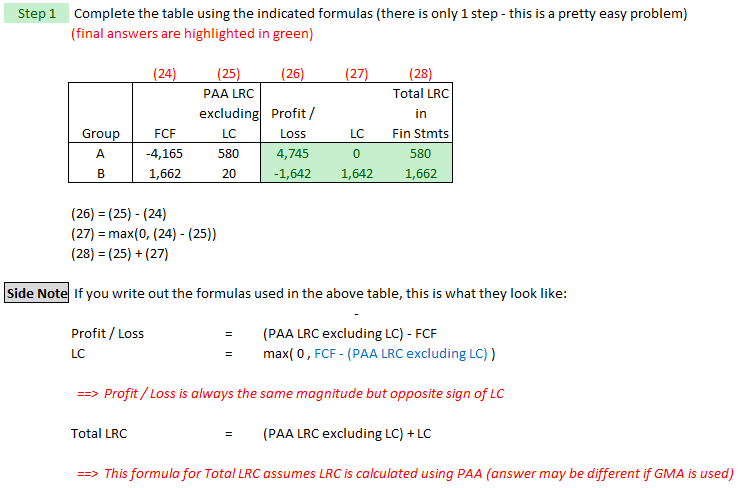

Calculating P/L from LRC and FCF

From my understanding, FCF is essentially the net CF (mainly inflow- outflow + some adj), so for the first group with -4165 should basically mean it has a net outflow of 4165 for Group A. But I don't understand how the logic behind why we subtract the FCF from the LRC to get P/L for a group and hope someone can explain. Thanks

Comments

FCF should be equal to outflow - inflow. A negative amount of FCF means the contract is profitable. The profit/loss is just the difference between the PAA LRC and the actual liability from the contract which is pretty intuitive

In the comment in red "this formula for total LRC assumes LRC is calculated using PAA (answer may be differeent if GMA is used)" This comment would only pertain to non onerous contracts right? For onerous contracts, GMA LRC = PAA LRC.

Pretty much

for Group A, FCF = outflow - inflow = -4165, it means inflow is larger than outflow by 4165. isn't 4165 the profit ? why do we need to consider 580? Thanks

Yes, 4165 is the profit, but it wouldn't be the LRC. You book the LRC on your FS not the profits. The whole purpose of IFRS17 is to prevent the pre-recognition of profit before it is fully earned

I know 4165 is not the LRC. I was talking about the profit, the profit in the table shows 4745 instead of 4165. so is the profit 4745 or 4165 ? 4745 is "PAA LRC excl LC" - "FCF". Do we need to consider PAA LRC when we calculate the profit?

Thanks again.

4165 is the pure 'profit' of the contract as a whole when measured using GMM. However, given that you are booking a liability under PAA, your total profit would be the difference in your current liability (580) and your FCF (-4165).

Simply written, if you expect to make 200 dollars selling this policy and have 100 dollars as a LRC for this contract, then when every thing is said and done, you will reduce your LRC to 0 which gives you a net position of 100, and then you will make 200 from the contract itself for a total change in asset position of 300

and could you please help me understand this.

1 Why do we need to compare FCF and LRC ex LC to decide if it is onerous, isn't that as long as FCF>0 (net outflow > inflow) , it is onerous ?

Thank you again.

For point 1, yes. However, your total liability under GMM will be less than your PAA LRC so in that sense it is fine as you are overstating rather than understating your liability.

I prefer the former for point 2

Say a contract with outflow =100, inflow = 90 , then FCF = 10.

a. if LRC ex LC = 8 under PAA , we need put up LC =2, LRC = 10

b. if LRC ex LC = 12 under PAA, LC =0, LRC = 12

so under point a. , the contract is onerous and for the same contract (under b.) , it is non-onerous ? this confuses me, as I thought as long as outflow>inflow (FCF is positive, the contract is losing money), it is onerous regardless what LRC ex LC is.

Thank you.

Yes that is right. Again it is about conservatism. You are non-onerous in option (b), but you are actually carrying more liability or 'reserves' than in option (a) so that is fine. Remember PAA is meant to be a simplification of the GMM. Also, your LRC in (a) should be 8 not 10. The LC is not part of the LRC

Thank you. I know the numbers are correct but the confusion is around the definition of non/onerous.

A contract can be considered as "onerous" or "non-onerous" depends on how much liability the company is carrying for that contract? I thought as long as the contract is not profitable, it is considered as onerous.

Say, if the company wrote a very unprofitable contract but they carry enough reserve/liability for that contract , the contract is considered as non-onerous?

"Also, your LRC in (a) should be 8 not 10. The LC is not part of the LRC"

This got me really confused.

LRC Excl. LC=8 and LC=2

Why isn't LRC=10?

Since LRC = LRC excl. LC + LC? Like the example at the top of this discussion

oh yeah you are right. PAA Excl LRC + LC = FCF. Somehow I was thinking about the GMA when I typed that out. LRC = 10

Concerning the question of jjj820 on May 4th, do you have an idea? (Sorry for poking you like that, I just assumed the message got lost because of mine)

I never thought of that, but I'm curious about that. I understand how we determine if a group is onerous with the formulas, but that question is really good: Can a contract be non-onerous AND unprofitable (or Onerous AND Profitable)?

You can be onerous, but if your PAA excl LC is greater than your GMM estimate, then you can continue booking the PAA excl LC estimate of your LRC. It's not profitable, but you can still use your PAA estimate

Hello I am really confused by this reading.

Can you please explain: "However, given that you are booking a liability under PAA, your total profit would be the difference in your current liability (580) and your FCF (-4165)."

If we have FCF=-4165, we need to book CSM=4165, which is a liability.

Say now that we have Hydro Payable(Liability)=580. Why would that increase the Total profit from 4165 to 4745?

From the example from @jjj820, part b), how do we have LRC=12 but FCF=10?

I thought we would have LRC=FCF.

CSM is a negative liability, so essentially an asset, but still a liability nonetheless.

For part (b) LRC = FCF iff measurement is done using the GMM. Under PAA, it is not necessarily true that the LRC excl LC is equal to the FCF (It is usually higher)