Appendix A

For group B, once it passed threshold 2, should not we assess if group is onerous? Same goes for threshold 3.

I would personally compare PAA and GMA estimate and book LC if GMA estimate > PAA estimate.

It looks like you're new here. If you want to get involved, click one of these buttons!

For group B, once it passed threshold 2, should not we assess if group is onerous? Same goes for threshold 3.

I would personally compare PAA and GMA estimate and book LC if GMA estimate > PAA estimate.

Comments

Hello @Staff-T1 and @graham ,

Being less than 1% indicates that it is PAA eligible. It does not indicate that there is no need for LC.

If I recall properly, LRC under PAA = (LRC excluding LC) + LC

Could you please let me know?

Thanks,

Andrew

It says in the example that they are not onerous so why do we need to assess if there is a LC?

where does it say that group B is non onerous? it says group A1 is non onerous, is it non onerous if there's no GMA estimate? in a similar way why dont group C&D need a loss component/why arent they onerous?

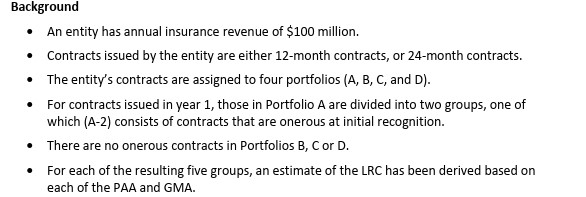

Please see the screenshot below from page 19, second last bullet point