Formula for margin required on unregistered reinsurance

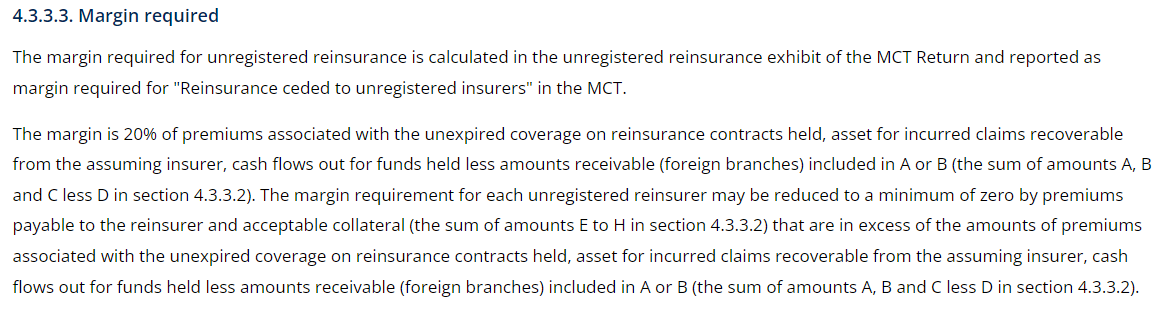

In the battle acts wiki, the formula for the margin required on unregistered reinsurance is: Formula Un-req: margin required = 20% x (A + B + C)

But in the source text, they state that the formula is 20%*(A+B+C-D)

Also, the formula to determine if we can further reduce CapReq based on if payables and collateral are greater than receivable in the battle acts wiki is: (E+F+G+H+I) – (A+B+C+D)

But in the source text, the formula to check is: (E+F+G+H+I) – (A+B+C-D)

For both of the above, which formula should we be using on the exam?

Comments

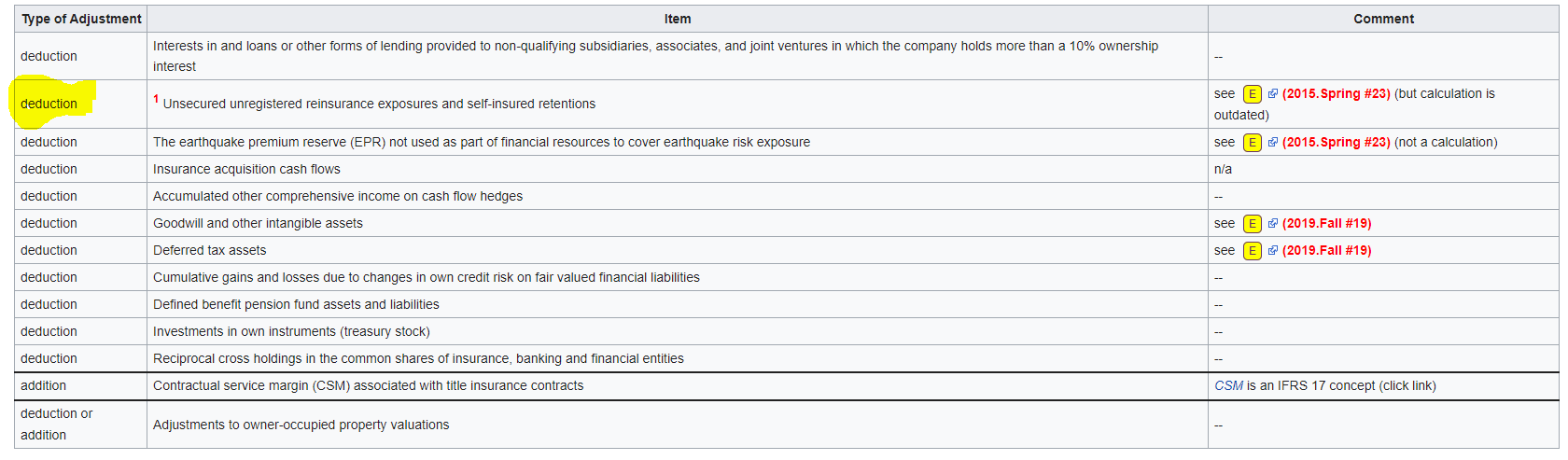

2024 MCT text says Deduction from capital available = A+B+C−D−E−F−G−H but wiki says (A + B + C) – (D + E + F + G + H + I).

The correct formulas:

Margin for unregistered reinsurance = (A + B + C - D) * 0.2

The correct formula to check to further reduce capital required should be ( E + F + G + H ) - (A + B + C - D).

There is no longer an item for 'I' anymore. The screenshots and the sample problems still need to be updated and we are working on them. Apologies as the new MCT paper was just released and we are still bridging the gap with the 2023 paper

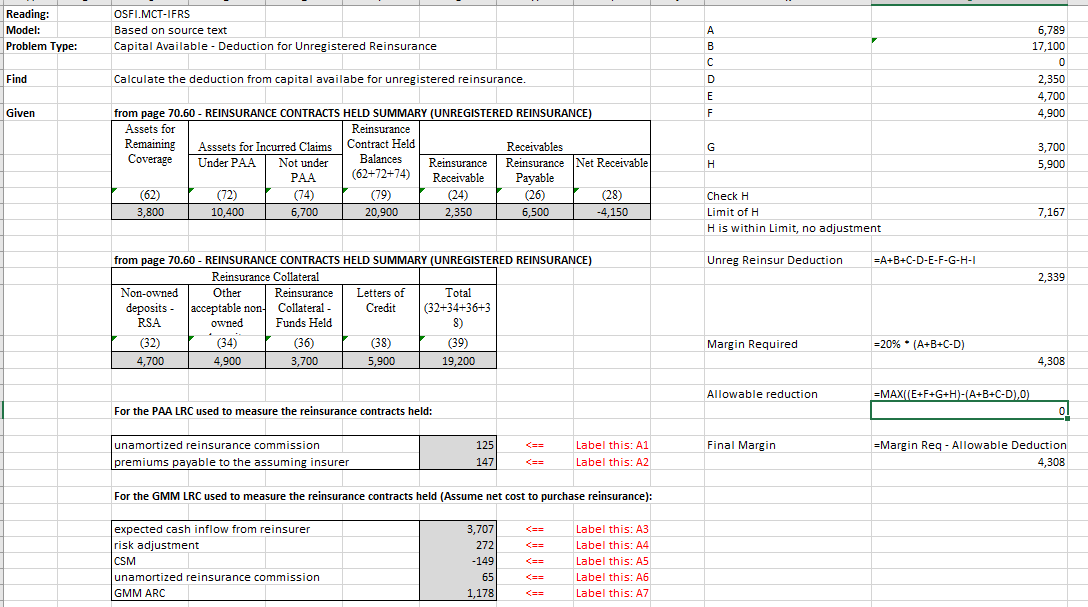

Just to confirm the example in excel "OSFI.MCT_(044)_capital_required_unreg_re_v8" is incorrect with the formula right?

You should be downloading a v9 version when you click the link. Maybe try to clear your cookies and redownload

Can you please double check the link it used a different computer to download and its still v8. I also cleared my cache and cookies and still v8 on both computers. This is right before section 4.4

That's odd. I just tested it by downloading it myself and I got version 9. (You have to refresh the page of course but I assume you did that.)

I have now cleared the server cache. If it still doesn't work we will have to investigate further. If you are using work computers, it could be related to the firewall of your company.

It works now thanks.

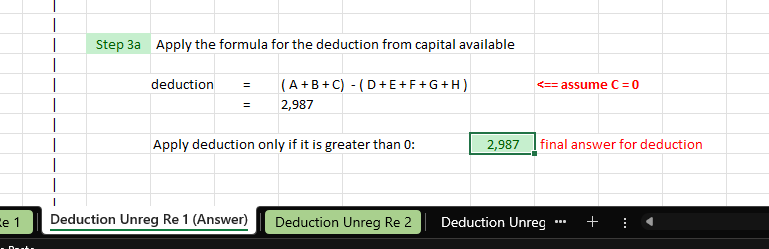

Just a follow up questions in the excel the deduction is

( A + B + C) - ( D + E + F + G + H )

and in the wiki it is also:(A + B + C) – (D + E + F + G + H)

But in this discussion it is: ( E + F + G + H ) - (A + B + C - D)

I don't see this formula on the Wiki.

Also I am not sure if this deduction formula is right, in the source text it states:

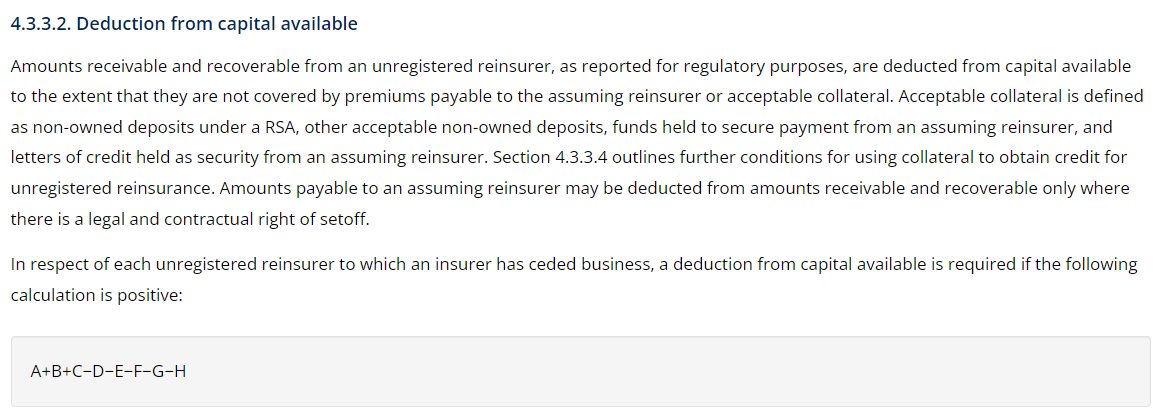

The margin is 20% of premiums associated with the unexpired coverage on reinsurance contracts held, asset for incurred claims recoverable from the assuming insurer, cash flows out for funds held less amounts receivable (foreign branches) included in A or B (the sum of amounts A, B and C less D in section 4.3.3.2). The margin requirement for each unregistered reinsurer may be reduced to a minimum of zero by premiums payable to the reinsurer and acceptable collateral (the sum of amounts E to H in section 4.3.3.2) that are in excess of the amounts of premiums associated with the unexpired coverage on reinsurance contracts held, asset for incurred claims recoverable from the assuming insurer, cash flows out for funds held less amounts receivable (foreign branches) included in A or B (the sum of amounts A, B and C less D in section 4.3.3.2).

I read this as (layman version so its easier to understanding)

The margin requirement can be reduced by:

[premium payable + (sum of E to H)] - [A+B+C-D]

(Premium Payable to the reinsurer + E + F + G + H ) - (A + B + C - D)

Is in this question from v9, shouldn't the deduction in step 3a be

(6,500 + 4,700 + 4,900 + 3,700 + 5,900) - (7,967 + 17,100 + 0 - 2,350)

And logically this make sense. We can consider what we have on hand and we reduce it from margin (or risk). We can reduce the margin by the collateral that we have and what we owe them, which is 6500 + sum of E to H). But we are also on the hook for the unpaid claims and unexpired coverage again, which is (A + B + C - D).

I read 4.3.3.2. and 4.3.3.3 as two parts

One is a deduction from Capital Available 4.3.3.2.

One is the margin required for Capital Required 4.3.3.3.

For the margin there could be a deduction for the margin which:

(Premium Payable to the reinsurer + E + F + G + H ) - (A + B + C - D)

I am not sure if my interpretation is correct, please advise

Technically yes, if you assume that column (26) only consist of reinsurance premiums that are paid over the course of the policy, but reinsurance payables do not only consist of reinsurance premiums payable. To add further to that point, reinsurance premiums are most of the time payable up front so column (26) would mostly be Contingent profit commissions (Profit Sharing) and other miscellaneous items.

For your first question, you deduct ( E + F + G + H ) - (A + B + C - D) from cap available. But if you want to check whether to deduct you do (A + B + C - D) - ( E + F + G + H ). Its just sign flipping

Okay that make sense with the Reinsurance Payable since that is not the same thing as Reinsurance Premiums Payable

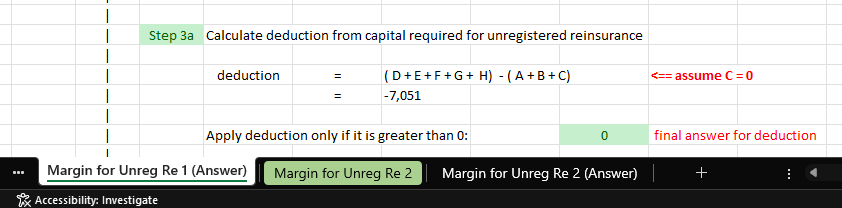

I am still confused regarding 4.3.3.2. and 4.3.3.3.

Can you confirm the following:

For these two section, these are two separate calculation. One is for Deduction from capital Available, one is for Margin which is added to Capital required as part of the Insurance Risk.

Let's say for the following

(A + B + C - D) = 5000

( E + F + G + H ) =2000

For 4.3.3.2.

Since (A + B + C - D) - ( E + F + G + H ) is positive, we would need to deduct Capital Av for 3000.

Can you confirm if this deduction of $3000 from Capital Available is correct?

Now for the Margin in 4.3.3.3.

And the Margin would be 20% * 5000 = $1000

Source Text:

The margin requirement for each unregistered reinsurer may be reduced to a minimum of zero by premiums payable to the reinsurer and acceptable collateral (the sum of amounts E to H in section 4.3.3.2) that are in excess of the amounts of premiums associated with the unexpired coverage on reinsurance contracts held, asset for incurred claims recoverable from the assuming insurer, cash flows out for funds held less amounts receivable (foreign branches) included in A or B (the sum of amounts A, B and C less D in section 4.3.3.2).

Based on my interpretation of the source text the amount we can deduct from the Margin is (the sum of E to H) in excess of sum of (A, B, C less D).

So the amount we can deduct is (2000 in excess of 5000), which is $0

However this would be different from the Excel example.

Excel example would say we can deduct $3000, which would reduce the margin to -$2000. Which would get capped to $0.

To me it make sense that there needs to be a deduction for Capital Av of $3000 and a Margin of $1000. Because if something goes wrong with the Unregistered reinsurance, the asset in A and B is gone, but we keep the collateral. If the Asset is greater than collateral there is risk, so that's why we have to deduct it from the capital available and we have to add a margin to the Insurance Risk. And for the margin do decrease (or get a deduction) we need to have more collateral than the asset. Otherwise the risk is not reduce. So it feels like the excel example is not correct.

Can you confirm if the Risk Margin should be $1000 or $0?

Thanks in advance, sorry for the long reply

@NycxBattle "Can you confirm if this deduction of $3000 from Capital Available is correct?" Yes this is correct.

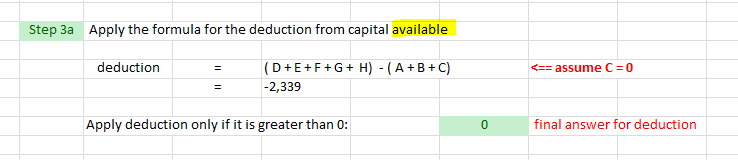

And yes you are both correct for the latter point regarding deduction from unregistered reinsurance. The order should be flipped for the capital required formula to ( E+ F + G + H) - (A + B + C - D). I'll update the Excel files and wiki

Is it normal that I'm not able to access solution to the example provided for the deduction of unregistered reinsurance from capital available?

Can you send a screenshot?

nevermind, it seems to be resolved. Thanks!

@Staff-T1 , did you update the excel files yet? I tried downloading it and it seems like it still the old file. Also can I get shoutout if you update excel.

Also I apologize ahead of time because this is a long post I think its important to clarify this point @graham if you could also take a look and verify if this is correct.

I just want to point out that there is also two separate parts to this Unregistered Reinsurance.

The first part is a deduction made to Capital Av. That is 2) from the list of 11)

This is also talked about in the source text:

As stated in the source text this is a deduction to capital Av, which has nothing to do with margin needed in capital required.

The second part is a margin that is required that is part of the insurance risk, these are two separate calculation.

This is the source text for reference:

The margin required is 20% of (the sum of amounts A, B and C less D in section 4.3.3.2)

But this margin can reduced by:

(the sum of amounts E to H in section 4.3.3.2) that are in excess of (the sum of amounts A, B and C less D in section 4.3.3.2)

In other words the margin can be reduced by (E+F+G+H)-(A+B+C-D).

After reduction, it will be capped to 0.

Now Back to the excel exercises.

The first part, the deduction from capital available, Un-ded (Unregistered Reinsurance Deduction) is shown in practice question and I think this is correct:

OSFI.MCT_(043)_capital_available_deduction_unreg_re_v8.xlsx

However for the second part the margin calculation which is shown in the second excel file,

OSFI.MCT_(044)_capital_required_unreg_re_v11.xlsx

But I don't think it's correct.

First of all, in v11 of the excel file I think it might be helpful to rephrase the question to say:

"Calculate the deduction from capital available for unregistered reinsurance and margin required for Insurance Risk, as these are two separate things.

I've posted screenshot of my answer for these two questions for OSFI.MCT_(044)_capital_required_unreg_re_v11.xlsx

Question 1: $4,810

Question 2:

Thinking about this logically, the margin here is not talking about what if the reinsurance bankrupt (since they are unregistered), this was already accounted for in the deduction from Capital Available.

Ultimately what is margin? It's when something doesn't go expected and we have a margin for it. In this case, what if the reinsurance held is worth more (claims are volatile), and if the reinsurance contract held is worth more now and reinsurance company bankrupt and we lose this reinsurance contract held, the risk will be bigger. Thus we need to add a margin for this. That is what this margin is, 20% of value of the reinsurance contracts held, 20% * (A+B+C-D).

But if we have collateral higher than this amount we can reduce the margin. And this make sense because the collateral is already enough to cover losing the reinsurance contract so whatever is left which is (E+F+G+H)-(A+B+C-D) can be used to cover the margin.

Yeap you are right - I think maybe I am getting mixed up because I could have sworn I updated it. But anyways, I think the Excel file could be cleaned up a little at the deduction for capital for unregistered reinsurance since it's confusing now. Mainly because of the earlier part regarding the deduction from capital available. Thanks for pointing that out! I'll give you a shoutout I'll probably reupload some files tomorrow

I'll probably reupload some files tomorrow

Note on downloading Excel files: You may have to clear your cache to ensure you get the latest version.

Hello,

I'm still confused about deduction from capital available for unregistered reinsurance. Why are the formulas different between the 2 handouts when both gets applied only if greater than 0?

Are we applying a deduction to both capital required and capital available?

Yes, you are doing two deductions. They are both different things.

The first deduction is meant to penalize capital available based on the amount of unregistered reinsurance that an insurer has which is not collaterized.

The second deduction is to reduce the amount of capital needed for unregistered reinsurance based on acceptable collateral.

Hi,

can you please check OSFI.MCT_(044)_capital_required_unrez_re_v12.xlsx, in both problems, we're asked to calculate capital available, but I think you mean capital required right? also in problem 2, step 3a, again you're calculating cap available, can you please fix it?

It should be correct now. Please double-check @Staff-T1. The problem is at the end of this section from the MCT wiki article:

Yes it looks good now