2017Fall - 25a

Hello,

I have been struggled with Income from Subsidiary. When should we add it to Net Income when we calculate ROE & ROA? According to the examiner's report, subsidiary income should be added into net income.

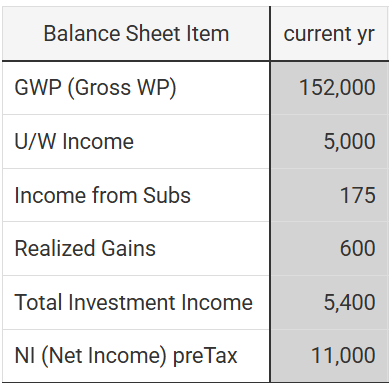

However, in the battle act, the Net Income pre-tax = U/W Income + Total Investment Income + Realized Gain.

Does that mean the income from subsidiary is already included in any subcomponent? or my understanding of the calculation is incorrect?

it also brings to another question, since the Total Investment Income does not include Realized Gain, why do we need to subtract it in ROR? or still my understanding of the battle act calculation is incorrect?

Thanks very much

Comments

Total Investment income includes realized gains.

For NI, you are not given all the components here which is why you can't directly derive net income from the information provided. I think that will address most of your questions. You are double counting by including realized gains. It is just by luck that NI + UW income + II + realized gains. Generate a new set of numbers and you'll see that is not true

Can you please give the FULL numerator for ROR, ROA and ROE?

ROE = UWi(NEP - Net Claim & Adj - Total Acq - Gen Exp) + II(inv inc + cap gain + other inc) + (subsidiary inc) - taxes

ROR = same thing as ROE but NO CAP GAIN and NO TAX deduction?

ROA = same as ROE?

1) How would one accurately know whether income is post-tax/pre-tax? 17F#25 (the word net isn't used either, but no tax removed)

2) How will I know whether or not cap gain is included in II or not? 17F#25 doesn't include, other questions mostly include.

Yes to all 3.

1) Income in the numerator of ROE should always be post tax. In #25 F2017, there was no way to know how much income tax should be charged which is why that is fine.

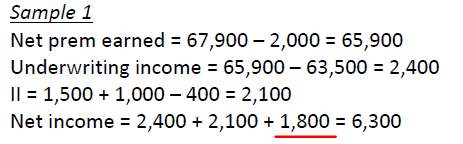

2) Capital gains are included in investment income here: 1500 (investment income) + 1000 (realized gains) - 400 (expenses)

is OCI included in Net Inv Inc?

It seems like no.

2019 F 23. There are 2 ways calc NII, don't understand the first 30K - 23K + 17K, what exactly are these numbers and how does it equal to the other 'easier' way

No it is not.

The numbers are in the question which is CI + NII - NI

Simplifying this, we get CI - NI = OCI

Which simplifies to OCI + NII