accounting steps required for LC in subsequent measurement

Hello,

There are two places discussing subsequent adjustment for LC in wiki and they seem to contradict each other in my understanding. Could you please explain a bit more?

First one:

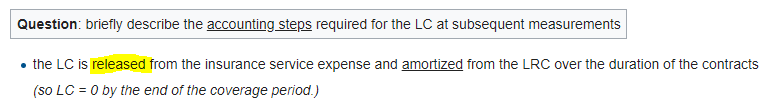

Here it says LC is released from ISE and amortized from LRC. My understanding is it means LRC decreases because LC is amortized and ISE also decreased because LC is release, although I don't know why LC is released.

Second one:

It says amortization of LC would increase ISE. This makes more sense to me because once LC is amortized from LRC, LRC would decrease and LIC would increase which is a part of ISE.

Looking forward to hearing back! Thanks in advance!

Comments

Yes, good catch! It should be LC is released into the insurance service expense rather than from. LC is released as it is advance recognition of losses, so that advance recognition is no longer needed when service is provided.

Fixed, thanks. (fyi..the original post was in the wrong thread. This material is from CIA.IFRS17-LRC.)

Hello @Staff-T1 @graham ,

Is the following correct?

If the contract period is 2 years, I understand that we would amortize LC over time and that would increase ISE. But that would be recognizing the loss twice. (In a previous post you mentioned that amortizing LC would result to net loss = 0). Could you please explain the mechanism?

Thanks a lot!

Thanks for your response @Staff-T1.

The link above is actually from a question I asked myself and the reason why I am re-asking it here is that I did not understand. I understand that we had a loss at initial recognition. But could you please explain how we have net loss = 0 at subsequent measurement? When we amortize LC, it increases ISE (So I guess it would decrease profit/increase loss) again. But we already took a loss at time=0.

The P&L statement after initial recognition would be something like this:

Profit/Loss = Decrease/Increase (+-) in LRC - Expenses

When you amortize your LC by 20 for example, your LRC will go down by 20 while expenses would increase by 20.

Profit/Loss = +20 - 20 = 0