Multi-peril contracts & Portfolio change

Hola!

I would need some clarification on the following section of the wiki porfavor.

1. What does additive structure mean here? Additive algorithm to price each peril or Contract premium as sum of peril premiums? And why does that lead to inaccurate financial reporting?

2. Do you have an example of a risk that could be split out by contract?

3. I think I might just need examples to put the pieces together...

- How can a portfolio change over time for NBS, RWL, INF?

- How can you change portfolio but not group given group is a subset of portfolio?

Muchas gracias in advance ![]()

Comments

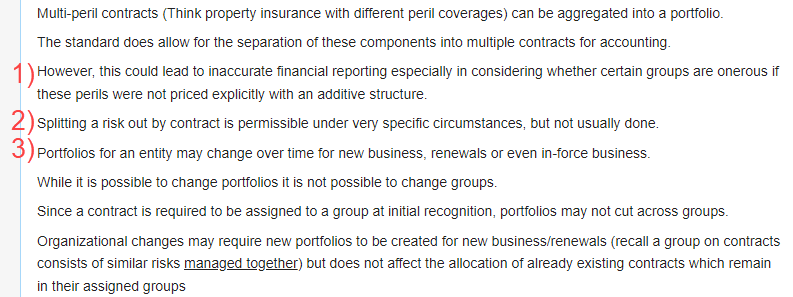

1) For example, let's think of a property policy with 2 perils, flood and wildfire.

In an additive structure, Premium = flood premium + wildfire premium

In a multiplicative structure, Premium = Base PremiumFlood DifferentialFire Differential

It's just harder to separate out the exact amount of premium related to each coverage in a multiplicative structure due to the correlation implicit between the differentials

2) Off the top of my head, maybe TPL-BI and TPL-PD? No explicit examples are provided in the text

3)

Crystal clear. Thank you very much!