Fall 2018 qs24 - AOCI

The formula for calculating Equity(x)=Equity(x-1) + NetIncome(x) + AOCI(x) - Dividends(x)

However, in the Fall 2018 - qs24aii - it subtracts prior years AOCI from the formula - can you please explain why?

It looks like you're new here. If you want to get involved, click one of these buttons!

However, in the Fall 2018 - qs24aii - it subtracts prior years AOCI from the formula - can you please explain why?

Comments

Your formula is not correct

Equity(x) = Equity(x-1) + Net Income(x) + OCI(x) - Dividends (x)

You wouldn't add your total AOCI to find the increase in equity in a current period. Just the OCI

Thanks for correcting that.

Can you please explain why the formula includes "change" in AOCI

A comment to another exam question (Fall 2016 qs22) said that we should not use the change. This is mentioned on the CCIR wiki

This is actually a typo on the examiner's solution. If you look at the row, it actually says OCI for the year and NOT AOCI. In the calculation however, they just take the row as is which is correct

I guess my first question remains,

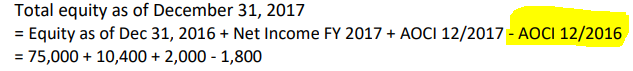

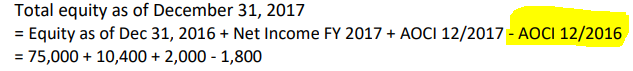

in the Fall 2018 - qs24aii - it subtracts prior years AOCI from the formula - can you please explain why?

As I mentioned in my initial response, you need to add OCI and not AOCI.

OCI(x) = AOCI(x) - AOCI(x-1)

Thank you for the explanation!

No problem

I have a question on a) i), the Capital Gains are excluded from the calculation of the Net Income. Is it because we assume they are already included in the Net Investment Income? Or there is another reason?

Where are you seeing that capital gains are excluded from the net income calculation for a)i)?

The formula is:

Underwriting Income (Loss) + Net Investment Income + Other Revenue and Expenses - Total Income Taxes

Since Capital Gain was not in the formula, I assumed they were not considered. With your reaction (and after looking at more formulas), I understand that Capital Gains are included in the New Investment Income!

Thank you

I have a question for a) iv:

Net unpaid claims and adjustment

= Gross Unpaid Claims and Adjustment Expenses 12/2016 - Ceded Unpaid Claims and

Adjustment Expenses 12/2016 + Net Claims and Adjustment Expenses Incurred FY 2017 - Net Paid Losses FY 2017

Why don't we deduct Ceded Unpaid Claims and Adj. Expense 12/2017?

You are taking net CAE for FY2017. The ceded amounts are already implicit in it

For part b i) ROR, why can we assume that net investment income= investment income?

They are not assuming that investment income = net investment income. If you look at the formula, they are backing out investment income from net investment income by removing capital gains

I have the same question as AndrewL:

ROR = (UW.Inc - CapGains + InvInc + IncFromSub) / GWP

The answer to b i) is actually using

(UW.Inc - CapGains + NetInvInc + IncFromSub) as the numerator.

Can you please explain?

I explained above

I understand the part you say they are backing out investment return using NII - capital gains. So the formula they are using is actually "(U/W.Inc + Inv Inc)/ GWP" (since they dont have IncFrmSubs).

But compare with what we have in the reading "( U/W.Inc - CapGains + InvInc + IncFrmSubs ) / GWP", there is an extra " - CapGains" term here.

Could you please explain which one should we use?

For RoR, you are basically looking for the pure investment return, excluding capital gains. You are provided with NII, which includes capital gains. So you're simply removing it.

Hello,

I just noticed that RoR in this question does not include Other Revenues and Expenses of $1100. Could you please explain why? I thought it was the income from subs.

Thanks!

Other revenues and expenses could include income from subsidiaries, but it also includes many other things. You could include it for the exam, but you would need to explicitly state your assumption

so for ROR, would the correct answer be = (11,000 + 2,500) / (100,000 + 10,000)

= 12.3% as we have NII?

Nope, you have to subtract out realized gains, so the numerator would be 11,000 + 2,500 - 500

I want to Confirm what "ChristoRoyer" stated above.

Does "Net Investment Income" of $2500 includes "Realized Gains (Loss)) of $500?

Also for part b) i)

Our formula for ROR is

( U/W.Inc - CapGains + InvInc + IncFrmSubs ) / GWP

How do we treat "Other Revenue and Expense"? How do we know that its part of Income from subsidiary?

It is stated in the MSA guide that Net Investment Income ** Includes** Realized gains.

As I mentioned above, you could assume that other revenue and expenses consist of income from subsidiaries, but you'd have to clearly state your assumption