%) * 0.25"?

Comments

2100 is the expected claims amount for the unearned portion. Its not the total amount of unpaid remaining. We are dealing with LRC not LIC here so this would all be future claims and not incurred claims which is where you would use the formula you have above.

How do we know the remaining premium is received midway through the first quarter? If this was an exam question would it be fair to assume everything from premium and loss payments occurs mid year? That way we dont need to break 2024 into quarters. I dont see anything in the question that mentions when the premium is recieved

I also always assumed acquisition costs was the only expense included in LRC but would we include maintenance costs in LRC as well? What other expenses would we include? Is this because we are doing a GMA projection here and so we include all directly attributable expenses

I also noticed that risk adjustment only applies to the claims and not any premium or expense. Is this because all risk associated with premium and expenses is assumed to be financial risk (ex: Credit of inflation) and so it is not included in risk adjustment as it is only for non-financial insurance like risks?

Also what are maintenance expenses? Is this ALAE or different? I would expect risk adjustment to apply to ALAE

It's an assumption. If nothing is stated in the question, any assumption that you make will be accepted. Maintenance costs directly attributable to the contract would be included in the LRC. And yes this is because we are doing a GMA calculation.

Premiums have no risk adjustment because they are a known fixed contractual amount. They are also received before service is provided so there is no uncertainty regarding their timing and receipt.

Maintenance costs here are related to LRC, so while they could be ALAE technically, I think that is more on the LIC side. I'm thinking certain policy servicing costs on renewal or for new business for example could be included in the LRC.

Risk adjustment does apply on ALAE in the LIC

Under 4.3.2 of https://www.casact.org/sites/default/files/2023-05/6C_CIA_Educational_Note_IFRS_17_Actuarial_Considerations_Related_to_Liability.pdf

"Premium inflows would normally be determined based on the balance of premiums receivable for the group of insurance contracts. The estimate would reflect, on an expected value basis, how policyholders will exercise the contract features available, including the option to cancel the contract. The risk that the actual behaviour may differ from the expected behaviour is reflected in the risk adjustment selection."

This seems to suggest the 100$ premium receipt should be included when applying the risk adjustment. Any guidance on what to do if there is a question like this?

Could this paragraph's point on reflecting insured's behaviour to cancel a policy be in relation to reflect expectation of cancellations when considering premiums receivables ? So the CAS examples 17 as an example.

I agree with sidkiriya here. My understanding is that the risk here is not on the premium side, but on the liabilities (Less cancellations than expected means more liabilities). More or less premium is not really the "risk" since you don't pre-provide the service and then try to get premium. It's the consequence of more or less premium which shows up in future claims. I can't think of any other explanation that would make sense.

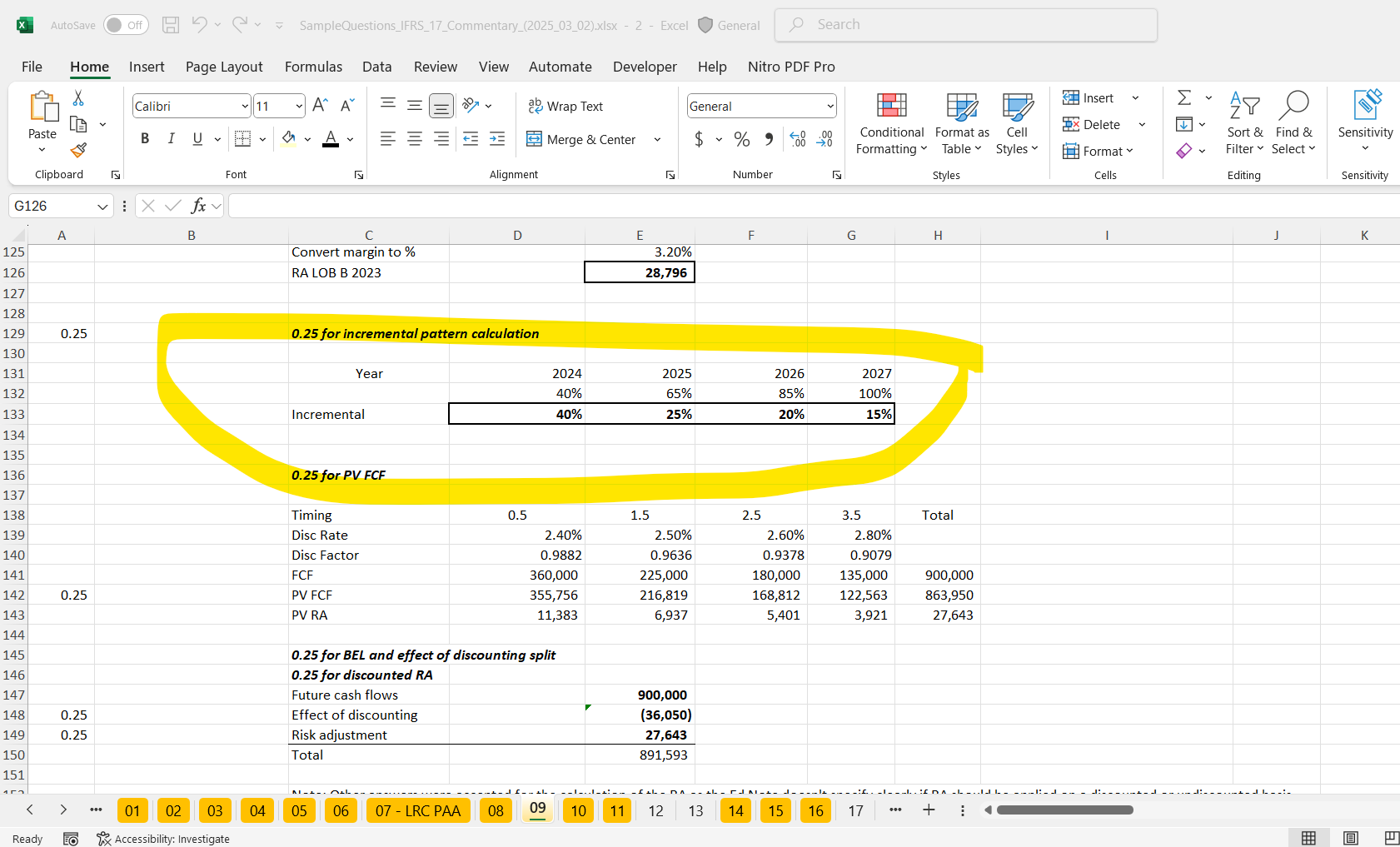

i am looking at the CAS sample question and the duration excel file, why are we not using (65%-40%)/(1-40%) like the way calculate in the duration excel file? i am very confused when to subtract only and when to divide for LIC?

In the sample duration calculation they've only provided you the unconditional payment pattern which means you need to scale accordingly based on the remaining years left in the payment pattern