MCT vs. BCAR - useful insight

This may help someone better understand the meaning of the BCAR scores. If this is incorrect - please let me know...

Cap.A = Capital Availible / Cap.R = Capital Required.

Given BCAR defines Capital Required at 99.6% VaR

and MCT defines Capital Required (at Target) at 99% CTE (which they say is close to 99.5% VaR - median of CTE99)

We can actually compare the two results (assuming Cap.A and Cap.R in both method is relatively similar)

1. BCAR = (Cap.A - Cap.R)/Cap.A = 1 - Cap.R/Cap.A [page 2]

2. MCT = Cap.A/(Cap.R/1.5)

3. MCT / 1.5 = Cap.A/Cap.R

Replace Cap.R/Cap.A with MCT:

BCAR = 1 - Cap.R/Cap.A

BCAR = 1 - 1.5/MCT

Which says that:

1. Strong == > MCT = 150%

2. Adequate is MCT < 150%

3. Very Strong == > MCT > 166.7%

4. Strongest == > MCT > 200%

5. Weak/Very Week should be under regulatory watch due to risk of insolvency.

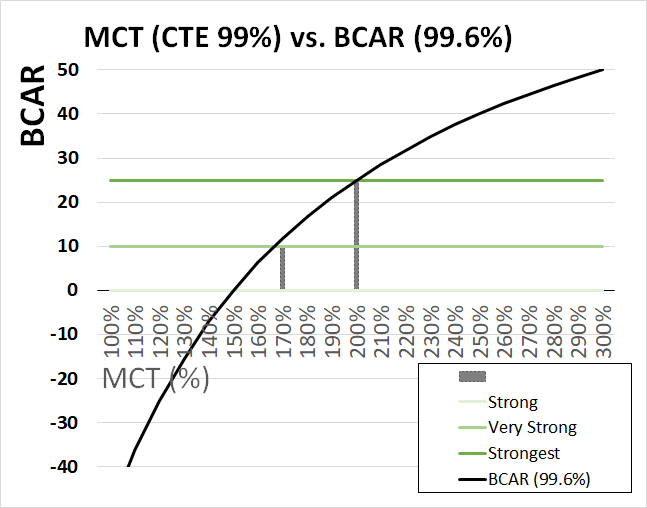

More importantly you can graph the relationship between MCT and BCAR (as above) and calculate a rough estimate of the BCAR from MCT (1-1.5/MCT). [200% = Stongest]. Note: BCAR does not generally report negatives. Instead, BCAR reviews whether you have adequate capital for a lower level VaR (eg 99%, 95%).

In general, there are quite a few differences in Cap.R for both MCT and BCAR. For example, earthquake, which seems to be using a 99.8% VaR in MCT (but using the correct 99.5% in BCAR). BCAR methods are much more complex (eg. the diversification factor is calculated using a correlation matrix).

Comments

That graph is quite interesting. Where did you find it?

I made it based on "BCAR = 1 - 1.5/MCT" adding in the BCAR cutoffs: 0 = strong, 10 = very strong and 25 = strongest

Oh, ok. Well, I'd expect there to be some sort of broad correspondence between MCT and BCAR since both are intended to broadly measure financial health. Exploring this in depth would make a very good research project.

Hi Graham,

In the wiki article, it said BCAR model is more robust than MCT as it permits qualitative adjustments due to economic and market conditions such as:

I'm not convinced that MCT ignores these considerations (maybe with the exception of U/W cycle).

In MCT, we need to calculate capital required for interest rate risk (assuming 1.25% shock factor). For reinsurance agreement, we have:

Why is BCAR analysis more robust than MCT in these cases? Could you please elaborate? I can't find any relevant discussion in the source text. Thank you!

The comment I had made about BCAR being more robust is from page 9 of the reading in the paragraph under "Market Adjustments". But it's true I was somewhat reading between the lines when I drew that comparison to MCT.

My overall understanding of MCT versus BCAR is that MCT is based on formulas and once you've calculated the numerical MCT ratio, you're done. But in BCAR, the final rating is not based only on the BCAR value. After calculating the numerical BCAR value, the rating analyst is still allowed to make qualitative adjustments to arrive one of the 6 possible final ratings: strongest, very strong, strong, adequate, weak, very weak. It's part of the 6-step "BOB-ECL" process from the flow chart on page 1 of the source text.

Anyway, I see the point you're trying to make but I would respond by saying the adjustments within MCT for interest rate and reinsurance are quantitative, not qualitative, because the MCT framework doesn't have as much scope for qualitative considerations.

Hi Graham,

For the 6 possible final ratings, I thought that is only on the first B from "BOB-ECL", Balance Sheet Strength? Isn't the AM Best final rating is like AA, BB, something?

Just want to confirm in which rating process actually deliver the one of the 6 rating?

Is it after cured-salami, or go through all the BOB-ECL process?

Thanks and Warm Regards,

Wilson

The final A.M. Best ratings look like aaa, aa+, aa, and so on, but this is covered in the appendix of the source text which is not on the syllabus.

The first step is the BCAR assessment which is according to the scale: strongest, very strong, strong, adequate, weak, very weak. The source text doesn't provide many details after this, but this rating can then be modified by by "Cured Salami". Once you've done this, you've done the "B" step in "BOB-ECL".

The rest of the steps in "BOB-ECL" are as indicated in the diagram in the source text (reproduced in the wiki) and the final result is a rating on the scale aaa, aa+, aa, but again, this is not part of the syllabus and not discussed in any detail in this particular source text anyway.

I see. Sure Graham, I dont believe they will ask too much details like this as well. Thanks mate!

Thanks mate!