IFSR 17 Bonus Question, b

Hi,

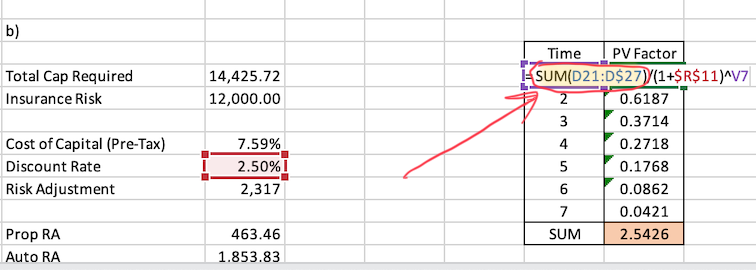

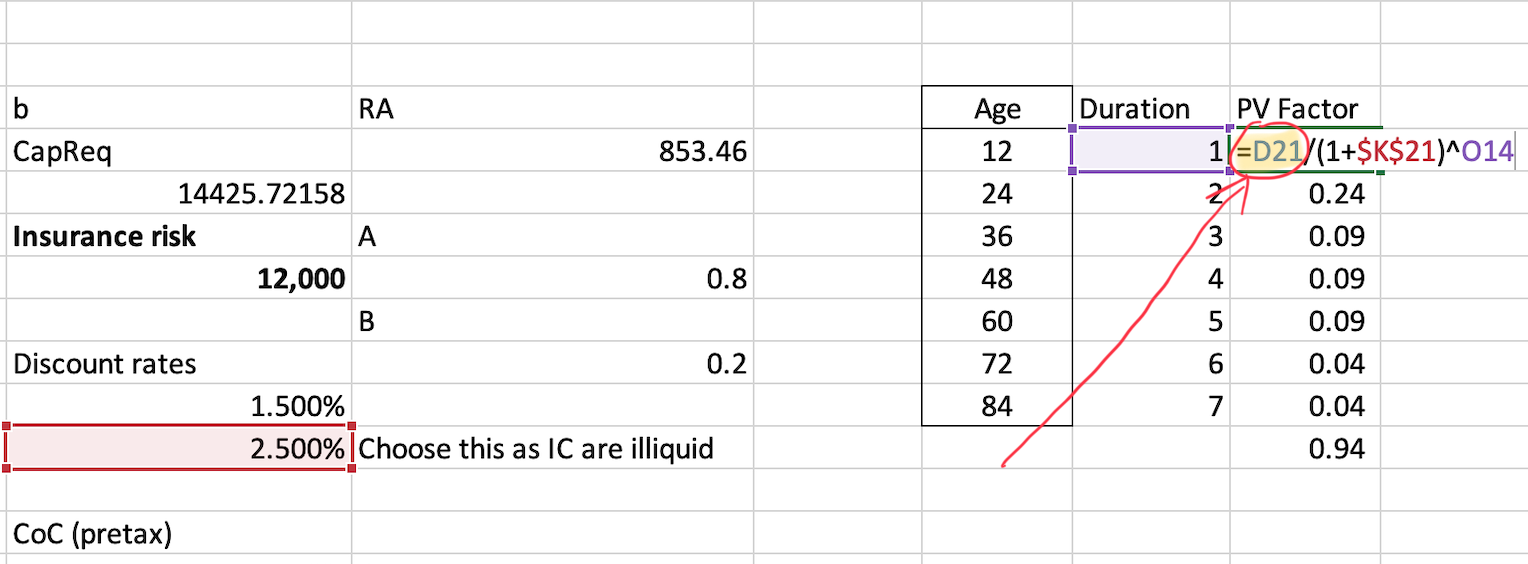

For IFRS 17 bonus question (which i found here: https://battleactsmain.ca/wiki6c/Excel_Practice_Problems) part b, just curious why PV Factor is calculated this way (D column refers to a given payment pattern in excel file):

I thought that we'd need to discount each percentage separately to get this:

Comments

I believe its because when determining RA under CoC method you need to determine the cost of holding capital (effectively the "compensation" required to onboard a risk)

A simple example:

Say I have 100 dollars in my bank account and I need to make payments of 10, 40 and 40 over next 3 years. Let's also say my bank charges me 10% fee of my account balance to keep the money in my account. Then the cost to hold the cash isn't going to be my payment pattern, its going to be the amount of money I need to hold to make the payments for the rest of the years

So in my example the cost that I need to pay to the bank will be

Year 1: 100 * 10% = 10

Year 2: 60 * 10% = 6

Year 3: 40 * 10% = 4

Thus my RA would be 20 dollars (assuming no discounting)

@Staff-T1 Hope that is a correct analogy. I want to also piggy back off this topic and ask in this example we are discounting as if the capital charge is at end of the year (similar to commutation of claims) but the IFRS sample question 4 discounts the capital charge in the middle of each year. Is there a way to know when to use end of year vs middle of year? I couldn't find anything in the reading to suggest 1 way vs the other.

Thank you @maazzu94 , that makes perfect sense.

Yup you are right with your analogy. I think it is fine to do either mid-year or year end discounting if it is not mentioned. Just state your assumptions