How to understand LRC = FCF + CSM

Is there a way to understand the intuition of the formula?

How come the unearned profits + net future cash flow becomes the liability?

It looks like you're new here. If you want to get involved, click one of these buttons!

Is there a way to understand the intuition of the formula?

How come the unearned profits + net future cash flow becomes the liability?

Comments

LRC = FCF + CSM = 0 at time 0

It becomes a liability because you have an obligation to provide services to the insured throughout the period.

Think of it this way, assume you receive a premium at time 0. At time 0.5, you no longer have any premium inflows but rather only have an outflow. Your CSM < premiums and this means you now have a net liability.

At time 0, you book the CSM as an asset because PV of your premiums > losses and you have no liability (yet).

If your unearned profits + net future cash flow < 0, this means you have a liability. If it is > 0, you have an asset.

Thanks!

Just a follow-up to your last sentence, Is it "unearned profits + net future cash flow > 0, this means you have a liability"?

Also - I don't think CSM is booked as an asset at time 0. It may make more sense to say that the profits are booked as a negative liability at initial recognition.

If net FCFs are defined as PV future inflow - PV future outflow then yes.

For your second point, absolutely. The more correct way is to define it as a negative liability. I just call it an asset for simplicity but it may not be the most correct terminology

Thank you again! But I'm defining my FCF as PV future outflow - PV future inflow.

As per your last sentence, "If your unearned profits + net future cash flow < 0, this means you have a liability. If it is > 0, you have an asset.",can I interpret "unearned profits + net future cash flow" as "CSM + FCF" with FCF = PV future outflow - PV future inflow + others?

If so, how come a negative LRC (CSM+FCF) would become a liability?

Thanks!

Okay let's define LRC as PV future outflow - PV future inflow

This is confusing even for myself - But let me try to use an example to clear things up

Example:

At time 0, CSM = 1000 - 500 = 500, FCF = 500 -1000 = -500, LRC = FCF + CSM = 0

At time 0.25:

In my initial point I was considering both reinsurance held and insurance contracts together which confuses everyone (You can have an ARC or Asset for remaining coverage for reinsurance held). So just looking at insurance specifically I hope this is clearer. The LRC is always a liability (Liability for remaining coverage). You can have a negative or positive LRC and it will still be a liability

"You can have a negative or positive LRC and it will still be a liability"

I remember reading in the wiki somewhere that you can never have a negative LRC, since that implies that there is a profit, which is then recognized in the CSM, since CSM = -FCF.

Unless this is only for initial recognition, but the LRC can become negative throughout the life of the contract. If this is the case, do you have an example just so I can visualize it better?

No, it is possible to have a negative LRC. CSM is only calculated at initial recognition unless facts and circumstances have changed significantly.

Here's an example:

At time 0.75:

FCF = 0 - 250 = -250

CSM = 500/4 = 125

LRC = -250 + 125 = -125

Perfect, thank you so much! Really appreciate the help

how do yo have LRC = FCF + CSM = 0 at time 0?

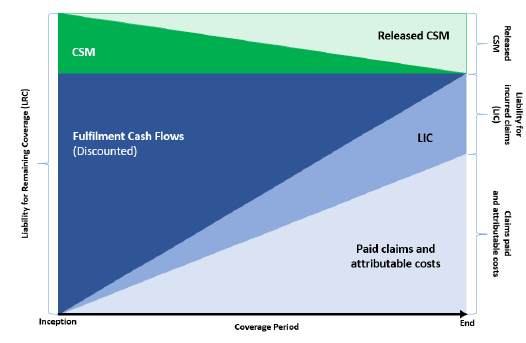

This seems contradictory to the graph (where LRC only goes to 0 at the end of the coverage period):

This is because of the way the CSM is defined to be exactly opposite of the FCF right at time 0. See the above example

@lawtsm

I believe your question is why CSM + FCF <> 0 at initial recognition.

To better answer your question, I believe the source text assumed all premiums are paid upfront. The graph is actually not at initial inception. The graph starts after all premium are received. So the FCF is purely cash outflow. In other words, CSM + FCF at initial recognition in the graph should be equal to premium received.

In IFRS17.IC article, question 6.5 asks about what changes are recognized in CSM. It states CSM at the beginning of the reporting period+ effect of any new contracts added to the group and + value of interest accretion (Using locked-in discount rate at initial recognition), etc.

In your previous comment, it's mentioned that CSM is only calculated at initial recognition unless facts and circumstances have changed significantly.

At time 0.25, I guess we would have new contracts added to the group. Do we re-calculate the CSM or not?

You wouldn't - Normally you'd consider the expected number of policies that you expect to write in a given cohort. Think about it, we have policies cancelling mid-term and non-renewing every day, and of course we are unable to accurately predict it completely. It would be insane to have to recalculate a CSM every day. Facts and circumstances generally refers to changes in actuarial assumptions or any material changes in business conditions for example

I'm struggling understanding the below equation

LRC = FCF + CSM

= (Future cash inflows - Future cash outflows + effect of discounting - RA) + CSM

for example, assume discounting and RA is 0, inflow is 100, outflow is 80.

CSM at initial recognition is 100 - 80 = 20

in this case, FCF needs to be 80-100 = -20

so that LRC = FCF + CSM = -20 + 20 = 0

Otherwise, if follow the formula, it's gonna be LRC = 20 + 20 = 40

Is there anything I miss?

I prefer to define FCF = outflow - inflow which is the more correct definition.

If you define it as FCF = inflow - outflow, then CSM at initial recognition = -20.

LRC = 20 + (-20) = 0. Smaller (more negative LRC) means a higher liability here.

It's all just signs though so it doesn't affect anything

I thought CSM is always positive. So CSM can be negative for non-onerous contracts?

Yeah CSM is always positive and can only be negative for reinsurance. The problem is here that you have flipped the signs of your FCF which is why I said I don't like this definition of LRC

I had the same confusion as @bicbic with the formula as stated in the wiki:

LRC = (Future cash inflows - Future cash outflows + effect of discounting - RA) + CSM

Changing to (Future cash outflows - Future cash inflows) makes a lot of it make more sense.

I agree that FCF = Cash outflow - inflow makes more sense. Unfortunately, for this paper the CAS defines it as inflow - outflow