Excel Illustration CIA IFRS 17 - LRC

Hello, Your last update (Oct 03 2022) says there was an error in the calculation of FCF. Are you still waiting for the exam committee response? Can you explain exactly what is the discrepancy you found between the formula in the first tab and the actual calculation in Appendix A? What are the other errors you found? I didn't notice anything wrong with the file so I'm not sure if I'm also doing it incorrectly.

Comments

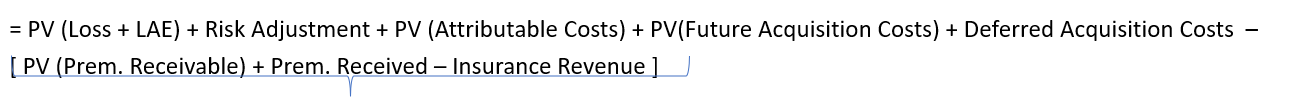

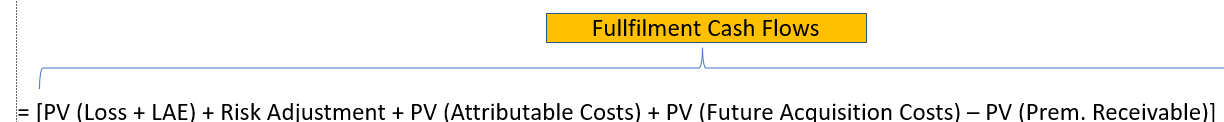

The way I interpreted the file is as follows. Here is what's shown for the FCF formula on the "Approach" page of their Excel file:

But on the "AppendixA-EndOfYear" worksheet, the formula for FCF shown in the cells in column (24) is different. The last 2 highlighted terms below for Deferred Acquisition Costs are not part of the above formula for FCF:

The exam committee did recently respond and this is what they said:

So my interpretation of their response is that the extra terms for Deferred Acquisition Costs are actually part of PV (Future Acquisition Costs). That means that:

But I'm not sure why they are subtracting (Deferred Acquisition Costs - Gross of Cancellations).

A further issue is that in the "AppendixA-EndOfYear” worksheet the formula for PAA LRC (Excl. Loss Component) only uses the value for (Deferred Acquisition Costs - Gross of Cancellations) whereas the response from the exam committee stated that PAA LRC (Excl. Loss Component) uses DAC net of cancellations.

The conclusion is that I haven't decided what to do. I guess I could make up a problem based solely on the "AppendixA-EndOfYear” worksheet using the formulas as given on that sheet even if they don't appear to make sense.

I see your point thanks @graham, but if we remove the noise from cancellations another question I have is how to interpret the use of deferred and future acquisition costs. For example:

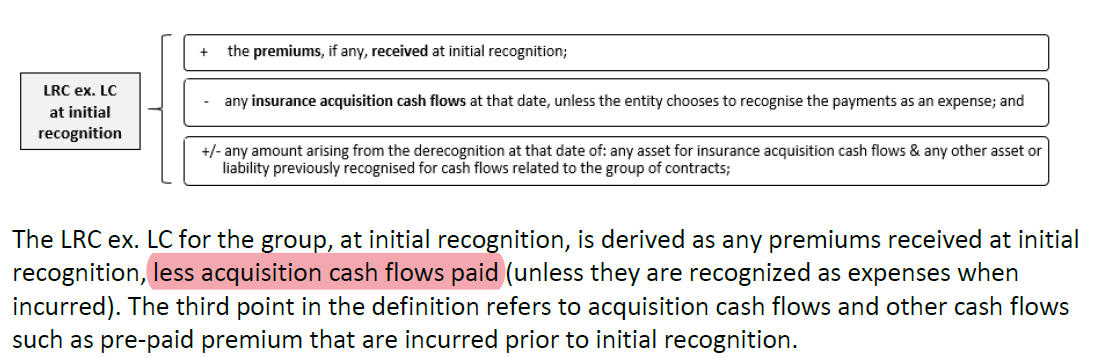

LRC exc LC involves subtraction of deferred acquisition costs

while:

FCF involves addition of future acquisition costs

and:

LC technically involves addition of both deferred and future acquisition costs (since we calculate LC = FCF - LRC exc LC)

1) How do you interpret the subtraction/addition of deferred/future acquisition costs in each of these 3 items?

2) Are deferred/future acquisition costs mutually exclusive?

Deferred and future acquisition costs are mutually exclusive. Future acquisition costs are for policies that have been written or are expected to be written but not yet incepted, while DAC is for policies that have already incepted. I believe this will answer your first query too

Sorry I don't think you answered my first question. For example in terms of acquisition costs how do you interpret LRC for non-onerous contracts only taking DAC as inflow and LRC for onerous contracts only taking future acquisition costs as outflow?

Does this formula for LRC in the wiki include or exclude LC?

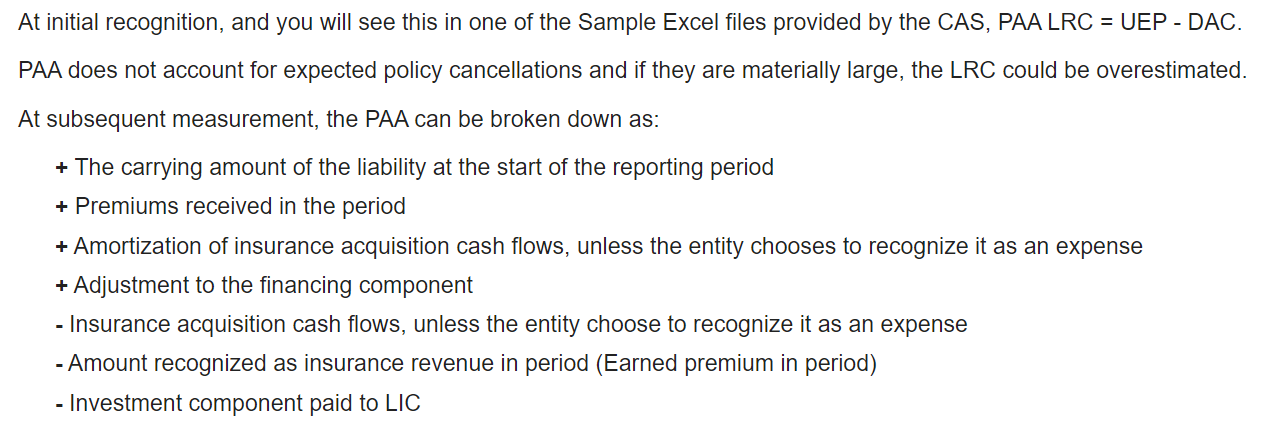

If it excludes LC how does this match the approach in Excel illustration? the Excel approach is only doing - DAC (there's no future acquisition cost component) while the formula in the wiki seems to consider both? If I take future acquisition costs as "Insurance acquisition cash flows, unless the entity choose to recognize it as an expense" and I take DAC implicit in "The carrying amount of the liability at the start of the reporting period" given that LRC = UEP - DAC at initial recognition?

And if it includes LC the formula for LRC inc LC in the approach would cancel out DAC? I'm not sure how that would match either

LRC = LRC exc LC + LC

where LC =

For non-onerous contracts, the PAA is UEP-DAC. It is not reflecting that the DAC is an inflow. This is a simplification to bypass the GMA approach for calculating LRC

When the contract is onerous, what you are actually calculating is the difference between the GMA LRC and PAA LRC. GMA LRC - PAA LRC = LC. Since GMA is the true LRC, you need to add the difference (LC) back to your simplification. Also, as I mentioned above DAC is for policies already written and incepted while future acquisition costs are for policies that are written but not yet incepted. Conceptually I view them as the same thing

For your second query, this is PAA for non-onerous contracts. As I mentioned above, DAC and FAC can be used interchangeably. You would amortize your DAC every period so it would be part of your carrying amount at the start of the reporting period and the portion of DAC amortized would be in the amortization of insurance acquisition cash flows

1) I understand your point about how to view DAC and FAC but the Excel illustration does not seem to use DAC and FAC interchangeably. FAC is not used in the Excel calculation of PAA LRC exc LC. They only use DAC. I thought this was because DAC is paid and FAC is not paid yet. Is this wrong?

2) Are you saying these 2 formulas lead to the same LC?

This is confusing because that would mean GMA_LRC = FCF + LC but from the reading isn't GMA_LRC = FCF for onerous?

Unless this formula of GMA FCF = PV(future CF) + RA is not equivalent to this formula in Excel?

On a different note, I think I found another contradiction in the response from the exam committee. The educational note says DAC net of cancellation needs to be included in FCF while their response says only the cancelled portion of DAC is included in FCF; and that DAC net of cancellation is included elsewhere (i.e. LRC ex LC). This would be in addition to the fact that the formula in the approach page of Excel doesn't even mention DAC in the formula for FCF unless they meant FAC+DAC net of cancellation as "Future Acquisition Costs"?

I'm wondering if it would be worth replying to the exam committee this time mentioning their response contradicts the educational note? @graham

1) Okay, I see what you mean. I think this is because the standard lays out that the PAA simplification is specifically only UEP - DAC and not UEP - FAC. As to why this is the case, I have no idea, but conceptually, I view them as the same thing. I think that under GMA, any DAC would be implicit in the CSM and LC as long as the release pattern follows the premium earning pattern (and it usually does). FAC would eventually be DAC when a policy is incepted and be released using premium earnings pattern. You cannot have both FAC and DAC for a policy.

2) Yes, whenever I mention PAA I am referring to the PAA excluding LC. In the industry, PAA is always referring to the UEP- DAC formula which is the PAA excluding LC.

I have talked to Graham about this and honestly I feel the CAS' formula is wrong. Thinking about it from a first principles perspective, why would you include just the cancelled portion of DAC? If anything you should exclude it which is what you refer to in the notes. Anyways the CAS are not the most responsive and are wrong quite often in their exam commentary so this is nothing new.

Based on your comment above should we interpret "PAA estimate" here as "LRC excluding LC"

and "GMA estimate" as "LRC including LC"

In that case is it correct to conclude the following?

LC = GMA_LRC - (PAA_LRC ex LC)

And one more question about acquisition costs. I am very confused by this paragraph from the educational note. Do you mind explaining it in plain English? It seems to contradict how DAC/FAC are treated in the calculation of LRC

To your first question, the answer is yes.

For your second question, 59(a) states than an insurer may recognize insurance acquisition cost as expenses when they are incurred. If you expense the costs of acquisition immediately, it goes straight to the P&L and has no impact on onerousity. In other words, there is no DAC. The Excel files are not reflecting this scenario. The Excel files are representing acquisition costs that are incurred at the same time as premium is earned

thank you, I think the part that throws me off is where it says costs related to future contacts are not part of LRC. This seems to apply to the scenario reflected in Excel file but I do see FAC are part of the calculation of FCF which at the end are part of LC and therefore LRC (including LC). Unless the notes refer to LRC exc LC (last line highlighted in yellow) when they say "LRC"?

Hijacking this thread to refer to the original question regarding the error in formula in the Excel file:

I assume based on first principles the accurate version of the formula would be to simply add DAC (net of cancellations) when calculating FCF correct?

If this is the case interestingly since we have the following formulas in the Excel file:

PAA LRC (excl. LC) = Premium Received - Insurance Revenue - DAC(gross)

FCF = PV(Loss & ULAE) + RA + FAC(net) + PV(Other Costs) + [DAC(net) - DAC(gross)]

Profit/Loss = PAA LRC (excl. LC) - FCF

The DAC(gross) term ends up getting cancelled when we calculate Profit/Loss and eventually the LC value. Basically it seems like them making 2 wrongs in 2 separate formulas did make a right. Is that correct?

That's actually a good point @maazzu94. I would also be wondering why PAA LRC (excl. LC) would ignore the effect of cancellations even on the portion related to premium received? FCF seems to use premium net of cancellations to estimate the Loss & ULAE portion (as well as net premium receivable) so I didn't understand why the same reasoning would not apply to PAA LRC (excl. LC) unless that's because PAA is not supposed to account for cancellations, so the effect of cancelations only comes into play when the group is onerous so you do GMA instead (to calculate FCF and thus LC)?

This whole section that you are highlighting is referring to the "expensing acquisition costs" immediately option. In the Excel file, the assumption (which most insurers take) is to incur expenses as revenue is earned. When you expense your acquisition costs immediately, there is no longer any DAC or FAC.

I think there is a fundamental issue with the Excel file. PAA excl LRC is **GROSS **of cancellations as per the insurance contracts paper. As to why that is the case, I think you will come to find that the standard is mostly applied at face value and unless you are one of the people who actually wrote the standard, the logic behind many things is pretty opaque. Going back to the Excel file, if you follow the formula in the "Approach" tab, then it seems like there wouldn't be any DAC at all even in the FCF. In summary, as Graham alluded to, it seems like the CAS themselves are wrong and confused too. At this point, no one really knows what the true formula is. Maybe I will try to find the GMA calculations for one of my work files to check the mechanics

thanks but the second paragraph of the section I was highlighting starts with "if acquisition cash flows are NOT recognized as expenses when incurred..."

So wouldn't that be the opposite to the "immediately option" that you're referring to?

Right - The contracts in the Excel file have already been "recognized". FAC would only not been considered in the LRC for unrecognized contracts