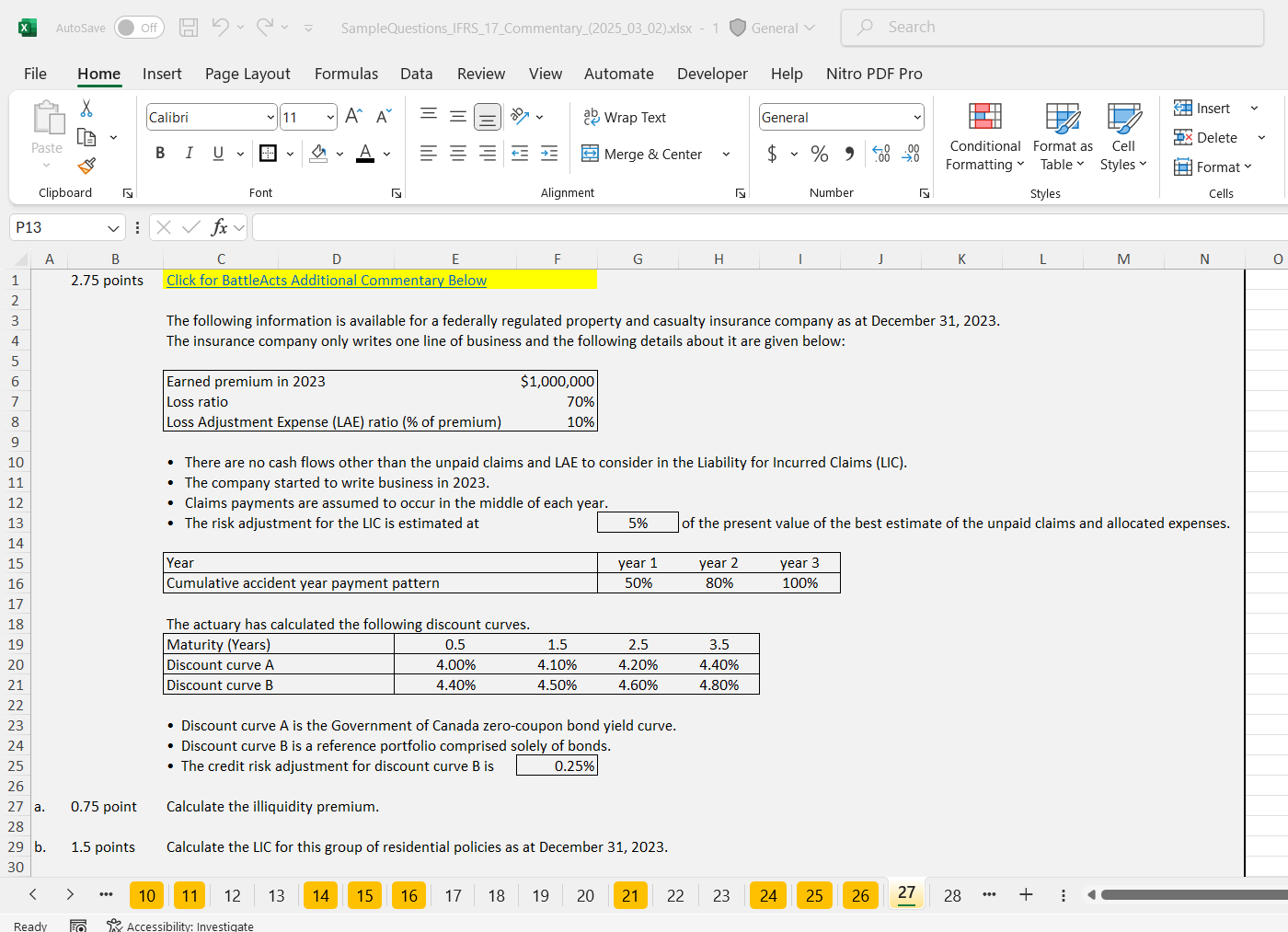

CAS Sample Question Q9 and Q27

i still don't understand why we use 65%-40% for Q9 but (80%-50%)/(1-50%) in Q27, i see that the comment said "The only trick here is that half of the claims have been paid out"...

It looks like you're new here. If you want to get involved, click one of these buttons!

i still don't understand why we use 65%-40% for Q9 but (80%-50%)/(1-50%) in Q27, i see that the comment said "The only trick here is that half of the claims have been paid out"...

Comments

In Q27 you are already at year 2, which means the unconditional payment pattern needs to be rescaled to get a remaining payment pattern as of year 2.

In Q9 they have already provided you a conditional scaled payment pattern at the end of AY 2023

how can you tell it is as of year 2? i am more confused now