There is a lengthy discussion on how to select a discount rate under IFRS17 but there is virtually no discussion on how to select a discount rate for the CIA methods. So comparing discount rates under IFRS17 versus current practice is difficult to answer in detail based on the current syllabus readings but here's something that might help:

IFRS 17 uses current interest rates whereas CIA may use actual investment return rates. Current interest rates are probably lower than investment return rates so balance sheet liabilities would be higher under IFRS 17 and that's a big deal.

The benefit of current rates however is better standardization across the industry in terms of financial reporting.

Also,

An IFRS17 discount rate may be a single rate, or a curve of rates varying by duration.

A CIA discount rate is generally just a single rate.

Given the current climate of inflation and raise in interest rates, does the statement below still relevant?

IFRS 17 uses current interest rates whereas CIA may use actual investment return rates. Current interest rates are probably lower than investment return rates so balance sheet liabilities would be higher under IFRS 17 and that's a big deal.

I am wondering if current interest rates will still be lower than actual investment return since BoC has increased rates in the past few months.

Investment returns varies from company to company but you probably will never get an investment rate lower than the current interest rate which is essentially the risk free rate

Yes and no. That exam question was from an older version of CIA.Valn and there is a footnote to the BattleTable in that wiki article that I've copied below. But keep reading further down because I also copied a snippet from CIA.IFRS17-DR.

Comments

There is a lengthy discussion on how to select a discount rate under IFRS17 but there is virtually no discussion on how to select a discount rate for the CIA methods. So comparing discount rates under IFRS17 versus current practice is difficult to answer in detail based on the current syllabus readings but here's something that might help:

Also,

Given the current climate of inflation and raise in interest rates, does the statement below still relevant?

I am wondering if current interest rates will still be lower than actual investment return since BoC has increased rates in the past few months.

Investment returns varies from company to company but you probably will never get an investment rate lower than the current interest rate which is essentially the risk free rate

Could you also say that IFRS 17 used as top-down or bottom up approach to select discount rates?

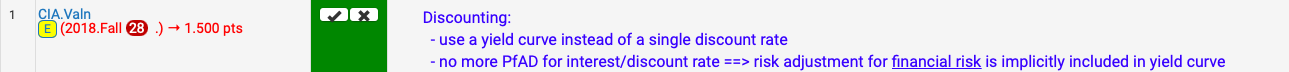

@graham don't we need a yield curve, not a single rate???

Hi @adipelino,

Yes and no. That exam question was from an older version of CIA.Valn and there is a footnote to the BattleTable in that wiki article that I've copied below. But keep reading further down because I also copied a snippet from CIA.IFRS17-DR.

Here's the snippet from CIA.IFRS17-DR:

@exampasser yes and you could also saying using your own asset portfolio yield rate without adjustments is no longer allowed