Section 7 - Loss Component Example

In the attached example, group A has a PAA LRC of 0. The GMA approach has an LRC of -3376.

One of the requirements of the PAA approach is that the GMA does not differ materially from the PAA, which it appears to do in this example. Am I missing something here?

Additionally, if the PAA LRC is 0, does that mean the contract is over? If thats the case, will the GMA CSM be 3376 ?

Comments

Have a similar question.

For GMA, the LRC @ initial recognition = FCF +CSM = 0

For PAA, the LRC @ initial recognition = expected premiums - directly attributable acquisition expenses. It is not 0.

does it mean that PAA and GMA approach always have material difference?

Thank you

Not necessarily. At initial recognition the PAA estimate is also 0 if you have not received any premiums yet. Your formula for PAA should be UEP - DAC. Also, there are normally differences between PAA and GMA due to discounting and revenue recognition. Only if the differences are material would you use the GMA method -> This is the whole purpose of doing PAA eligibility testing

Conceptually when would there be a negative LRC excl LC under PAA? Is it DAC > premium received?

Also what does profit/loss represent here? I understand when there's a LC this is booked immediately in insurance service expenses leading to a loss, but why is there a profit recognized for group A when LRC is 0? Is this basically saying at this point in time the FCF are -3376 but we have booked an LRC of 0. Overtime the 3376 difference will flow into profits?

It's almost impossible for you to get a negative LRC excl LC. I say almost because I have seen some actual internal reinsurance treaties that are structured in such a way where a negative LRC excl LC is obtained, but for normal groups of contracts you wouldn't see it.

P&L here just represents the excess of your assets over liabilities for this group of contracts.

LRC isn't 0 for group A, it is 580. This example is for groups of contracts measured using the PAA. But yes, any profit and loss will flow into the P&L as revenue is earned

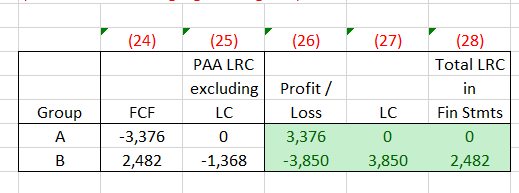

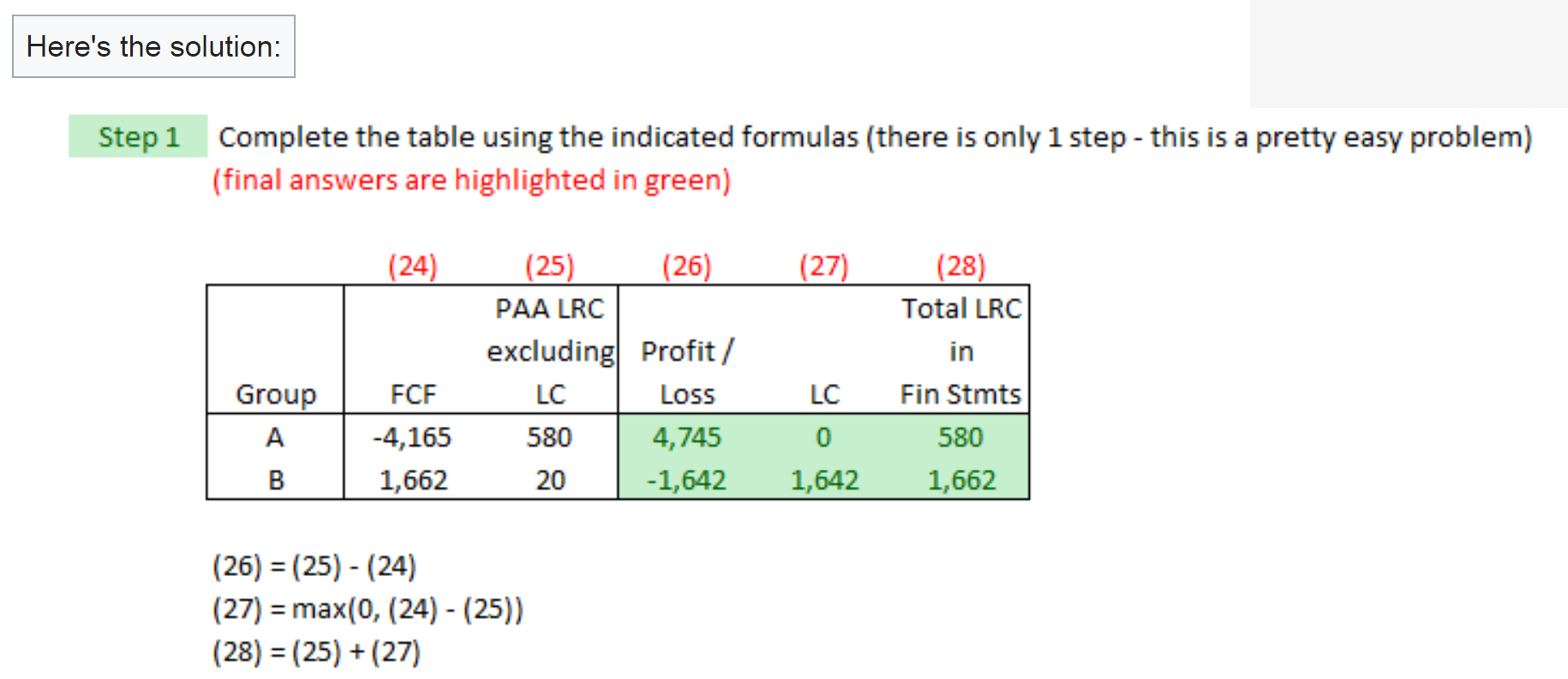

I'm having some trouble grasping the intuition behind group A in the wiki example of this topic:

My interpretation of givens:

FCF = -4165

-> means when we actually project cash flows, we have 4K more inflows than outflows

PAA LRC = 580

-> means if we estimate claims based on unearned premium for simplicity, we estimate claims for future coverage to be 580

Based on the above, I'm having a hard time conceptualizing what subtracting the two would represent. I feel I must be missing something, please let me know what a better way of conceptually interpreting these values would be. Thanks!

@Staff-T1, @graham, please let me know any thoughts on the above. Thanks!

Your true profit on this group of contract is 4165. You are holding a liability of 580. At the end of the contract coverage if everything happens exactly as expected, you release your liability for +580, and you realize a profit for +4165. Your total increase in assets or profit is the sum of both

Could you expand on the last part? "The total increase in assets or profit is the sum of both". Why is the "profit" in column 26 the sum of the "true profit" and the liability I'm holding for future claims?

I'm considering just forgetting about this concept altogether and if the exam asks for the profit in this kind of situation I would just put 4165.

Let's say I owe someone 500 dollars. If he decides one day to cancel my debt for no reason, my net worth has gone up by 500 dollars.

Apply this example to an insurer. If I have a liability of 580 and this liability disappears, the insurer is now 580 richer. This is what happens when your LRC excl LC goes to 0.

The reason for all this is that IFRS17 is that the PAA is meant to be a more conservative approach to measuring liabilities, as a trade-off for being simpler.

Under the GMM method, you would have an LRC of 0 at initial recognition as your CSM will cancel out the FCF. However, under the PAA, you are going above and beyond and booking more liability than what is needed on your balance sheet. When the contract is fully earned, you have your profit of 4165, and you then have that excess liability of 580 also being released which is why you need to sum both to get your final profit amount

Thanks, that helps I feel like I'm almost there. Where I'm struggling is that I don't understand why the 580 liability is not already taken into account in the FCF.

Lets say in the simplified 500 debt forgiveness example, in my mind:

Would the correct interpretation rather be that FCF = 0 (because they already lent you the 500 and you don't expect to pay it back) and the LRC using PAA would be 500? Then you add them to get +500 in profit?

No, FCF would still be -500.

In your example then, the profit here is 1000,

If I book a liability on my balance sheet expecting to pay out 500, and I actually paid out -500 at the end of the contract, how much is my profit?

Because all that happened is that somebody gave me 500 and never asked for it back, making profit 500. Could you lay out how this simplified situation would look like in terms of FCF, LRC using PAA, and profit? Thanks!

How much profit do I make in the following scenarios:

1000

0

Not sure

Could you, please, lay out what the FCF, LRC using PAA, and profit are in the following simplified scenario and I will fill in the rest in my brain.

Somebody lends me 500 dollars for a year and I expect not to pay them back.

My interpretation:

FCF at initial recognition = -500 (500 inflow expected, 0 outflow expected)

LRC using PAA = 500 (under a conservative approach, since I have not earned the 500 profit yet I have a 500 liability which will be released through the year)

Expected profit = 500 (I get 500, give 0)

Profit at end of year = 500 (assuming everything happened as expected)

Please let me know what, if anything, in the above simple scenario is wrong and I will fill in the rest on my own. Thank you!

The answer is 1000 for all of the above.

You are not releasing your PAA LRC in your example above. You have to think of profit as the change in what was booked vs what actually happened. You booked a 500 dollar loss (LRC) which turned into a 500 dollar gain which is a net swing of 1000 (your profit). Your main issue if that in all of your examples, you are still leaving the LRC on the balance sheet when all coverage has been provided

How can somebody essentially gifting 500 to me be a 1000 profit, logically speaking?

I understand that I book a 500 liability but wouldn't I also book a 500 asset (the cash) so net expectation would be 0 but then realize a 500 profit by releasing the liability?

For the contract VadimSem described there would be no point in time where FCF = -500 and LRC booked = 500. The only way we can have a LRC of 500 under PAA/GMA is if premiums are already received. If this is the case FCF = 0.

Before we receive the first premium payment:

PAA LRC = Premiums Recieved - DAC = 0-0 = 0

FCF = outflows - inflows = -500

CSM = -FCF = 500

GMA LRC = FCF + CSM = -500 + 500 = 0

Profit = - FCF = CSM = 500

Once we have already received the premium of 500 (assuming this is paid immediately and no coverage has been earned yet):

PAA LRC = Premiums Recieved - DAC = 500

FCF = outflows - inflows = 0 <- the premium has already been received no longer a future cash flow under the contract

CSM = 500 as there has been no amortization since no coverage earned

GMA LRC = FCF + CSM = future outflows - future inflows + CSM = 0-0 + 500 = 500

Remaining profit = CSM = 500

I think the problem with the proposed question is that there is no situation where the LRC booked is 500 and FCF -500. By the time premium is received and LRC is set up to be 500 there are no more expected cash flows under the contract. As a result FCF is now 0. Profit = LRC booked - FCF = 500 - 0 = 500

Hypothetically if we did have LRC booked of 500 and FCF of -500

We would amortize the liability of 500 over the duration of the contract and as our liability decreased to 0 we would recognize 500 in profit.

There would also be an additional source of profit, as not only do we amortize the liability with no outflows, but we expect future inflows of 500 as FCF = -500

In such a case total profit would be 1000 recognized over the remaining life of the contract

Thank you! I know this is an overly simple example but the breakdown above is very helpful. @Staff-T1 thank you as well for all the responses!

No problem. I would confirm with @Staff-T1 to make sure my interpretation is right

The breakdown makes sense.

One additional thing to add: "Hypothetically if we did have LRC booked of 500 and FCF of -500" This is the example in the OP and happens anytime that you use the PAA approach on a non-onerous group of contracts so I don't think this statement:

"I think the problem with the proposed question is that there is no situation where the LRC booked is 500 and FCF -500."

is correct