Time value of money not recognized in CSM

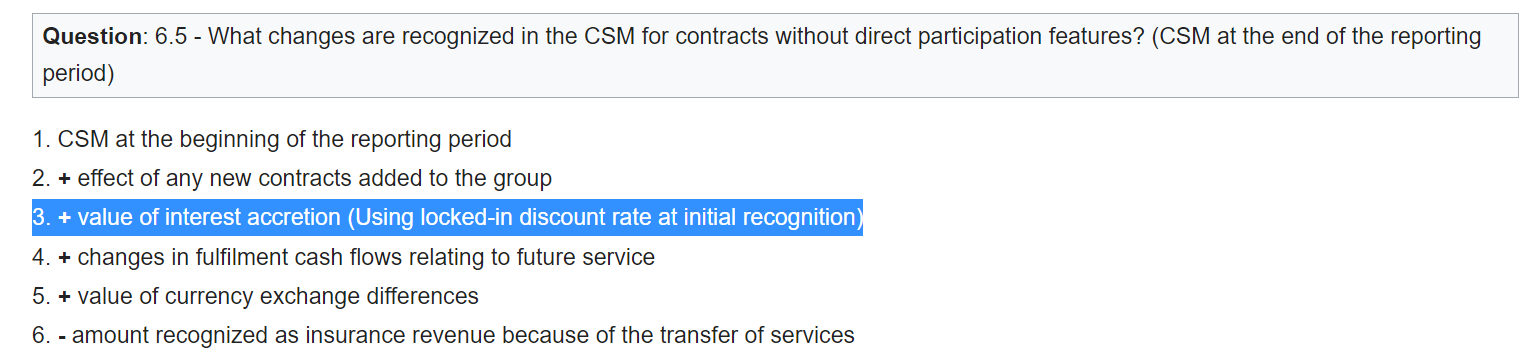

Hello, what would be the difference between:

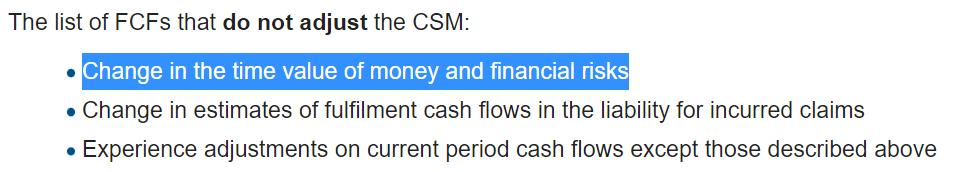

and:

1) Isn't value of interest accretion same thing as time value of money?

2) Btw I'm wondering why effect of discounting in FCF is said to capture financial risk if it is calculated at rates locked in at initial recognition, so risk of actual rates deviating from locked in rates is not meant to impact the estimation of FCF. Isn't this risk what we understand by financial risk?

Comments

1) No, time value of money represents discounting of your premiums and losses whereas the interest accretion represents amortization of the CSM.

2) Broadly yes. You would make a provision in your initial discount rate to reflect the expected volatility in the future. The standard does not explain why any changes would not affect the CSM and would instead go into AOCI or the P&L immediately so not able to provide more information on this. My thinking is you would only want material changes to affect the CSM, else you would have constant CSM changes every quarter whenever the interest rates move by a couple of basis points

Since interest accretion does reflect the time value of money probably you meant that the bullet below refers to changes in the discount rate assumptions (that would produce changes the time value of money) due to financial risks? As opposed to the time value of money at locked-in rates

Yeah that is what I was referring to. Changes in discount rates (TVM) would flow into AOCI or directly into P&L so it won't have any affect on the CSM.