Fall 2019 q#23

in MSA.Ratios

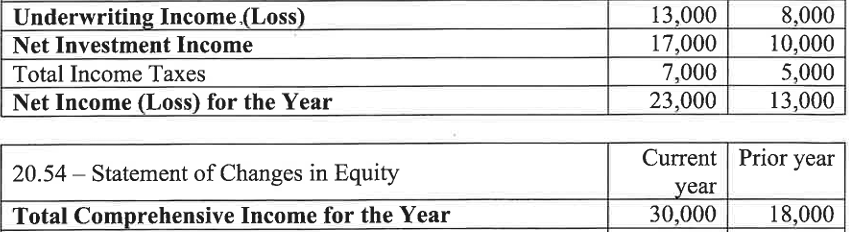

For part a.i, I thought OCI would be calculated as follows:

CI = NI + OCI - Dividends

OCI= CI - NI + Div

OCI = 30,000 - 23,000 - (14000+1000)

But for some reason the answer key excludes the dividend piece from the calculation of OCI. Why is that?

Comments

Hi,

Other Comprehensive income is mainly used to adjust to fair market value certain assets (stocks for example). You wouldn't subtract dividends because dividends have no impact on other comprehensive income. How I think of it (And this might be a simplification) is that dividends are simply cash returned to shareholders when management decides to do so. It has nothing to do with income (They are not an operating expense) or fair value of your assets for that matter and is usually paid out from retained earnings. Dividends are recorded in the statement of stockholder's equity and do not appear on the income statement.

Sorry I have a type in my post above, I am referring to part a.iv of this question.

Total CI = NI + OCI - Dividends

We are trying to isolate for OCI using the information given correct?

Yes, we are. However, dividends are not considered in income because they are not an operating expense so you would ignore them

I thought there is no OCI in this question? Why to try to isolate for OCI as mentioned above?

Or maybe I am not understanding what OCI is.

I thought that there is already CI given, just need to subtract out the dividends.

Also, what is the difference between AOCI, OCI, and Total CI?

For the prev year equity method to solve for equity, is CI = NI + OCI the same Total CI = NI + OCI?

The poster just wanted to calculate OCI to see if the numbers make sense. OCI includes any revenue, expenses, gains and losses that have not yet been 'realized'

AOCI is just the cumulative OCI through the years, since OCI is per reporting period. Total CI is as defined by sant93 above. Yes, CI = Total CI

Hi, for this question for the Net Leverage, the standard is 400% in the answers but its 500% in the wiki page. Thoughts?

The source text (available only in the study kit and not online) says the threshold is 500%. I checked the 2018 version of the source text and it is 500% there also. It appears the sample solutions are in error in using 400% although the final conclusion is the same since the calculated value of net leverage in the question was 513%.

There is a footnote under the table for 2019-Fall in the "Exam Summaries" wiki page that mentions this:

@Staff-T1 when you said as defined by sant93. I think you meant as defined by user1.

Because Sant93's definition had the dividend which you explained should not be part of the calculation.

Yeah that's right. Dividends are part of retained earnings which does not impact CI

Something isn't working for me, I keep reading the above and still wouldn't make sense to me.

To determine, Investment Yield using MSA formula we need OCI.

In the sample answer they determine OCI= 30k-23k(Total CI-NI), isn't that simply our Total Income taxes?

That's not right. Your net income is already net of taxes so how can that be total income taxes

I'm still confused by this I understand that NI is net of taxes.

But is Total Comprehensive Income also net of taxes?

Was this just a trick in the question to have Taxes exactly equal Total CI-NI for both years. So 30k-23k=7k ( same as taxes) and 18k-13k=5k ( same as taxes for prior year).

It's just a coincidence here. I wouldn't look too much into it