Basic Financial Statement Metrics (Part A)

Hi,

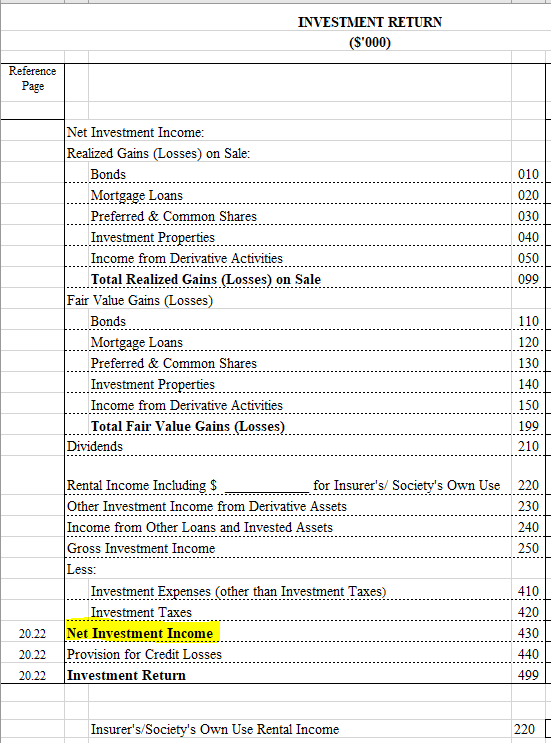

I don't understand how the Investment Yield is calculated as to me the formula is : 2*(Net_Investment_Income + AOCI)/(Inv. Asset at beg of period + Inv. Asset at end of period - Net_Investment_Income - AOCI) but we are adding the following component to the Investment return : Share of Net Income (Loss) of Equity Accounted Investees, which do not belong to the Net_Investment_Income. I thought the Net Investment Income was the one attached (coming from the Invetsment return page 40.74 at line 430, thank you!

Comments

Could I also have more details around when should we avg Equity to compute ROE? Should we always do it when precedent year is available? Thank you!

Just to clarify, are you referring to the formula in mini battle quiz 4?

You should always use an average when the preceding year is available

Yes I am referring o battle quiz 4.

Thank you very much for the Insight!

I am confused as to where you are getting your formula from (including AOCI). Is this something you came up with yourself?

The numbers you should be using to calculate this as per the CCIR instructions are coming from page 20.22

The formula is taken from the MSA.Ratio page. I still don't understand why we should include the "Share of Net Income (Loss) of Equity Accounted Investees" in the net investment income.

Equity accounted investees are the profits earned from your ownership in other companies so it would make sense to include it in the net investment income.

MSA and the annual return uses different formulas I suppose (looks like MSA includes unrealized gains since OCI is considered)