Emergence in t with respect to accident years t-1 and prior

Is the text incorrect or am I not understanding the modification for investment income?

Page 3 and 4 of Evaluation of the Runoff of P&C Claim Liabilities when the Liabilities are Discounted in Accordance with Accepted Actuarial Practice has two calculations:

Undiscounted Basis:

1.1.(b) = (Claim liabilities at t-1) – (Paid during t) – (Claim liabilities at t)

Is followed by an explanation on how to determine the discounted emergence (or excess):

Equation (b) in item 1.1 above would be modified by subtracting a term for the portion of the investment income earned during calendar year t on assets supporting the liabilities.

Immediately followed by a table with equation 5 (excess), which proceed to add the investment income

Excess (Deficiency) During (t) = [(3) + (4)] – [(1) + (2)]

[(3) Discounted Claim Liabilities @ (t-1) + (4) Investment Income (t)] - [(1) Paid Losses (t) + (2) Discounted Claim Liabilities (t)]

Comments

@chrisboersma, I believe you are right. I definitely would agree with the calculations in the table as that makes more sense.

Going back to the two options given in section 1.2:

1. discounting the amounts in the second and third terms to time t-1 (i.e., calculate the present value of the cash flows)

2. subtracting a term for the portion of the investment income earned during calendar year t on assets supporting the liabilities.

Option 1 would result in a larger value (since you're discounting the terms that are being subtracted), whereas option 2 would result in a smaller value. So these options seem to contradict each other.

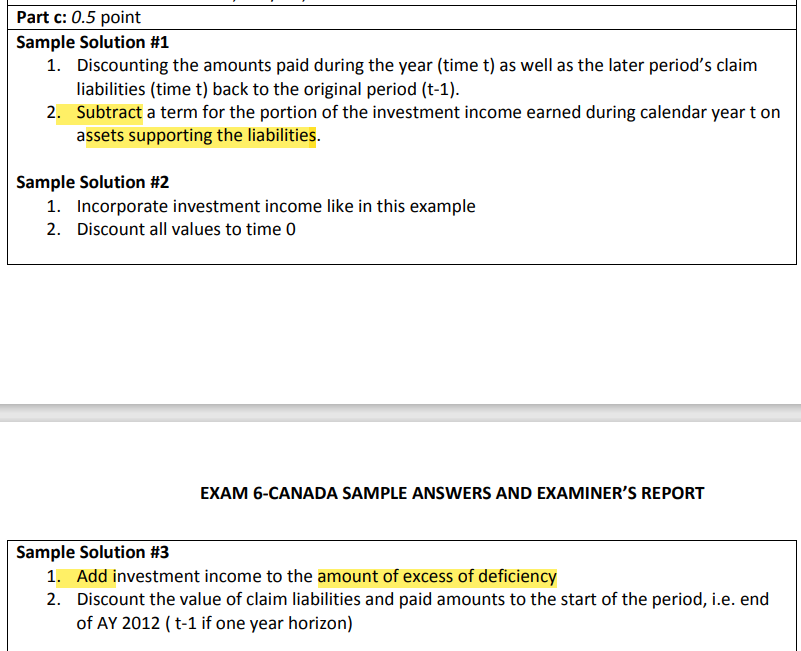

Maybe the difference resides in subtracting from "assets supporting liabilities" vs adding to "amount of excess or deficiency"? The difference is still unclear for me but I found this in 2015 Fall 13

I think it is more intuitive when you write it this way:

The calculation has 2 components:

(1) discounted unpaid at time t-1

(2) discount unpaid at time t + paid claims at time t

We want to bring (2) back to time t-1 to put everything on a comparable discounting basis. We do this by subtracting the investment income earned during CY t on assets supporting the unpaid claims

(2*) discount unpaid at time t + paid claims at time t - adjustment for investment income during year t

because the final formula is (1)-(2*) we end up adding the adjustment for investment income due to a double negative

Final formula:

= discounted unpaid claims at t-1 + adjustment for investment income earned during CY t on assets supporting unpaid claims - paid claims at time t - discounted unpaid claims at time t