Formula for FCF

Hi,

On wiki page, I see this formula repeated at several places:

FCF = (Future cash inflows - Future cash outflows + effect of discounting - RA)

should it be +RA instead here?

It looks like you're new here. If you want to get involved, click one of these buttons!

Hi,

On wiki page, I see this formula repeated at several places:

FCF = (Future cash inflows - Future cash outflows + effect of discounting - RA)

should it be +RA instead here?

Comments

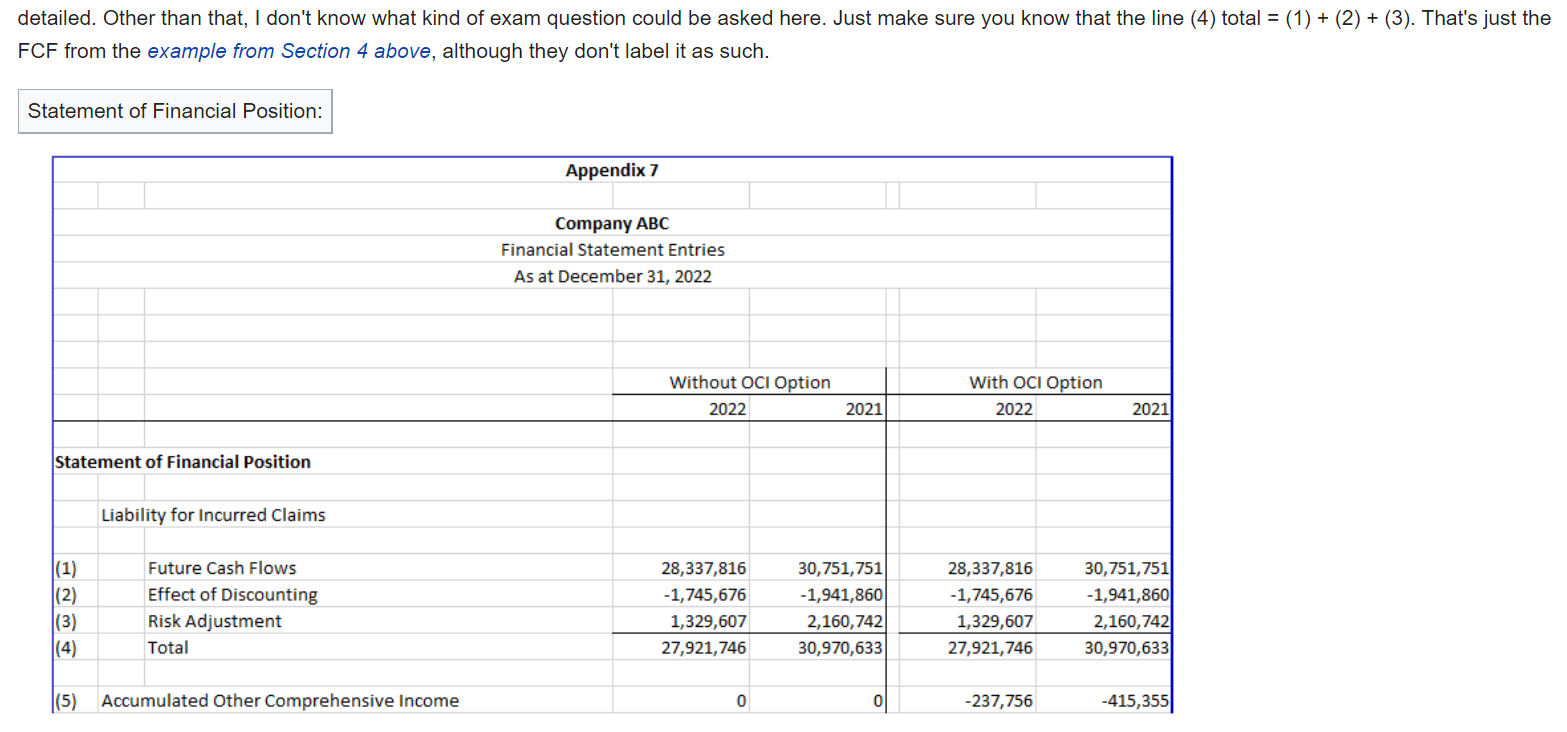

I think there's some inconsistency with the way FCF is defined in the material as Graham alluded to in one of the prior IFRS questions.

But for me, I think of it this way: Just make sure your cash inflows and outflows are all the same sign. It's more important to understand what FCF actually is rather than memorizing signs.

Back to the question, you are defining future cash inflows as a positive sign. RA is basically equivalent to PFADs under IFRS4. Does a PFAD increase or decrease your liability? It increases your liability and so it should have the same sign as your cash outflow(liability).

Hi,

sorry, it's still a bit unclear to me, are these 2 formulas the same?

FCF = Future cash inflows - Future cash outflows + effect of discounting - RA

FCF = estimate of future cash flows + effect of discount + RA

Estimate of future cash flows = Future cash inflows - Future cash outflows. So you would have to subtract the RA from your second formula

It is unclear to me why it is future cash inflows - future cash outflows if the contract is considered to be profitable if FCF<0 (that would require the future cash outflow to be > cash inflow, in which case the contract is actually not profitable)

The source isn't clear on this which makes it important to understand the FCF rather than memorizing it. If:

FCF = Future Cash Inflows - future cash outflows, then the contract is profitable if FCF > 0

FCF = Future Cash Outflows - future cash inflows, then the contract is profitable if FCF < 0

I prefer defining FCF as the latter but the educational notes has described FCF in both of the ways above. I believe Graham sent a question to the CAS exam committee about this

Can I please confirm if FCF can express as one of the following:

FCF = (Future cash inflows - Future cash outflows + effect of discounting - RA)

FCF = (-Future cash inflows + Future cash outflows - effect of discounting + RA)?

Yup that is correct

If there is a question providing the individual FCF components as well as the LRC excl LC and asking us to evaluate whether the contract is onerous or not, which version of the formula should we use? or would it not matter as long as we use one of those formulas and show we understand how to evaluate onerousness?

So in my mind, number two is the more common one. Number one is basically a footnote in a picture in one of the papers. I think FCF would be clearly defined for you in an exam and if you understand it really well I wouldn't expect any problems. But if everything is vague and you are just provided FCF with no context, go with option 2 and state your assumptions

It was said above that RA would need to be subtracted from the second formula posted March 29th following the logic that RA would have the same sign as cash outflows, where estimated future cash flows would be calculated as future cash inflows - future cash outflows.

Why does the above not apply in this example?

You are looking at the LIC and not the LRC here

@Staff-T1 would the CSM be added or subtracted in each of these?

FCF = Future cash inflows - Future cash outflows + effect of discounting - RA

FCF = estimate of future cash flows (=outflows - inflows) + effect of discount + RA

I think it would be added in 2 and subtracted in 1, but not sure.

If it's set equal to -FCF regardless of which formula is used, then it would be added either way?

CSM is added in both cases. CSM is a negative amount in case 1 but a positive amount in case 2. And yes your initial conclusion is right - I normally just remember the second formula -> if you understand the concept it will come naturally

A couple of question:

1. Would the formula for Profit/Loss (i.e. LRC - FCF) and Loss Component on the FCF formula as well?

From my understanding (which might be wrong haha), the formula for Profit/Loss from the Excel Exhibit is only equal to (PAA LRC excl LC - FCF) because of the usage of FCF's (outflow - inflow) version of the formula. So, if we were using the (Inflow - Outflow) version, would the Profit/Loss then become (LRC + FCF)?

I don't think it would... but just want to make sure I'm covering everything

Could you please help me understand the formula Profit/Loss = (PAA LRC excl LC) - FCF ? if a contract is non-onerous, isn't the profit = CSM = -FCF ? if it's onerous the loss = LC ? why is there a PAA component?

Thank you!

@lotsofpies yes to your first question. But again, as much as possible try to keep it at FCF = outflow - inflow. As for your second question, I would think maybe it should be max(0, FCF + LRC excl LC) -> A larger negative number means more LC in this case

@jjj820 You are thinking about the GMM method. Under PAA which is the simplified approach, the formula for calculating LC is the difference between the PAA and FCF. Or put it another way, PAA excl LC + LC = GMM

@Staff-T1 Thank you for your rely.

Also, if FCF>0 (there is a net cash outflow), it already indicated that the contract is onerous, why is it necessary to compare FCF and LRC (ex. LC), if FCF > LRC (ex. LC) then it is onerous?

If it is onerous, you need to book the loss immediately in P&L by calculating the Loss Component by comparing FCF and LRC (excl. LC)

@Staff-T1 Thank you. What I meant was - if FCF>0 (net cash outflow), then the contract should be onerous. why do we need to take an extra step (FCF>LRC (ex LC)) to decide if it is an onerous contract? ie. if FCF>0 then it is onerous, why do you need to compare FCF and LRC (ex LC) ?? Thanks again

@jjj820 I believe this would mainly apply to PAA, where we don't measure using FCF automatically

This is because we do not calculate FCFs under PAA. We only do so if we feel the contract if onerous. If we do, we then calculate FCF and book the difference as a LC

When we say, FCF > LRC ex LC -> onerous

Which FCF is applied ? Thank you.

It is always outflow - inflow most of the time

@graham I'm confused by @Staff-T1 answer above. Is it always like that or what does it mean most of the time?

And another question given the following formulas:

FCF = PV(future cash flow) + RA

FCF = outflows - inflows - effect of discounting + RA

Does that assume effect of discounting < 0 as shown in the statement of financial position (see screenshot in one of the prior posts)? In that case how subtracting a negative amount (i.e adding) is equivalent to getting PV? Shouldn't be the opposite?

And one last question for non-onerous contracts when we add CSM to FCF, how do you interpret unearned profit increasing LRC? Shouldn't future expected profit reduce future liabilities instead?

Yes, it is confusing @miguel. I will let @Staff-T1 give you a more detailed explanation since he has addressed this issue before.

Most of the time here refers to the fact that the CAS themselves do not define FCF clearly in their papers, which is why I mention that it is important to understand what FCF is conceptually and not just attempt to memorize the formula.

For discounting, it is usually has the opposite sign of the RA/ cash outflows since it will reduce the liability.

Expected future profit doesn't reduce liability because the whole concept of IFRS17 is to prevent insurers from recognizing profit before it is earned and thus you "defer" it by having a CSM

Ok thanks @Staff-T1 , for your first comment since the broad definition of FCF for LRC is:

FCF = outflows - inflows - effect of discounting + RA

Could you please give examples of inflows related to LRC? that would help to understand what FCF is conceptually instead of memorizing the formula. I understand the outflow part would be the expected value of future claims that have not incurred yet. I read somewhere that LRC also involves insurance services not provided yet as well as anything that is not already captured under LIC but that still sounds a little bit abstract for me to really understand. When it comes to inflows I can only think of premiums but isn't that already captured in CSM? (i.e. premium not earned yet)

Regarding your response about expected future profit. When the reading says that the establishment of CSM is used to eliminate a negative liability (inflows > outflows) is it correct to infer in that case FCF < 0 so CSM = - FCF so that LRC = FCF + CSM = 0 ?

For inflows, the only ones that are coming to me off the top of my head right now are Premiums Receivable as well as expected salvage and subrogation. Conceptually, you can think of LRC as premium liabilities (sorta) which reflects insurance services yet to be provided. The CSM does not capture premiums, it is reflects unearned profit or the difference between the PV of inflows and outflows, of which premium is a component.

Yup LRC will be equal to 0 at initial recognition since the CSM perfectly offsets the FCF

Thanks, S&S makes sense. I think I've seen Premium Receivable included in the formula of FCF under PAA. But is that also captured as an inflow under GMA? When you say CSM does not capture premiums, then where does Premium Received would be captured at initial recognition? Would that be another example of inflow under GMA?