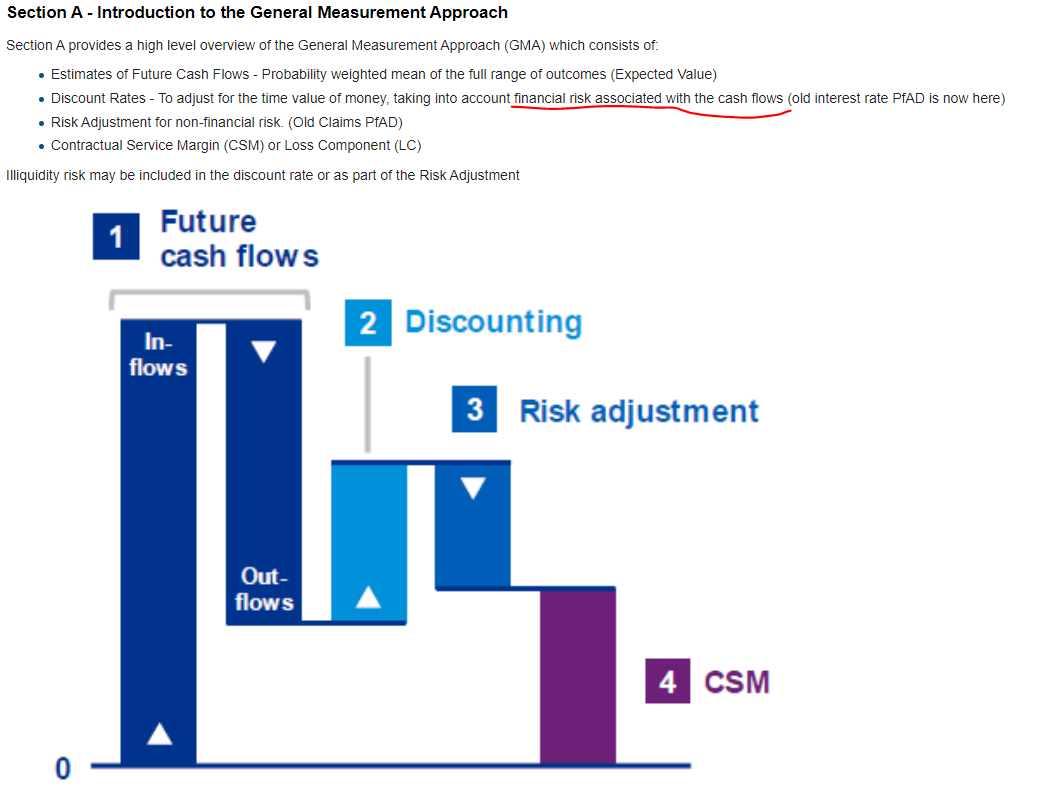

Approach to this paper with the new syllabus

Hi,

I am a bit confused by this paper and I am not so sure whether IFRS17 makes this paper less important or not.

As I was going through this paper, I realized that all of the examples provided and past exam questions involve MfAD calculations. Now that MfAD is no longer syllabus, how do you think we should approach this paper? Do you think we will be given reported reserve & claim liability (or the components of them so that we calculate them) to estimate the effect of discounting the future income taxes? How about the present value factor?

Thank you in advance.

Comments

Hi,

This paper wasn't really important to begin with for past sittings.

I think conceptually it would be the same:

Hope this helps!

Thank you!

Would the calculations in Fall 2019 #15 be testable? How would part a and b be revised under IFRS? An example would be helpful to see how old questions would be modified. Thanks!

Undiscounted unpaid would be exactly the same under IFRS17.

APV would be equal to your LIC.

For an example, maybe Graham and I will try to come up with something for the Practice Exams

What does BEL stand for?

Best-Estimate-Liability

Would it be possible to provide practice questions for this topic under IFRS?

We're working on some extra practice problems but this is more an issue for the CAS to address. They really should have updated all the readings to IFRS 17 at the same time. Unfortunately, there is now a situation where the syllabus readings are a mixture of IFRS17 and pre-IFRS17 readings.

Is this correct? Is APV = LIC?

From the practice exam I gather that APV = LIC + LRC

Which question are you referring to in the PE? The IFRS 17 components which are analogous to the IFRS4 components are as follows:

LIC = APV

LRC = Premium Liability

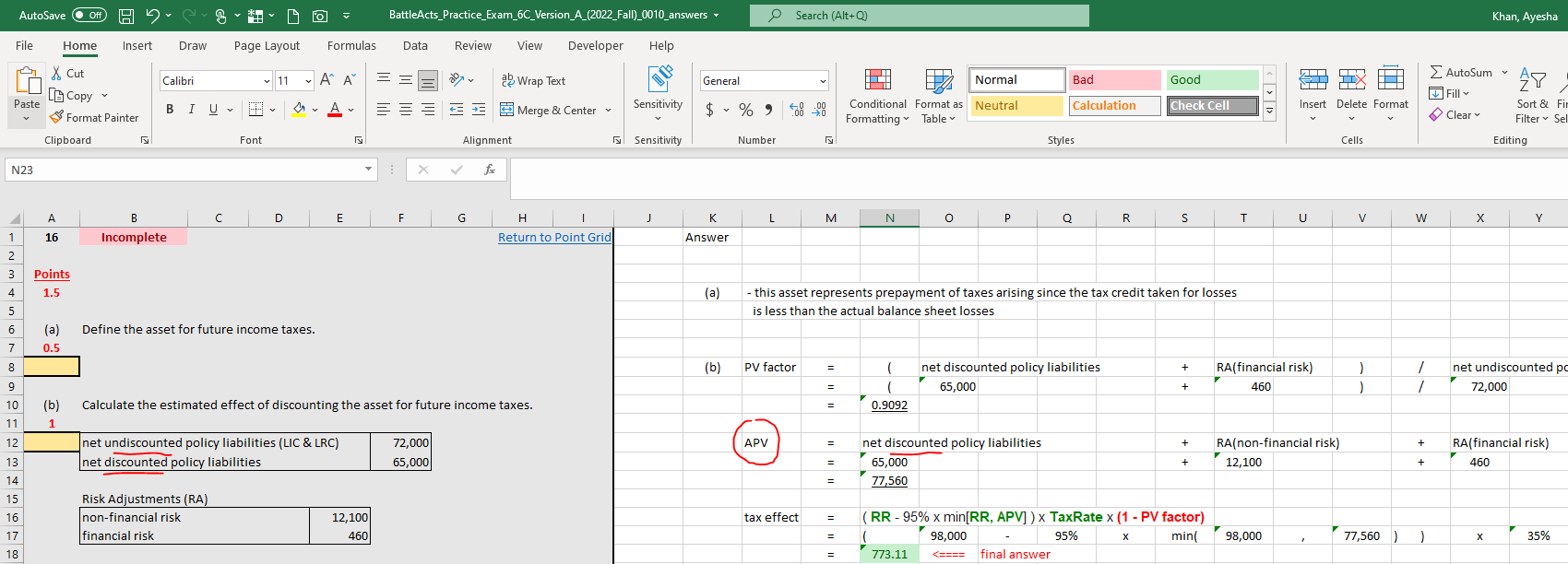

Qs 16 on the new PE:

It says the Net undiscounted Policy liabilities is comprised of LIC + LRC

I assumed the Net discounted Policy liabilities are also comprised of LIC and LRC? (this is the value used in APV formula)?

I don't think the APV contains the LRC(Premium Liabilities) @graham . What do you think?

I think it can. The source text says:

Also, the exam problem 2019-Spring Q16 refers to "policy liabilities" (which includes claim and premium liabilities) then calculates APV based on policy liabilities:

In IFRS 17, claim and premium liabilities translate roughly to LIC and LRC. Of course, the tax calculation may be totally different in IFRS 17 but if you just update the old tax reading directly, I think what I did makes sense? (I get that in IFRS 17, APV may refer to LIC only however so there might not be any way to resolve the apparent contradiction without the CAS publishing an updated tax reading.)

Hello,

In the screenshot posted above by a225khan why do we include RA from financial risk in the PV factor calculation? Under section 4 of the LRC wiki article where "Ian-the-Intern was confused": https://battleactsmain.ca/wiki6c/CIA.IFRS17-LRC#Section_4.5:_Risk_Adjustment

Financial Risk can be reflected in estimates of the cash flows and/or the PV calculations of the cashflows. This makes me believe it would have already been captured in the "net discounted policy liabilities" and we are essentially double-counting it here

This is further reinforced in my mind when I read the IFRS17 Insurance Contracts wiki: https://battleactsmain.ca/wiki6c/CIA.IFRS17-IC

In the exam should we be careful to not assume Financial Risk is captured implicitly through discounting or cash flow estimation if it is separately provided?

I think the main idea here was to try to bridge a calculation that was mainly done under IFRS4 to IFRS17. However, you are right that RA for financial risk should be implicit in the discount rate and you can definitely make the assumption that RA for financial risk is implicit in the discounting factor. If it is separately provided, you can do it as in the sample exam, or state the assumption that it should already be in the discounted liabilities

in the updated BA practice exam #16, I don't understand why the APV = FCF (LIC + LRC) + Risk adjustment for non-financial risk.

Doesn't the FCF already account for the RA? FCF = discounted future cash flow + RA

Are we double counting?

FCF here stands for future cash flow not fulfillment cash flow

Here is a screenshot of the details in the calculation:

The APV is adding Fulfillment cash flows + RA and I would have expected the APV to just be Fulfillment cash flow.

is this correct?

Hi, I had the same question. Fulfilment cash flow should already include the RA for non-financial risk. Maybe it should be:

PV + PfAD(int) = Fulfilment cash flows for LIC and LRC - RA for non financial risk ?

and then APV = Fulfilment cash flows for LIC and LRC?

I think APV factor here should be fulfillment cash flows/ future cash flow.

For PV factor, (Fulfillment cash flow - RA)/future cash flow