Fall 2018 Q15 - LOC limit on multiple reinsurers

Hello,

I have a question concerning the part of Q15 in Fall 2018 where we calculate the CapReq for unregistered reinsurance inside of the insurance risk margin.

In the question, we are given the total reinsurance collateral so I understand that we do not or cannot test to see if the LOC limit has been breached.

I was hoping to know how we would solve the question if there seperate LOC amounts had been given in the question?

There has not been a problem before Fall 2018 with one than one reinsurer (from what I can tell) and it's a bit unclear to me how we can deal with it.

Can I get a confirmation if my understanding is correct on how I would solve it?

At first I was confused on how we can test the LOC limit on aggregate but then calculate the cap req for each reinsurer separately.

Let's say we have 2 reinsurers in the example, each with their own LOC (say LOC1 and LOC2).

I understand that we would need to test if the LOC limit is breaches at the aggregate level, so I would test:

LOC* = min(LOC1+LOC2, 30%*(UEP1 +UEP2 + O/S1 + O/S2) )

- If the min = LOC1+LOC1 -> calculate the D for each reinsurer separately using their respective LOC

- If the min= 30%(UEP1 +UEP2 + O/S1 + O/S2) _-> calculate the D for each reinsurer separately using their respective 30%(UEP + O/S)_

Where (all performed separately for each reinsurer)

- D= (UEP + O/S + Reins Recv) – (Reins Payable + NOD + LOC*)

- CapReq(UnregRe)= (UEP + O/S) x 15% – max(0, -D)

To me this is what the note "For a single reinsurer, if the LOC aggregate limit is breached, simply cap that reinsurer's LOC at the limit." implies but I am not 100% sure.

I don't know if the CAS would ask this type of question again and I wonder if this is why the collateral was provided as a total in last fall's sitting.

Any insight would be super helpful!

Thank you!

Comments

Hi,

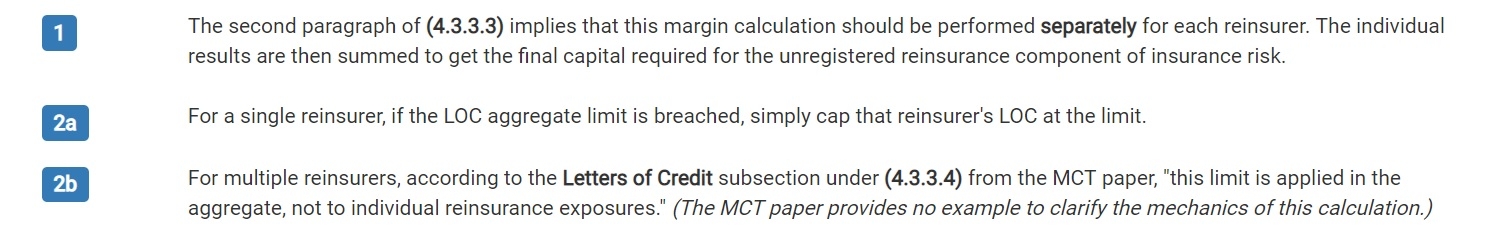

As mentioned in the screenshot you posted (from the battlecard), the paper does not appear to provide guidance on this calculation so I cannot really say what is the correct answer here. That said, if we were to go along with your thoughts above, I think one part I'd not fully agree with is the calculation of D when the LOC limit is hit:

D= (UEP + O/S + Reins Recv) – (Reins Payable + NOD + LOC*)

where LOC* is the aggregate limit. I don't think this would be entirely correct since you will be applying the aggregate LOC* to calculate the deduction for each reinsurer, e.g. if the LOC* was $400 and you used this in the calculation of D for each reinsurer, then you'd be saying you had $400 collateral to use for each reinsurer, which should not be the case.

You may need to re-allocate the $400 back to each re-insurer in some manner. For example, if the LOC1 = 200, LOC2 = 300 and LOC* = 400, maybe the LOC1* and LOC2* (that you're applying to each reinsurer) should really be 160 and 240 (in proportion to the original LOC1 and LOC2). Again, the paper does not provide guidance here, so I cannot say that this is correct to do.

I feel like my post was a bit jumbled but I was actually referring to applying the individual reinsurer's LOC* to their calculation of D, I definitely agree that using the aggregate LOC* to calculate the deduction for each reinsurer is probably not correct.

If the LOC*=400 (where LOC1=200 and LOC2=300), wouldn't that mean that 30%(UEP1 +UEP2 + O/S1 + O/S2) =400 and we could just split it as 30%(UEP1 + O/S1) and 30%(UE2 + O/S2)?

I wonder if we do this aggregate test because on the individual side, for one reinsurer the LOC limit would be breached and for another it would not.

Anyways, I understand that the MCT paper doesn't really clarify this, it simply bothered me that they handled Fall 2018 Q15 that way and I wanted to understand this more thoroughly.

Thanks for clarifying the use of the individual reinsurer's LOC. I think your logic is reasonable then, in applying the aggregate limit to each reinsurer's LOC (as per 2a above). So going back to my example above, if the LOC1 = 200, LOC2 = 300 and LOC* = 400, then neither of LOC1 and LOC2 is capped. However, if the LOC1 = 500, LOC2 = 300 and LOC* = 400, then LOC1 will be capped at 400 and LOC2 at 300.

If it ever shows on an exam, just remember to note any assumptions you are making.