I don't like the signs here but in general:

CSM = PV Outflow - PV Inflow + RA

However, in this case you would need to do: -750 - (-500) -(-50) to get the CSM.

This goes back to the fact that you need to understand what the CSM/LC represents (unearned profit/loss) rather than trying to memorise formulas

I understand the unearned profit/loss in general but the signs are still causing some confusion. In my mind it was PV Inflow (should be +) - (PV Outflow + RA). I just want to confirm that the risk adjustment for non-financial risk can be negative or positive?

What is confusing here is that this is the CSM for the ARC not the LRC which means signs are swapped. For risk adjustment, just make sure its sign is always the same as your PV of outflows

Reduce the reinsurance held asset (where the PV of reimbursements from the reinsurance contract exceeds the PV of reinsurance premiums) and therefore defer recognition of profit

Increase the reinsurance held asset (where the PV of reinsurance premiums exceeds the PV of reimbursements from the reinsurance contract) and therefore defer recognition of losses from the reinsurance contract"

From the table, CSM is negative (reduces) when PV of inflow < PV of outflow, which seems to contradict the statements above?

In scenario 1, you have that outflows > inflows. You then have a negative CSM which defers the recognition of losses.

In scenario 2, you have inflows > outflows. You then have a positive CSM which defers the recognition of profit.

CSM being negative in scenario 1 increases the PV of inflows. You have to be aware of the signs. the sign of the CSM is the same as the inflow -> It does not reduce but instead increases the PV of inflows

Hi, I'm still confused by the signs. How does the formula of FCF differs between reinsurance held and insurance issued?

FCF insurance issued = outflow - inflow + RA

so CSM = inflow - outflow - RA if not onerous (opposite signs of FCF)

FCF reinsurance held = outflow - inflow - RA

if recoveries are inflows and reinsurance premiums are outflows from the insurer perspective. But RA is subtracted because non-financial risk is also transferred to reinsurer? so CSM = inflow - outflow + RA if not onerous (opposite signs of FCF). Is this incorrect? I noticed you used different signs in previous posts

CSM = Inflow - (outflow + RA). RA is negative for AIC/RC. But yes, the risk adjustment is supposed to reduce the recoverable for AIC/RC. I think you will be fine as you get that concept

There is an error with the table -> Inflows should not have a negative sign. If your sign is not the same, it would be (750 - (-50)) for the outflows part

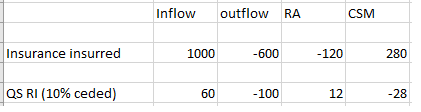

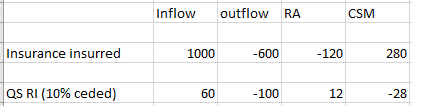

Attached an example, an insurer only covered by a quota share treaty (10% ceded) could you please let me know if my understanding is correct ? If it is correct, the sign of RA is not always the same is PV of outflow. Thank you !

For your example,

LRC should have a positive outflow amount, negative inflow amount and a positive RA

For your ARC, this number doesn't make sense. You are saying this is a net loss reinsurance contract, but you have a negative CSM which implies a net gain?

ARC = outflow - inflow, outflow = 100, inflow = 60, RA = -12, CSM = 28. As I mentioned above RA is negative for reinsurance held. If the sign is not the same, then you have 100-(-12) which is not correct

Comments

I don't like the signs here but in general:

CSM = PV Outflow - PV Inflow + RA

However, in this case you would need to do: -750 - (-500) -(-50) to get the CSM.

This goes back to the fact that you need to understand what the CSM/LC represents (unearned profit/loss) rather than trying to memorise formulas

I understand the unearned profit/loss in general but the signs are still causing some confusion. In my mind it was PV Inflow (should be +) - (PV Outflow + RA). I just want to confirm that the risk adjustment for non-financial risk can be negative or positive?

What is confusing here is that this is the CSM for the ARC not the LRC which means signs are swapped. For risk adjustment, just make sure its sign is always the same as your PV of outflows

Does the comment of "make sure its sign is always the same as your PV of outflows" applicable for reinsurance held?

yes

How does Table 6.2 illustrate the following:

"At initial recognition, the CSM can:

From the table, CSM is negative (reduces) when PV of inflow < PV of outflow, which seems to contradict the statements above?

In scenario 1, you have that outflows > inflows. You then have a negative CSM which defers the recognition of losses.

In scenario 2, you have inflows > outflows. You then have a positive CSM which defers the recognition of profit.

CSM being negative in scenario 1 increases the PV of inflows. You have to be aware of the signs. the sign of the CSM is the same as the inflow -> It does not reduce but instead increases the PV of inflows

Hi, I'm still confused by the signs. How does the formula of FCF differs between reinsurance held and insurance issued?

FCF insurance issued = outflow - inflow + RA

so CSM = inflow - outflow - RA if not onerous (opposite signs of FCF)

FCF reinsurance held = outflow - inflow - RA

if recoveries are inflows and reinsurance premiums are outflows from the insurer perspective. But RA is subtracted because non-financial risk is also transferred to reinsurer? so CSM = inflow - outflow + RA if not onerous (opposite signs of FCF). Is this incorrect? I noticed you used different signs in previous posts

CSM = Inflow - (outflow + RA). RA is negative for AIC/RC. But yes, the risk adjustment is supposed to reduce the recoverable for AIC/RC. I think you will be fine as you get that concept

what is AIC/RC?

Asset for Incurred Claims/ Remaining Coverage

Is "reduce recoverable for AIC/RC" the same as "reduce reinsurance held asset"?

yeah - reinsurance held asset is the AIC/RC

Hi,

so CSM for reinsurance held = inflow - (outflow + RA)

using scenario1, we would have CSM = -500 - (750 -50) = -1200??

Also, in the above scenario, how is RA and outflow the same sign? RA is negative while outflow is positive

There is an error with the table -> Inflows should not have a negative sign. If your sign is not the same, it would be (750 - (-50)) for the outflows part

Attached an example, an insurer only covered by a quota share treaty (10% ceded) could you please let me know if my understanding is correct ? If it is correct, the sign of RA is not always the same is PV of outflow. Thank you !

I think you need to be more specific here. Is this ARC or LRC?

Please let me know if this is correct based on the example above, i.e. an insurer covered by 10% quota share RI. Thank you

For your example,

LRC should have a positive outflow amount, negative inflow amount and a positive RA

For your ARC, this number doesn't make sense. You are saying this is a net loss reinsurance contract, but you have a negative CSM which implies a net gain?

Could you please let me know what the numbers should be ? I am still very confused. Thank you.

ARC = outflow - inflow, outflow = 100, inflow = 60, RA = -12, CSM = 28. As I mentioned above RA is negative for reinsurance held. If the sign is not the same, then you have 100-(-12) which is not correct

Thank you !