Q22

Hi,

Can you please help to clarify the following questions:

- What's included in the Attributable cost: Maintenance costs, acquisition cost and other cost, and for each cost we further distinguish directly attributable & non directly attributable cost, is this true?

- Is only directly attributable cost included in the insurance liability calculation?

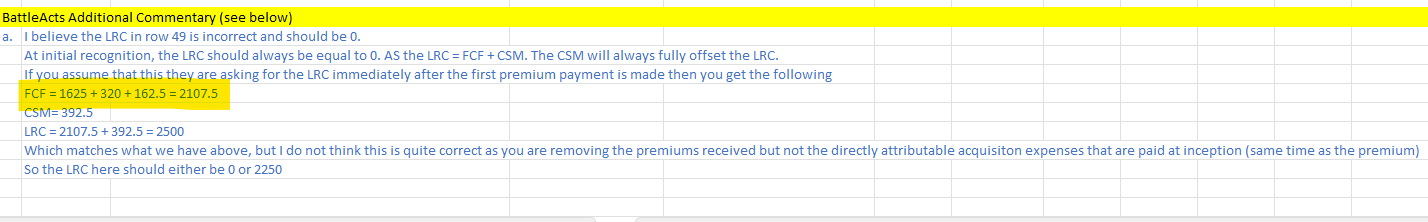

- I'm confused with the 2 statements about LRC, in your sample IFRS17 Q22 comment, you have LRC is alaways 0 at initial recognition, at the same time, in this illustration: https://battleactsmain.ca/wiki6c/File:CIA.IFRS17-LRC_(020)_FCF_diagram.png, we have LRC is non-zero, and it's the sum of CSM + FCF, can you clarify?

- In question 22, in the BattleAct comment row 96, you suggest to remove the directly attributable acquisition expenses because they are paid at inception. In the given information, it states that the acquisition expenses are deferred and amortized over 2-years. As they are deferred, should we consider them as future cash flow and keep them in the FCF?

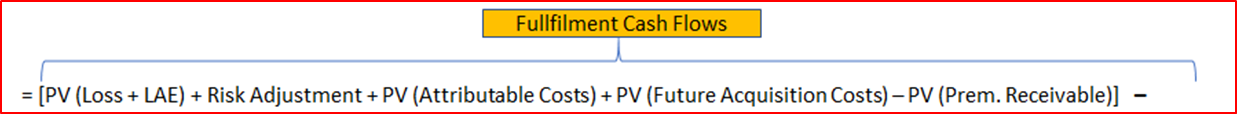

- In this attachment, is this formula always true (i.e. at initial recognition and also at subsequent adjustment)?

, can you further confirm that at subsequent recognition, we usually remove the last term pv(premium receivable) since most of the times, premiums are received in full at inception?

, can you further confirm that at subsequent recognition, we usually remove the last term pv(premium receivable) since most of the times, premiums are received in full at inception? - Is it typo that directly attributable maintenance expense of $70 is incurred in 2023 instead of 2024 in cell E9?

- for PAA LRC the formula = UEP - DAC, this is true all the time or only at initial recognition, or under specific conditions?

Thank you!!!

Comments

Is " initial recognition" and "at inception" the same thing?

How do we know if at inception we assume premiums are already received or not, do we just put down our assumptions explicitly during the exam?

Initial recognition and inception are the same thing.

In an exam question if calculating FCF they will let you know how much premiums are outstanding. You will know if the premium has already been received

for part a) if LRC is supposed to be 2500-250=2250, what would the CSM be?

Just reduce the CSM by 250 so you'll get 142.5

I have a similar question as above: if LRC is 2250, what should the CSM be? I read your comment that it will be 142.5, but I still concerned about whether we "double count" on acquisition expenses when we deduct them when calculate LRC and then we deduct them again when calculate CSM. Thanks.

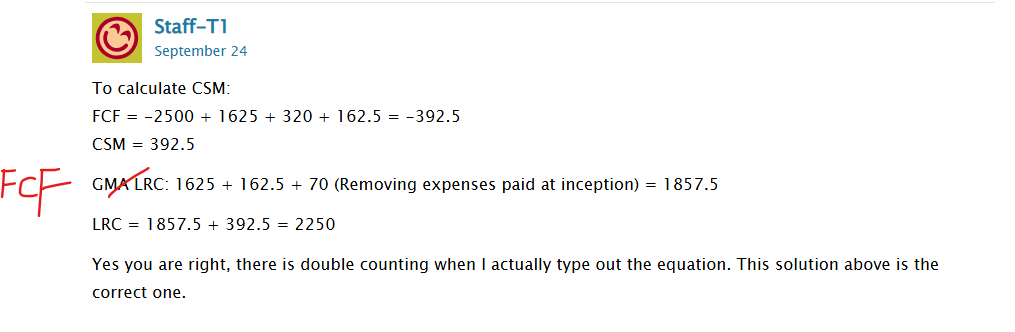

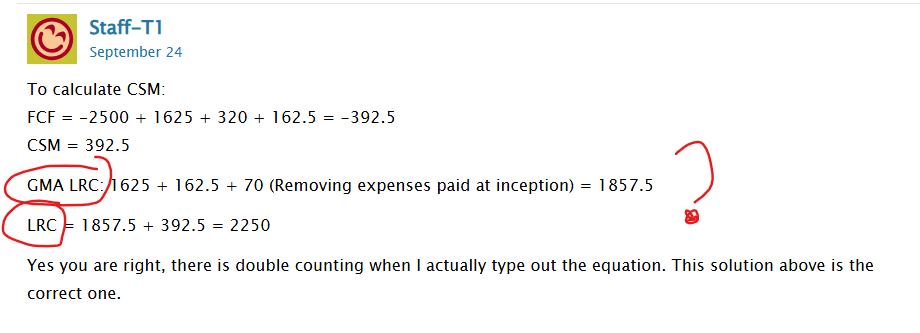

To calculate CSM:

FCF = -2500 + 1625 + 320 + 162.5 = -392.5

CSM = 392.5

GMA LRC: 1625 + 162.5 + 70 (Removing expenses paid at inception) = 1857.5

LRC = 1857.5 + 392.5 = 2250

Yes you are right, there is double counting when I actually type out the equation. This solution above is the correct one.

Can I use PAA to calculate LRC? which is 2500-250 = 2250?

I am not following what you calculate for GMA LRC, are you trying to calculate LRC = FCF + CSM?

and i don't understand why we are adding 70??? why adding Directly attributable maintenance expenses incurred in 2023

for GMA LRC is 0 or 2250 but for PAA is 2250 (assuming the question does not ask to calculate CSM), am I right?

is this incorrect then?

1. I am calculating it as FCF + CSM where the FCF is calculated immediately after the first premium and associated expenses are paid

2. Because those are future cash flows that have not yet been incurred as of the first premium payment

3. Yes

4. 2500 is not the correct solution. I was just showing how the CAS got to that number

am I right to say that FCF = -392.5 at initial recognition but FCF = 1857.5 immediately after the first premium and associated expenses are paid?