LRC at initial recognition

under GMA, is LRC=0 at initial recognition if the contract is non-onerous? as LRC=FCF+CSM and CSM=-FCF

It looks like you're new here. If you want to get involved, click one of these buttons!

under GMA, is LRC=0 at initial recognition if the contract is non-onerous? as LRC=FCF+CSM and CSM=-FCF

Comments

As a follow-up to this if the LRC= 0 under GMM at initial recognition then that would mean total policy liabilities = LIC + LRC = 0. So adding new contracts under GMM wouldn’t impact our liabilities at all at initial recognition?

To me that seems like a gross violation of first principles.

I totally understand what you mean but based on the formulas LRC=FCF+CSM and CSM=-FCF , the LRC = 0 if the new contracts are a non-onerous.

Yes I agree with your logic and its probably the way it is. It just seems antithetical to the concept of prudency in accounting. I suppose as CSM is released and at subsequent measures the LRC and LIC could change and we could record a liability but its seems crazy to me that I could write a million dollars worth of non-onerous contracts on April 28th 2023 and it wouldn't hit my balance sheet at all at initial recognition on that day

Yes, LRC is 0 at initial recognition. I disagree that it doesn't make sense. At initial recognition, if a contract is non-onerous and no service has been provided, why should there be a liability on the balance sheet? The insurer hasn't even started fulfilling its obligations. As service is provided, even if a contract is non-onerous there will be a liability on the LIC side.

When it is said that way it actually makes sense ahah Thank you!

But let's say the insurer has already received the premium and paid the acquisition expense. Can we calculate LRC "at initial recognition" as:

Received Premium

- Acquisition Expenses unamortized

+/- Derecognition of ASset/Liabilities

?

Or is this formula exclusively reserved to LRC excl. LC?

And is LRC excl. LC the same thing as saying LRC Excl. CSM? (Since LC is a bit like a negative CSM)

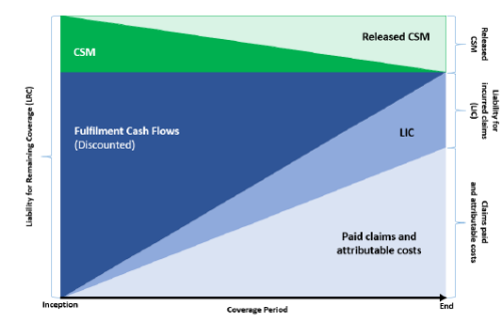

I think that what makes it to understand is this graph:

Clearly we see that at inception, FCF is added to CSM and LRC is not 0. CSM and FCF are not even the same size, so it seems weird that they cancel each others.

Edit: Actually I just realized this discussion was about GMA! So the first part of my question doesn't make sense since it relates to PAA and PAA doesn't have calculate CSM. However, I'm still curious about the graph and the presence of LRC != 0 at inception

So this graph is basically LRC at inception AFTER the first premium has been received. LRC is defined as FCF + CSM. You would just not add the LC to your LRC. When you have a LC, your LRC is just equal to FCF since your CSM is 0

Makes sense, thank you!

FCF is not just the expected loss, but the expected loss less premiums. Basically the LRC is sort of a replacement for premium liabilities under IFRS4

CSM has the same sign as the FCF. They do not really offset each other. LRC = FCF + CSM. The CSM is the unearned profit at inception, amortised throughout the life of the policy and not the premium

So to clarify, LRC = 0 at initial measurement but what happens after initial measurement? If LRC still = FCF + CSM, is CSM still = -FCF and would that mean LRC still equal 0 throughout? I know this doesn't make sense but what am I missing here to make it so that LRC isn't 0 the whole time?

Yes, LRC is 0 but only at initial recognition. Conceptually, the CSM represents unearned profit and will be amortized at a fix rate, provided assumptions do not change. Thus, at subsequent measurement the CSM will no longer be equal to FCF at any time period > 0.