2019 Spring Q17

https://www.battleactsmain.ca/pdf/Exam_(2019_1-Spring)/(2019_1-Spring)_(17).pdf

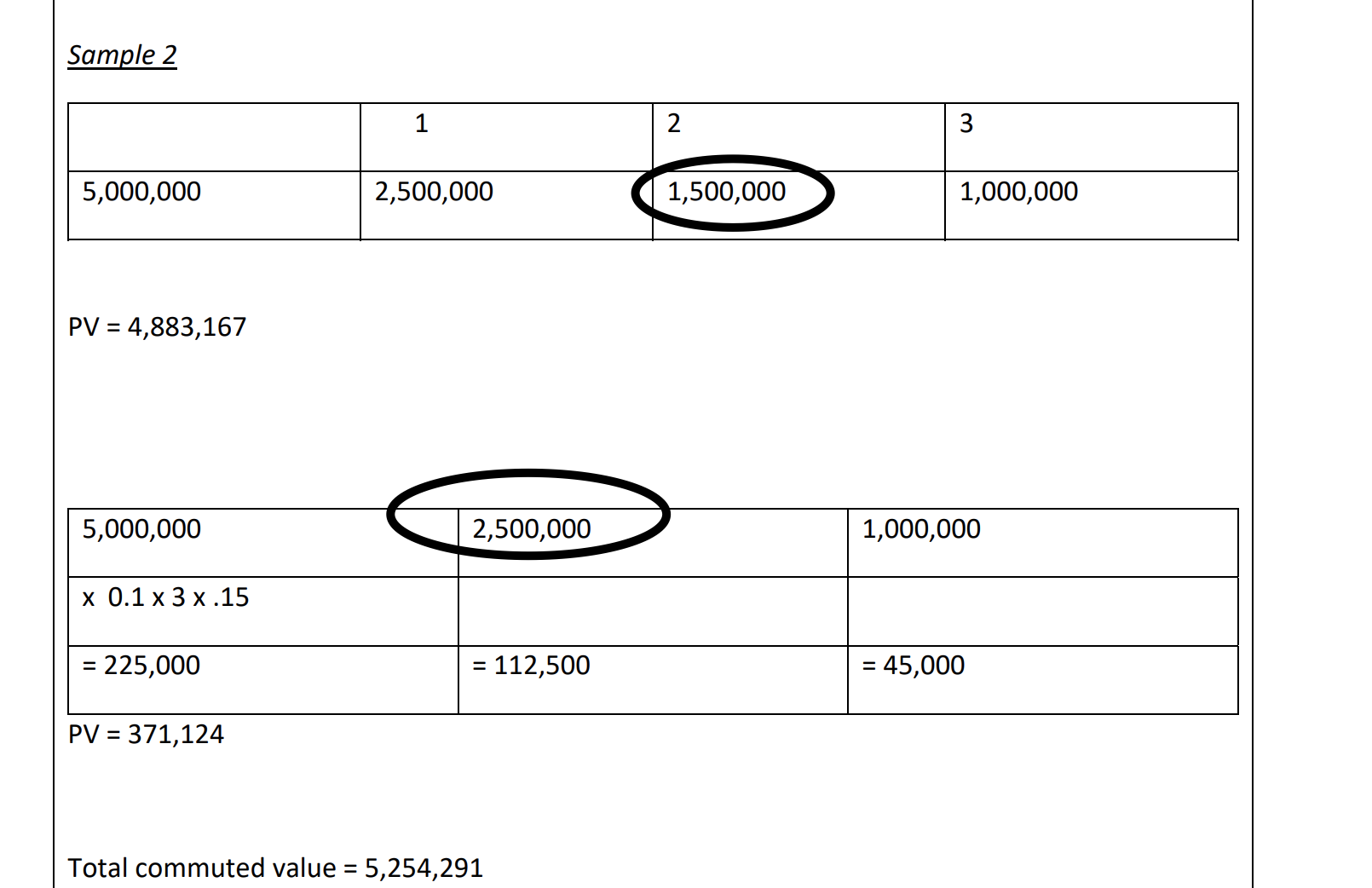

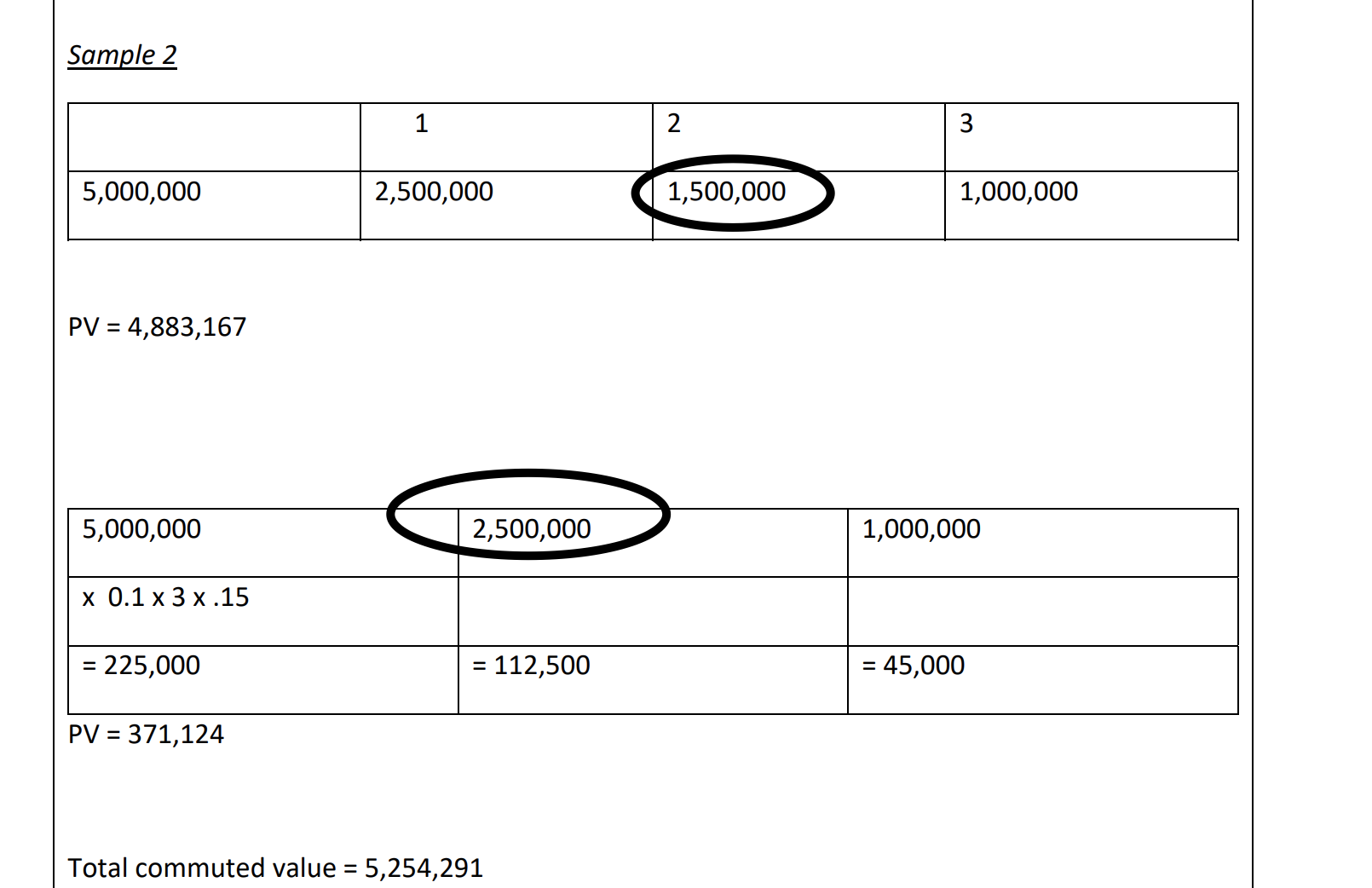

Hi Graham, do you mind explain to me why there is a different payment at the 2nd row when calculating PV w/o margin and the margin (1.5M vs 2.5M)?

It looks like you're new here. If you want to get involved, click one of these buttons!

https://www.battleactsmain.ca/pdf/Exam_(2019_1-Spring)/(2019_1-Spring)_(17).pdf

Hi Graham, do you mind explain to me why there is a different payment at the 2nd row when calculating PV w/o margin and the margin (1.5M vs 2.5M)?

Comments

I've copied my solution to this problem below. See if that makes more sense. Note that:

For the PV without margin, the numbers in the row represent the amount paid in the year. But for the PV with margin, the numbers represent the payment remaining at the beginning of the year.

Are margins always treated as of they year end? What I am really trying to ask, do we always use full year duration when discounting margins?

You could use middle of year also