sample-22

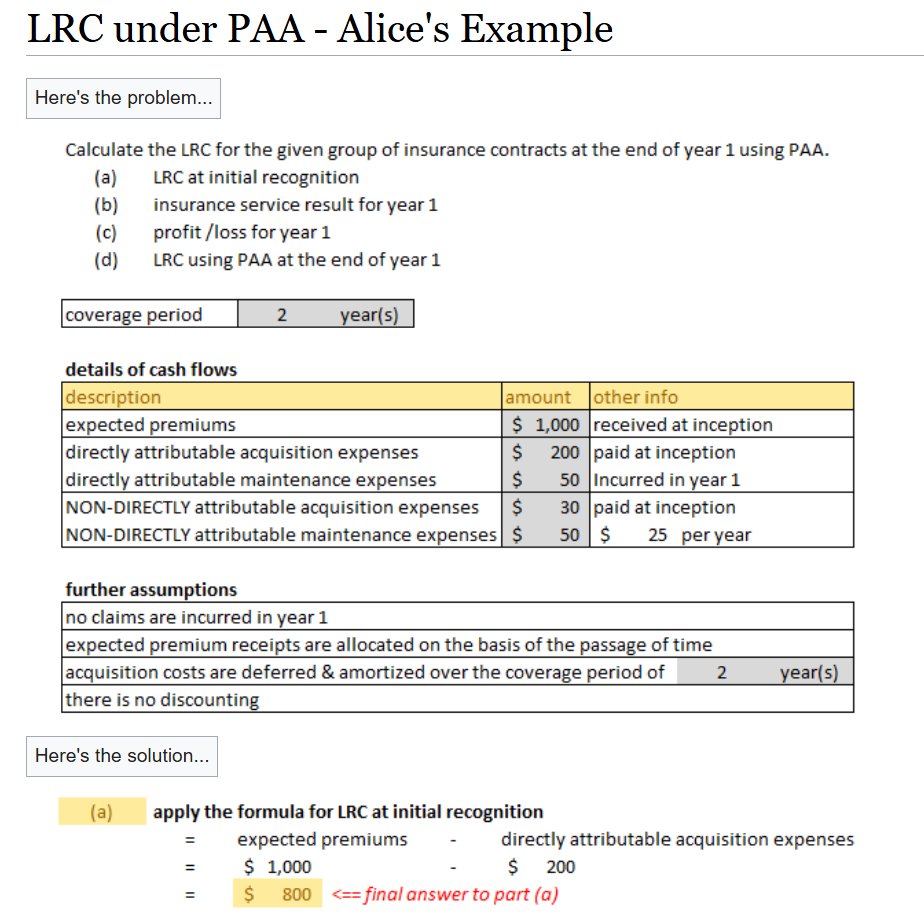

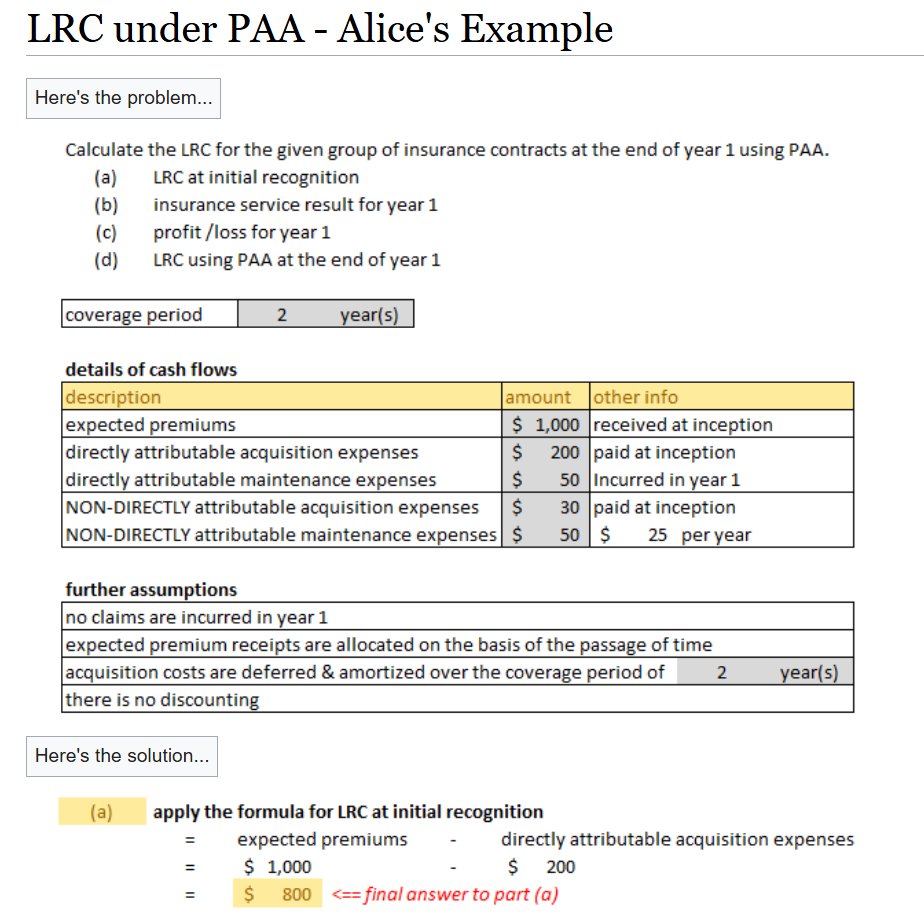

why we can't use 2500-250 for the LRC at initial recognition like below example?

It looks like you're new here. If you want to get involved, click one of these buttons!

why we can't use 2500-250 for the LRC at initial recognition like below example?

Comments

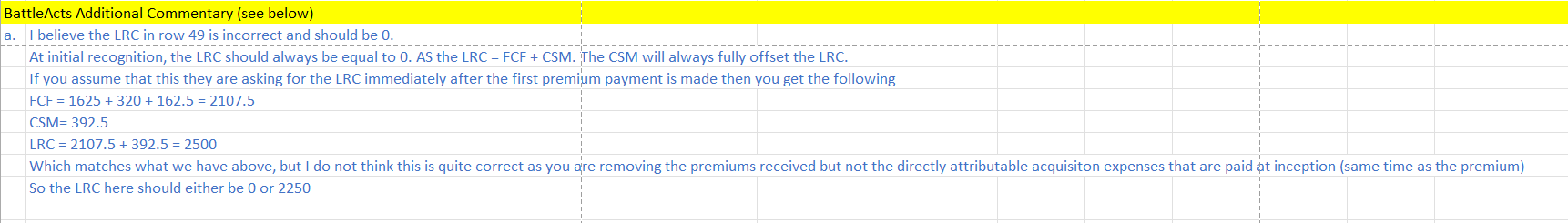

Please read the commentary at the bottom of the IFRS17 sample questions with BA commentary. I have already explained that this is an error on the CAS side

Please read what you comment at the bottom of the IFRS17 sample question, you got LRC is 2500 in the equation but 2250 in the comment, so 2250 or 2500?

is it because we are calculating the CSM here, so we can't use PAA at initial recognition? @graham

If you read the commentary fully, you will see that row 96 states that 2500 is not correct. The derivation is merely to show how the CAS obtained 2500. The correct answer here is either 0 if you are assuming that you are measuring using the GMM method or 2250 if following the CAS method which is basically calculating the LRC immediately after the first premium payment has been received

"2250 if following the CAS method", it isn't 2500 for CAS method? i get more confused now.

In short, can I use 2500-250 which is 2250 for the LRC using PAA at initial recognition like above Alice's example?

No, the CAS method is incorrect as they are removing the premiums received but not the directly attributable acquisition expenses that are paid at inception (same time as the premium). Removing that gives you 2250.

If the contract is PAA eligible yes, if the contract is not PAA eligible then no and you'd have to calculate it through the FCF and CSM

where does it show that "removing the premiums received but not the directly attributable acquisition expenses"

When you calculate your FCF, on row 93, the premiums received is not included but the directly attributable acquisition expenses that are paid at inception are still included

In "CIA.IFRS17-LRC_(060)_practice_LRC_PAA_v3.xlsx" and the example provided in the text page 25, LRC at 1 year end does not consider maintenance expense. While maintenance expense is included in FCF (row 93). I am confused. When calculating LRC, should maintenance expense be considered?

In this file: CIA.IFRS17-LRC_(060)_practice_LRC_PAA_v3.xlsx, you are calculating the PAA estimate of the LRC while in the sample file row 93, that is the GMA estimate of the LRC. They are different things. You would consider it in the GMA estimate but not the PAA estimate

My questions:

Why CAS is using PAA to calculate LRC then use this LRC to derive CSM? No matter we use the original answer from CAS (ie 2500) or BattleActs commented answer (ie 2250), they are both using PPA. I thought only LRC derived using GMA has CSM.

If we follow GMA to derive LRC, LRC would always be 0 at initial recognition. Then CSM = -FCF, floored at 0. In this case, FCF = 1625+162.4+70=1857.5. So CSM = 0, right? (This honestly does not look right... Please help!)