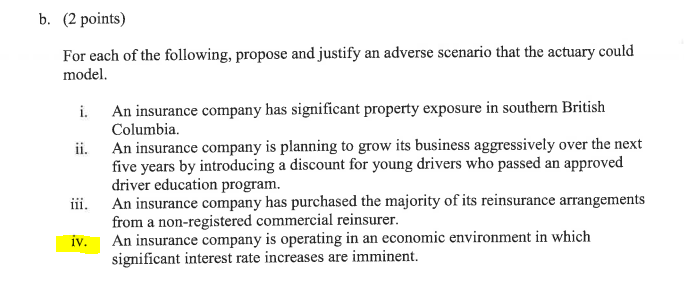

Spring 2018 Q19 (b)

Hi Graham,

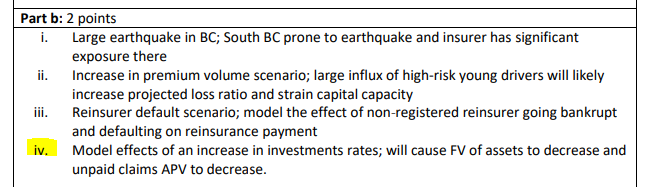

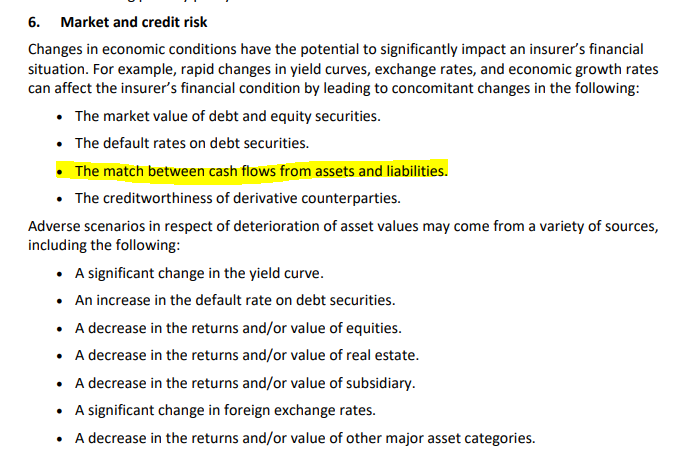

I am really struggling to come up with this particular adverse scenario described in the solution for the 4th scenario. I can tell that it relates to the "Market and Credit risk" risk category, but given the updated source text below, I'm not sure how to structure my response in the exam if asked about "an increase in interest rates".

- is the solution referring to the highlighted point above?? - that an increase in interest rates could cause a MISMATCH in cashflows from assets/liab? ... but the solution mentions a DECREASE in BOTH asset/liab cashflows so i'm confused...

- is there a typo in the answer key where "FV" is meant to be "PV"?

- would greatly appreciate any explanation on the market and credit risk section in general!! I am struggling to understand the source text in terms of relating it to an "actual" scenario

Thanks in advance!

Comments

The solution's point on a decrease for both asset and liabilities are true as well as FV because

1. The fair/market value of fixed-income assets (bonds for example) are reduced due to their discounted future cash flows now being worth less (due to the higher interest rate)

2. Reduce the present value of unpaid claim liabilities, since these are also discounted at the now higher rates

I would add for the exam and relating to "actual" scenario, think of the following