Excel Example for FCF calculation using issue year

Hi, I wanted to ask if we really have to use issue year in the Excel calculation example.

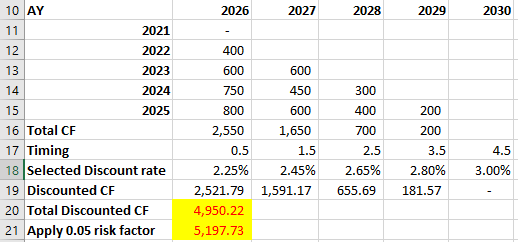

The following is how I did the discounting calculation without having to allocate based on issue year.

I basically summed all the cashflows that are allocated to each of the future years based on the payment pattern (the sums are on row 16). Then I discount them based on the corresponding discount rate & timing to get row 19. The total discounted CF and the one with risk adjustment are both the same as the answers given. I wanted to ask if this is also an acceptable method OR I have to use the issue-year method for these types of questions?

Thank you!

Comments

Yes, you would have to use the issue year method. The reason this simplification works is because the yield curve does not vary by issue year which is not the case in practice, and may not be the case in the actual exam