what is the sequence of events used to test whether there is a LC for these contracts?

For PAA

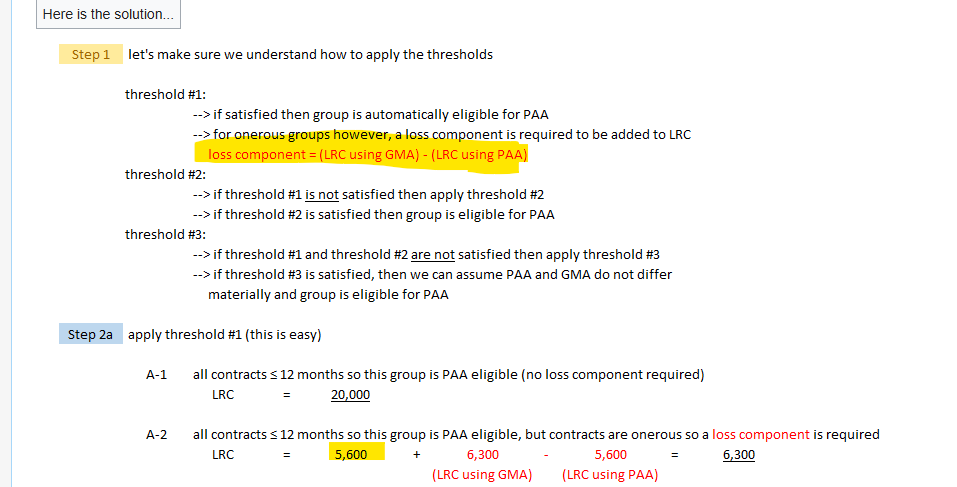

1) can do so qualitatively, but assuming we have to prove quantitatively:

IF PV(CF) minus RA is -ve then

2) LC (assuming -ve is loss signage) but LC is booked as LRC GMM - LRC PAA?

not understanding how to book a LC.

i) the formulas in this graphic not lining up and

ii) how and why LRC GMM - LRC PAA a LC?

1) If you have a LC there is no way to do it qualitatively, you'd have to do a quantitative assessment to determine a LC.

2) I don't understand your question here. This is the definition of the LC under PAA. It's not the same as the LC under GMA.

3) i) what is not lining up? I don't see anything immediately obvious

ii) That's the definition of it. The PAA is meant to be a simplified approximation of the GMA. When it's onerous you basically top it up to = the GMA estimate which is the main idea behind the LC for the PAA

You'd usually do a qualitative assessment to first figure out if this group of PAA contracts are likely to be onerous. If yes, then you would proceed to calculate the GMA estimate. If GMA estimate > PAA estimate then you have a LC.

There could be scenarios where is group is onerous, but if you qualitatively assess that it is not and don't specifically test for it then there is no way to know.

PAA is meant to be a conservative approximation. If the actual estimate is greater than the conservative estimate then you need to top it up.

For Q21, threshold 2, annual insurance revenue for the group is compared against the aggregate annual premium. Is it meant to compare against the entity's annual insurance revenue or is it the same as aggregate annual premium?

Comments

To calculate the loss component, you always need the GMA estimate of LRC even if you are measuring using the PAA

what is the sequence of events used to test whether there is a LC for these contracts?

For PAA

1) can do so qualitatively, but assuming we have to prove quantitatively:

IF PV(CF) minus RA is -ve then

2) LC (assuming -ve is loss signage) but LC is booked as LRC GMM - LRC PAA?

not understanding how to book a LC.

i) the formulas in this graphic not lining up and

ii) how and why LRC GMM - LRC PAA a LC?

2) I don't understand your question here. This is the definition of the LC under PAA. It's not the same as the LC under GMA.

3) i) what is not lining up? I don't see anything immediately obvious

ii) That's the definition of it. The PAA is meant to be a simplified approximation of the GMA. When it's onerous you basically top it up to = the GMA estimate which is the main idea behind the LC for the PAA

You'd usually do a qualitative assessment to first figure out if this group of PAA contracts are likely to be onerous. If yes, then you would proceed to calculate the GMA estimate. If GMA estimate > PAA estimate then you have a LC.

There could be scenarios where is group is onerous, but if you qualitatively assess that it is not and don't specifically test for it then there is no way to know.

PAA is meant to be a conservative approximation. If the actual estimate is greater than the conservative estimate then you need to top it up.

For Q21, threshold 2, annual insurance revenue for the group is compared against the aggregate annual premium. Is it meant to compare against the entity's annual insurance revenue or is it the same as aggregate annual premium?

Aggregate annual premium and annual insurance revenue can be used interchangeably here