Simplified Calculation of RA based on CoC Method

I just want to clarify a point, its states in the wiki:

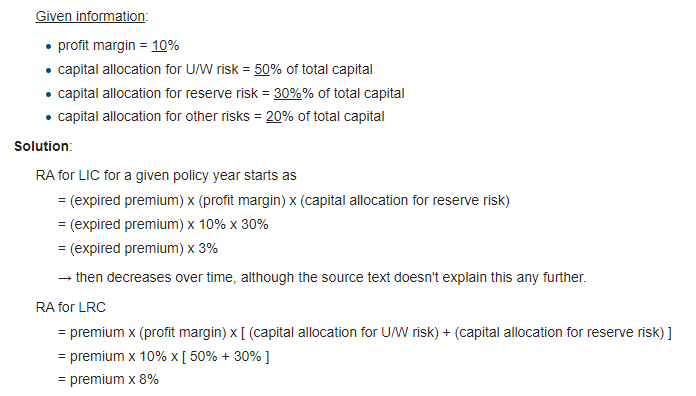

target profit margin is allocated between reserve risk, underwriting risk, and other risks that are not relevant to the RA

Is this CoC method for RA exclusively for the profit margin?

Can we use the CoC method for any other RA?

Comments

Im not sure what you mean by any "other" RA. You either have the RA for the LRC, and RA for the LIC. There is not RA for the profit margin. CoC is a method that can be used for either

Okay I might misunderstanding the concept than.

For the RA calculation here, why are we multiplying by the profit margin? I am trying to wrap my head around what it means? I mean I know how to do it mathematically its not too complicated. But I don't understand why we do it or the implication of it.

When you do a cost of capital calculation you always need a ROE number - You're just replacing ROE with profit margin here

Is the "Premium" used in the LRC calculation the full term premium? If so, why do we calculate the LRC based on the full term premium? I would think we would calculate it as a % of the unearned premium

It's the unearned premium - In this example expired premium refers to earned premium and premium refers to unearned premium

for this example, RA for RLC: why is capital allocation for other risk left out?

For the purposes of the risk adjustment for the LRC, "other risks" are not relevant, only risks that are directly related to the LRC which are underwriting and reserving risks should be considered. Likewise for the LIC, but you would only reserve risk for the LIC.