Practice Exam #1 Spring 2022 Q16

Hello,

I have a question regarding the discounting effect.

When we calculate the PV factor, why do we use the net undiscounted policy liabilities excluding PfADs as the PV?

Thanks,

Val

It looks like you're new here. If you want to get involved, click one of these buttons!

Hello,

I have a question regarding the discounting effect.

When we calculate the PV factor, why do we use the net undiscounted policy liabilities excluding PfADs as the PV?

Thanks,

Val

Comments

We need to include the investment rate PFaD for the PV. It's just the way the formula is defined in the CIA educational notes

Yes, but should we not use the discounted amount and not the undiscounted amount?

unless there is a typo in the problem and it's supposed to be "net discounted policy liabilities excluding PfADs = 64,000" ?

It is written "net udiscounted policy liabilities excluding PfADs" in the problem, I don't know if it's supposed to be undiscounted or discounted...

It's a typo - It should be discounted

It's fixed. Thx!

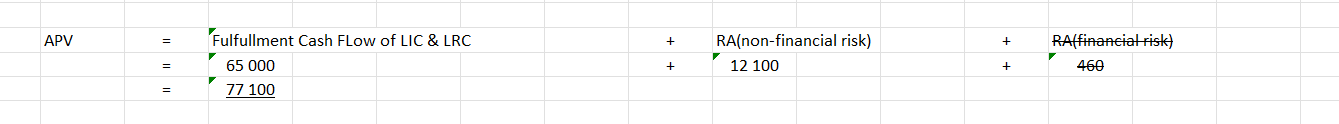

Another question I have for this question: In order to get the PAV, we add the FCF to the RA. However, if I remember well, in the IFRS-2 text, it states that RA is part of the FCF. Since FCF is not the same thing as Present Value of Future Cashflow. Is there some kind of notation I'm missing here?

There's two FCFs. FCF = Future cash flow or also fulfillment cash flow. Fulfillment cash flows are the ones that have discounting and RA

Great thank you. And I guess if it is not obvious we can just make an assumption and saying "I assume FCF = Fulfillment Cash Flow and it includes the RA" will be enough

But in the answer sheet, it literally say that APV = Fulfillment Cashflow + RA. Was it an error in this case?

Yeah and yeah it is a typo for your second point