unwinding - setting closing rates

IFRS sample Q-13

For the constant yield we're told for the 187500 pmt in 2025 the opening DR is 4.2%, I interpret that as at the beginning of period 2025 the rate is 4.2%, I dont think that interpretation is right because if the opening rate is 4.2% how can the closing rate be 4% from the 2024 rate? For the unwinding what exactly is the closing/opening rate?

Similarly for the spot rate if the second year curve becomes the first year curve why is the closing DR for 2025 the 2025 rate and not the 2026 rate?

Comments

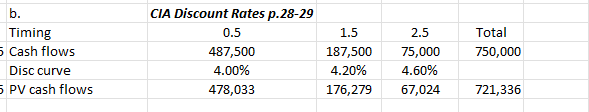

Your interpretation is not quite correct here. Your opening discount curve means that for the payment of 187500, the discount rate that will bring it to the PV is 4.2% compounded over 1,5 years.

I do not know what you mean here "opening rate is 4.2% how can the closing rate be 4% from the 2024 rate?" so you are going to have to rephrase that.

The opening/closing rate depends on the yield curve used - In this case it is the same for every year. You're focused on rates here where it is not the rates that are the supposed to be the same, but the yield curves across different maturities at a point in time.

Not clear what you mean here "Similarly for the spot rate if the second year curve becomes the first year curve why is the closing DR for 2025 the 2025 rate and not the 2026 rate?"

I just dont understand whats the difference between closing and opening rates and how the different rates are set for the unwinding, I cant make that make sense logically

I wouldn't look at it from an opening and closing rate. I would look at it as more of "what curve should I use at each period". For this example, you would use the same curve at each period. That means that at time 1, from the same discount curve, you use the discount rate implied at time 1; for time 2, use the discount rate implied at time 2, and so on. That's why it is called constant yield curve, you use the same yield curve at all times.

Using the same discount rate for opening and closing means that:

Thank you for the explanation!

Another Q - Q13 of the IFRS sample questions -> they don't give us a RA amount, is that intentional or an oversight? If we had a RA would we have to include the RA in the unwinding amount?

I assume that when it asks for the unwinding of the LIC youre specifically looking at the unwinding of the LIC and if they wanted to include RA they would ask for the unwinding of LIC & RA - Now that I'm thinking about it I guess if they gave you both LIC and RA info you state which one you assume.

The RA is also discounted, so you'd need to unwind that. And no, no one says LIC & RA. By definition the LIC includes RA so unwinding the discount on the LIC would include unwinding the discount on the RA also. For Q13 specifically, they probably did not include it for simplification purposes