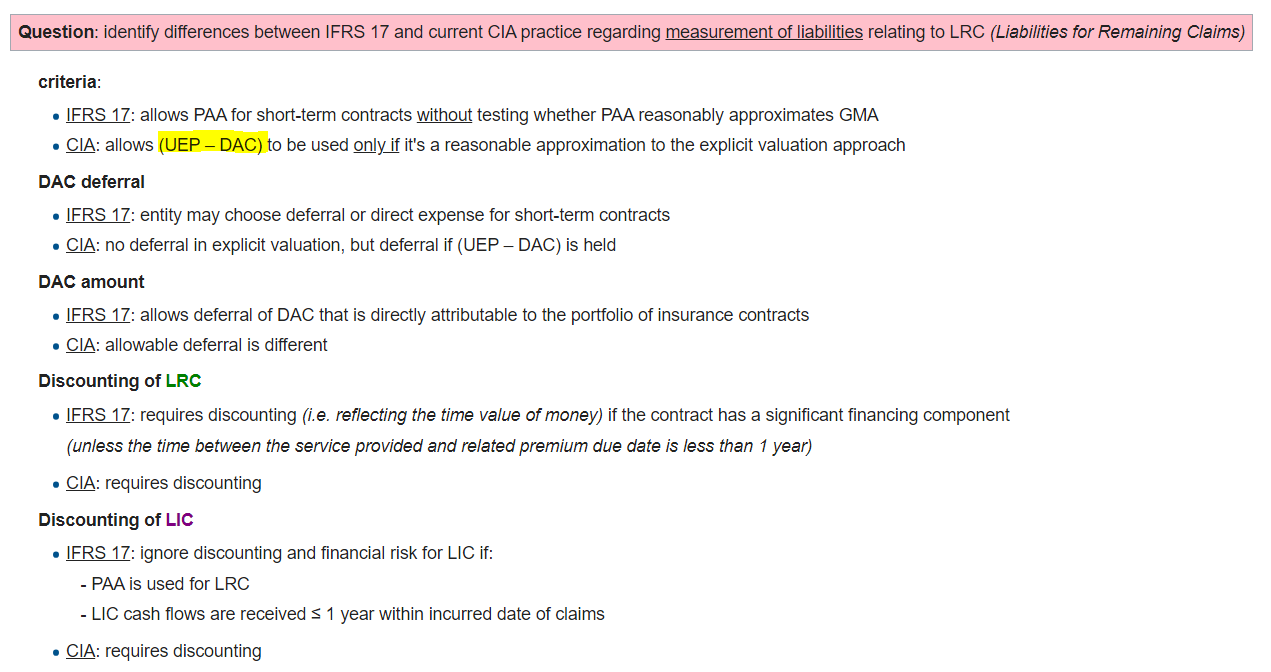

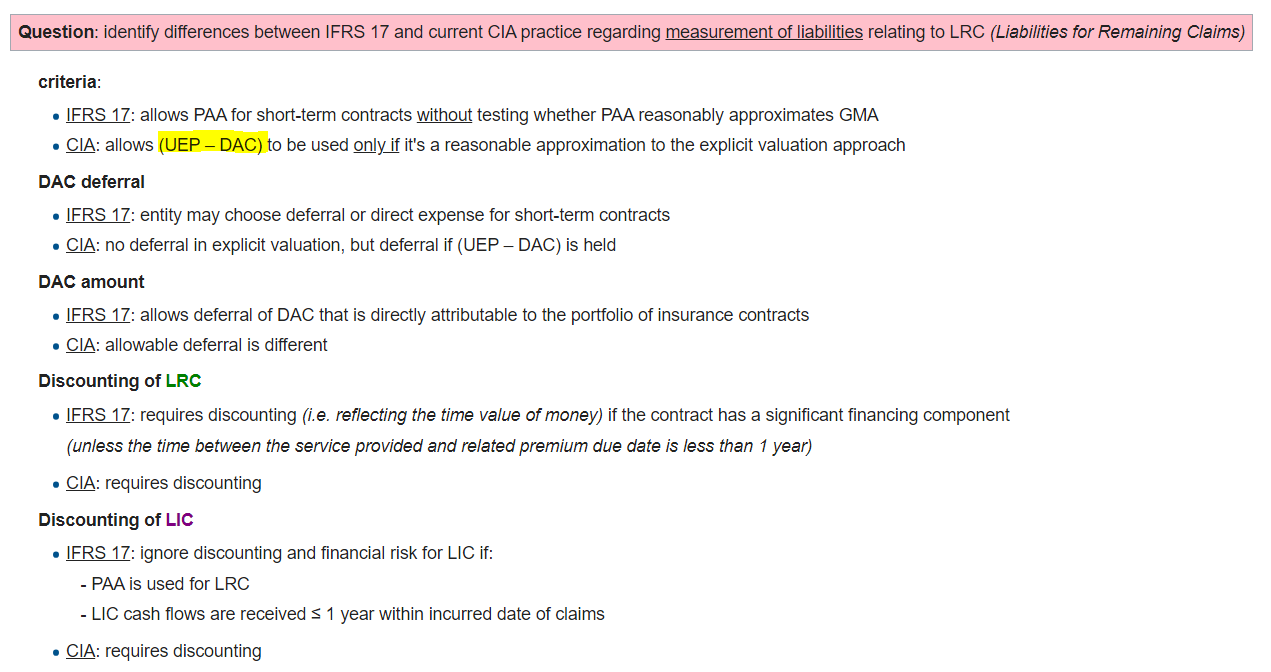

criteria

what is explicit valuation approach? should we use UEP-PR-DAC instead of UEP-DAC?

It looks like you're new here. If you want to get involved, click one of these buttons!

what is explicit valuation approach? should we use UEP-PR-DAC instead of UEP-DAC?

Comments

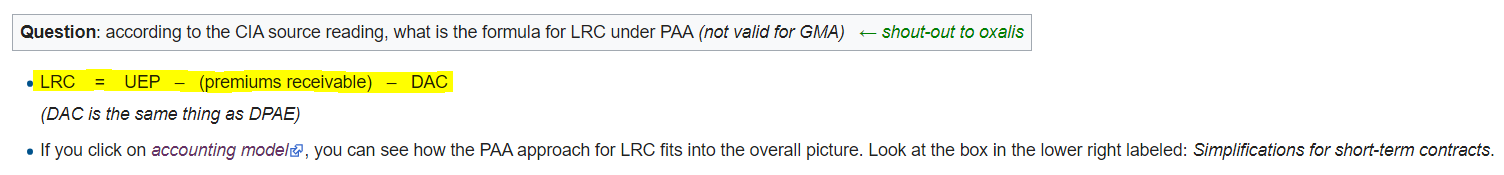

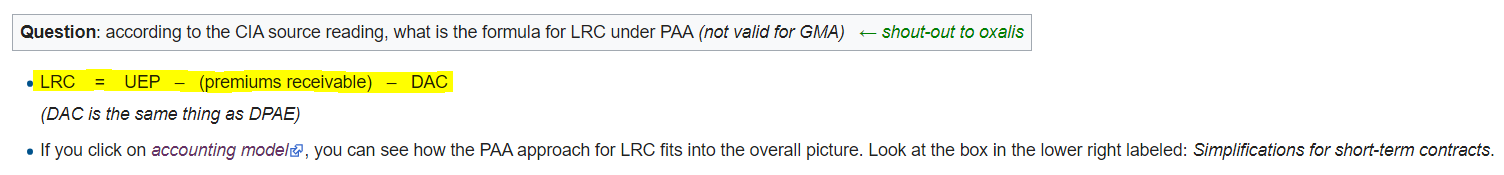

The CIA source reading is wrong - PAA LRC is always UEP - DAC. Thought we changed most of them in the wiki but there are always stragglers @graham

Fixed, thx!

Is the explicit valuation approach the same as GMA?

Yup

for the discounting of LIC, are the two points under ifrs 17 both required or is it one or the other? for example what if PAA is used for LRC but cash flows are greater than a year (didn't meet first threshold but meets the second threshold that it is an approximation to gma), will discounting be ignored?

If PAA is used for LRC but CFs > 1 year then yes you must discount. Simple example, Auto Bodily Injury for Ontario LRC is normally measured with PAA and has CFs > 1 year but you are definitely discounting the LIC

Okay great thank you and one other thing... I am finding the concept and treatment of acquisition cash flows very confusing.

For LRC GMA -> acquisition cash flows are included in the PV(future cash flows) (therefore deferred as they are part of the CSM)

For LRC PAA -> acquisition cash flows can be deferred and are the DAC in the UEP - DAC formula

Also what does it mean when it says unless entity chooses to recognize the payments as an expense? Does it mean it is recognizing it as something other than expense or does it mean recognizing it right away as an expense as opposed to a deferred expense?

1) Yes that is correct

2) They are all saying the same thing

When you recognize an expense immediately, it goes directly into P&L and you do not amortize it. You usually wouldn't do this as it will hit your bottom line quite hard and make earnings more lumpy