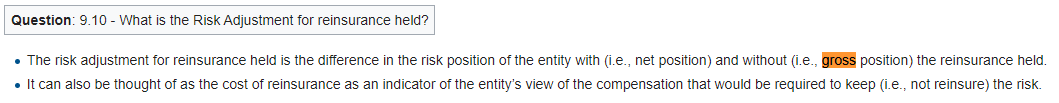

RA for reinsurance held

Hi,

I am reading IFRS17-2 the section about reinsurance held, and i remembered this section from the IFRS-IC.

To me the difference in net and gross position is the ceded amount. So RA is equal to the ceded amount? Or does RA is adverse development of the ceded amount being smaller than expected? the later would make more sens to me...

so the four approach here would compute some margin to reduce the ceded amount or in the same way increase the net amount by a margin called Risk adjustment?

thanks ![]()

Comments

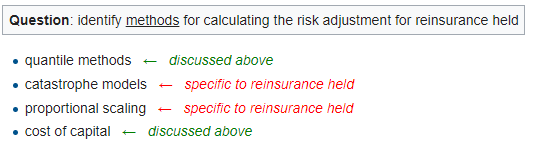

It is the difference in the risk position as pointed out in the middle of the sentence not the difference in dollar position. Basically at a high-level you can think of the RA as the difference in the capital position of the insurer with and without reinsurance. The 4 approaches would calculate methods to reduce the ceded amount here since it is for reinsurance held. You calculate reinsurance cash flows separately from the underlying