Chapter 9 - Reinsurance

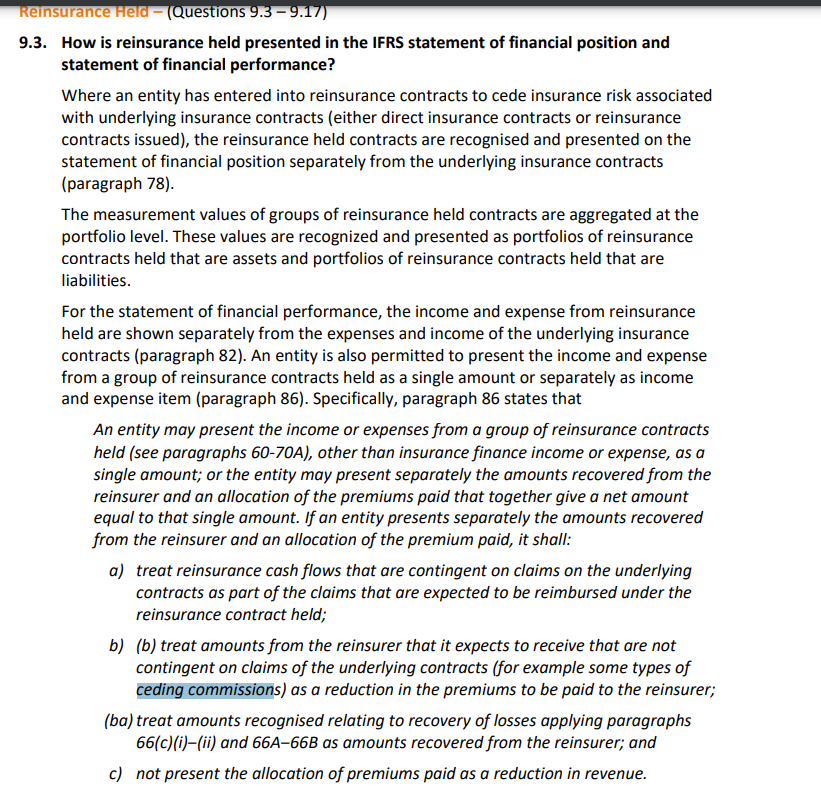

If an entity presents separately the amounts recovered from the reinsurer and an allocation of the premium paid, it shall:

Treat reinsurance cash flows that are contingent on claims on the underlying contracts as part of the claims that are expected to be reimbursed

Treat amounts from the reinsurer that it expects to receive that are not contingent on claims of the underlying contracts (for example some types of ceding commissions) as a reduction in the premiums to be paid to the reinsurer

Treat amounts recognized relating to recovery of losses as amounts recovered from the reinsurer

Not present the allocation of premiums paid as a reduction in revenue

what's the difference between point number 1 and 3? Isn't claims expected to be reimbursed the same as losses recovered from reinsurer?

Contractual options such as recapture, cancellation, recapture that are embedded derivatives are separated and subject to IFRS9.

I think the second recapture should be commutation (according to the source text).

Comments

Point 1 is more of referring to sliding scale commissions and the like (profit sharing mechanisms) whereas point 3 is the actual losses. Probably a typo

Probably a typo

Whoops thanks for pointing that out

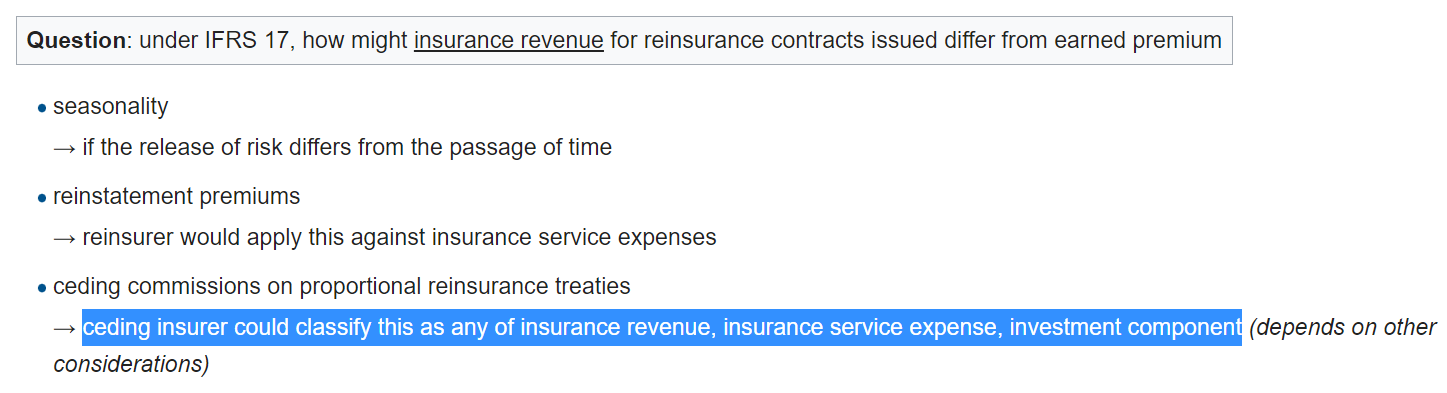

How ceding commissions could be classified as an expense for the ceding insurer. Isn't that an amount paid by the reinsurer to the insurer?

@miguel I interpret this to mean that its a contra-expense so basically it reduces the expense balance on the P/L.

thanks! it's confusing because the question in the wiki refers to reinsurance issued but the answer seems to refer to reinsurance held?

I'm going to assume that's a typo. I scanned the IFRS17 - Insurance Contract paper and ceding commissions only came up once related to reinsurance held:

This is not the right paper - CIA.IFRS17-1 is the paper you should be referring to. In any case, it is a typo, it should be "reinsurer" rather than "ceding insurer" @graham