Low inherent value increases liquidity

What is inherent value? I am not quite getting what inherent value means here and how it affects the liquidity premium?

It looks like you're new here. If you want to get involved, click one of these buttons!

What is inherent value? I am not quite getting what inherent value means here and how it affects the liquidity premium?

Comments

Inherent value just means the value remaining in the contract. If you have less value left, it is easier to exit the contract as there will be less costs which increases liquidity

Can you expand on what exit value means and how that affects the liquidity of insurance contracts?

Exit value is the how much the contract is worth currently, liquidity is how quickly you can get the exit value. If you have 30% unearned premium, the value is only 30% of the premium you are paid and it is easy for the insurer to pay you out right now. Instead, if you have a BI claim worth 1M pending with your insurer, it is very hard to exit the contract as it is not as simple as asking for the money now. You would have to go to court and through litigation. For larger exit values, you'd usually need to go through the process of settlement which greatly decreases liquidity

Thanks this is very clear. So based on your explanation, should the wiki say "a large portion of inherent value being paid out decreases liquidity" instead out increases?

no, if you pay out a large portion of your inherent value, then remaining value is low again which makes it easier to exit the contract. The wiki is right

Hi @Staff-T1 , in the $1M BI claim case you gave above, does that imply HIGH exit value? (thus low liquidity)

Yes that's right

I am a bit confused on the exit costs. I thought surrender penalties was what we charge the PH for surrendering a policy, so if we charge them MORE for exiting, doesn't that mean we have more cash (instead of charging them less for exiting) so we are more liquid?

Liquidity means the ability to exit a position quickly and at fair market value. A surrender penalty makes it more difficult for one party (policyholder) to exit. Being in a position to benefit favourably from a feature does not increase or decrease its impact on liquidity

For this section, I want to clarify if my understanding is correct.

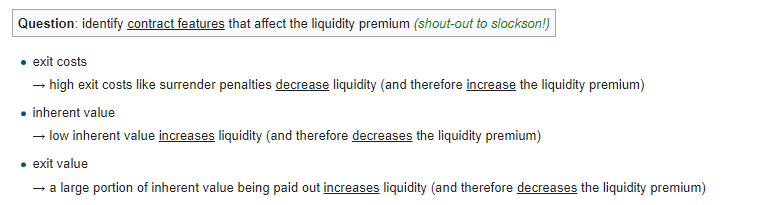

exit costs

→ high exit costs like surrender penalties decrease liquidity (and therefore increase the liquidity premium)

inherent value

→ low inherent value increases liquidity (and therefore decreases the liquidity premium)

exit value

→ a large portion of inherent value being paid out increases liquidity (and therefore decreases the liquidity premium)

Could I look at exit costs as a penalty for this trying to exit and hence its not easy to sell or turn into a money since there is a penalty. So it decreases liquidity which increases liquidity premium.

Exit value is actually really similar, but its not a penalty but a benefit. When I exit I get a large portion of money, so its very liquid, hence its increases liquidity which decreases liquidity premium.

Last one with low inherent value, its like the value itself is low, its more liquid. Its like trying to sell 1 gram of gold versus trying to sell 1 ton of gold. The 1 gram of gold is more liquid cause it has low inherent value. Hence its increases liquidity which decreases liquidity premium.

Is my interpretation correct?

"Exit value is actually really similar, but its not a penalty but a benefit. When I exit I get a large portion of money, so its very liquid, hence its increases liquidity which decreases liquidity premium. " This is not true. The higher the value of an asset in general, the more illiquid it becomes as there are fewer and fewer market participants that are able to transact on said asset the higher prices go.

"Last one with low inherent value, its like the value itself is low, its more liquid. Its like trying to sell 1 gram of gold versus trying to sell 1 ton of gold. The 1 gram of gold is more liquid cause it has low inherent value. Hence its increases liquidity which decreases liquidity premium." Correct, but you just contradicted your earlier statement.

In general, liquidity is the ease in which you can realise fair market value of your asset. The amount of impairment that you would need to take to sell the asset quickly is the illiquidity premium. For example, your house may be worth 1M, but you can't sell it for 1M immediately. You'd need to get a buyer and wait for them to get financing, etc. But if you drop your price to 700K, you may get someone who can buy it form you immediately. There's no one size fits all for liquidity , but its always good to think "does this specific action make it easier or more difficult for me to realize the market value of my asset". If it makes it easier, the liquidity premium decreases and vice versa if it makes it more difficult

Higher up HateExams99 gave this example:

“Hi @Staff-T1 , in the $1M BI claim case you gave above, does that imply HIGH exit value? (thus low liquidity)”

However in battle card #15 they suggest a large portion of inherent value being paid out means a high exit value and actually increases liquidity.

I would’ve thought a large portion of inherent value being paid out means the remaining exit value is low (not high) which increases liquidity

There's a distinction here:

Basically, the lower your reserves outstanding on a policy, the higher your liquidity