Why is RA subtracted?

In the formula, it says:

LRC=FCF+CSM = (Future cash inflows-Future cash outflows)+effect of discounting-RA +CSM

I am having a hard time understanding why is RA subtracted?

I remember in a prior reading that is no longer on the syllabus, it said:

APV=PV(Future Cashflows)+RA for non-financial risk+CSM

Why is it being subtracted now?

Comments

I think because they definite the FCF as (inflows - outflows) in this formula, instead of the reverse. RA in an insurance contract issued is a 'bad' thing (adds to the liability) so it should go in the same direction as the outflows. This is how I remember it.

But not sure why the CSM is added in both cases

Adipelino is right. The CAS have been inconsistent in how they define the LRC in different papers.

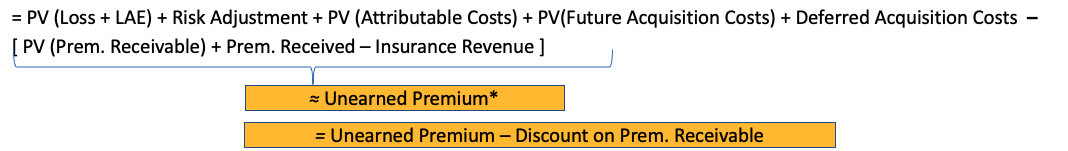

Looks like the formula they give in the excel WB doesn't match this formula either in terms of FCF definition of inflows - outflows:

LRC=FCF+CSM = (Future cash inflows-Future cash outflows)+effect of discounting-RA +CSM

Vs in excel they have outflows - inflows

As I mentioned a few times the CAS is inconsistent in their definition everywhere. It is inflows - outflows on Page 22 of the LRC paper which is what the wiki is referring to