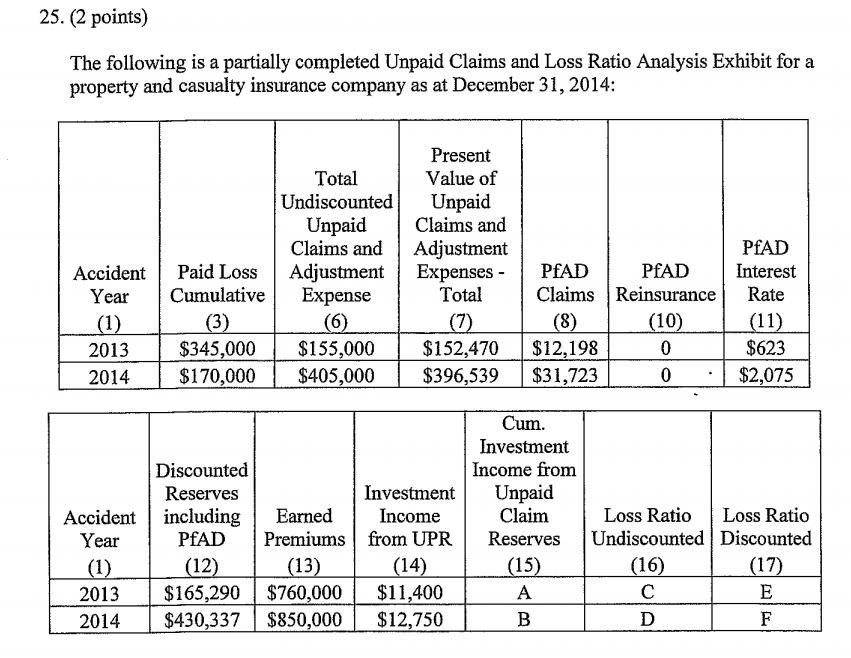

Spring 2015 Q25

Hi Graham, I have some questions about Spring 2015 Q25.

To calculate the letters A and B, I see that in the examiner's report, the solution is calculating Investment income during the first CY of the AY. For example for AY 2013, we calculate investment income for CY 2013. I believe that this calculation is for "Investment income attributable to Insurance operations", and if I'm not mistaken, this has been removed from the syllabus. Is that right?

Also, I saw on the Wiki that Discounted Loss ratio has been removed from the OSFI.MemoAA but I'm not really sure what that means. Does that mean that we are not expected to know the calculation of Discounted LR for questions like this one?

Thank you!

Comments

Unknonws A & B:

The investment income calculation here is actually not the full "investment income from insurance operations". It is just the investment income on unpaid claims liabilities, which is the same as the investment income piece of the excess/deficiency ratio calculation. You can find that in the CIA.ARinstr wiki article here:

https://battleactsmain.ca/wiki6c/CCIR.ARinstr#Excess.2FDeficiency_Ratio_-_Part_1

Discounted Loss Ratio: E & F:

Hi Graham, thanks for the detailed response.

I still don't understand the calculation for unknown A and B. In the CCIR.ARInstructions, we do NOT calculate investment income for the first CY of an AY.

In this question, for AY 2013, we calculate CY 2013 investment income as 0.03Average(0, 371896). And for AY2014, we calculate investment income in the FIRST CY (so CY2014) as 0.03Average(0, 430337).

If I'm not mistaken, that calculation is different from what we do in the Excess/Deficiency calculations.

Please let me know what you think.

Yes, that's right. The reason you don't calculate the investment income for the first CY in the excess/deficiency problem is that you're evaluating the excess/deficiency at the end of the first CY. That's your first "data point" and you're tracking the accuracy of that initial unpaid amount year-by-year until all the claims are closed. We don't care what the investment income was earned during that first CY because that's prior to our first "data point". (The unpaid amount at the end of the first CY is our first data point because the unpaid at the beginning of the first year is always 0. We have to wait until the end of the year before we have an unpaid amount to consider.)

But for the loss ratio exhibit in this problem, we are interested in the investment income earned during the first CY. That calculation is essentially the same in that you multiply the yield by the average of the beginning and ending unpaid amount. Here, the beginning unpaid amount is 0, so you average 0 with the unpaid amount at the end of that first year, 371896, then multiply the average by the yield.

Ok I see, I think that makes sense.

Thanks for taking the time to reply!

My understanding is that the undiscounted LR is still on the syllabus. Solution for this question calculates C & D = (Cumulative Paid Loss for AY+ Undiscounted UCAE for AY) / Earned Premiums.

The wiki page of CCIR.ARinstr lists that Net LR = APV(incurred claims)/EP = [paid loss during the period + change in APV(unpaid claims)]/Earned Premiums.

Is the undiscounted LR a different metric from net LR?

Yes, the undiscounted LR is different from the net LR. There's no discounting and PFADs for the undiscounted LR - It's just the ultimate incurred/ EP