Discount rate used when calculating margins for unexpired coverage or LIC

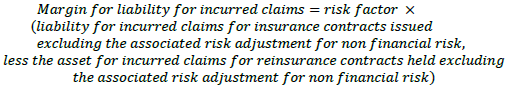

I know we exclude the RA when we are multiplying risk factors by LIC or for net unexpired coverage. For example:

https://battleactsmain.ca/wiki6c/File:OSFI.MCT-IFRS_(041)_formula_LIC.png

Does this mean we also would use the risk free rate when discounting if we had to determine the LIC based on a payment pattern (ie exclude any liquidity premium)?

I believe under the old practise, the MfAD for interest rate risk was NOT used when calculating the claim liabilities that are part of the insurance risk margin (as well as excluding all other MfADs). So I was wondering if we'd do the same and use the risk free rate under IFRS, or if they've changed it to only NOT account for non-financial risk.

Comments

No you would discount it using your IFRS17 discount rate. So three things here: